Is D. Western Therapeutics Institute (TSE:4576) Using Debt Sensibly?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that D. Western Therapeutics Institute, Inc. (TSE:4576) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for D. Western Therapeutics Institute

How Much Debt Does D. Western Therapeutics Institute Carry?

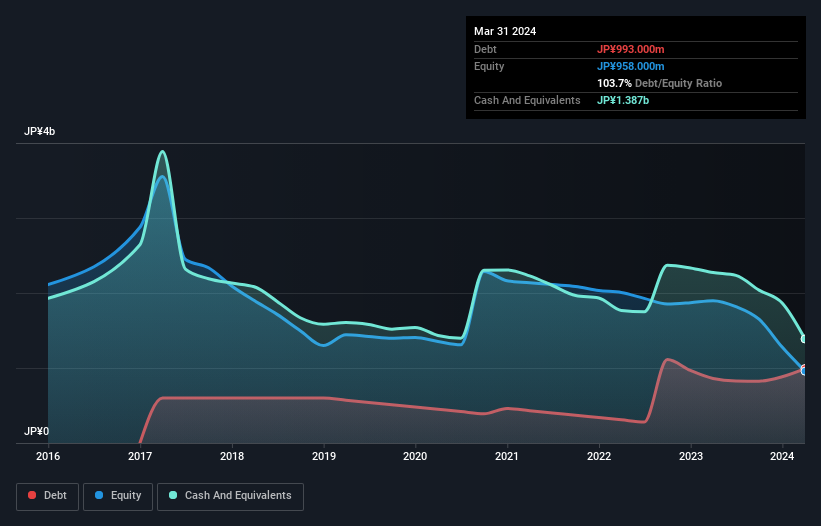

As you can see below, at the end of March 2024, D. Western Therapeutics Institute had JP¥993.0m of debt, up from JP¥860.0m a year ago. Click the image for more detail. But on the other hand it also has JP¥1.39b in cash, leading to a JP¥394.0m net cash position.

How Strong Is D. Western Therapeutics Institute's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that D. Western Therapeutics Institute had liabilities of JP¥154.0m due within 12 months and liabilities of JP¥1.01b due beyond that. On the other hand, it had cash of JP¥1.39b and JP¥152.0m worth of receivables due within a year. So it can boast JP¥380.0m more liquid assets than total liabilities.

This surplus suggests that D. Western Therapeutics Institute has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Simply put, the fact that D. Western Therapeutics Institute has more cash than debt is arguably a good indication that it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since D. Western Therapeutics Institute will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, D. Western Therapeutics Institute reported revenue of JP¥442m, which is a gain of 3.0%, although it did not report any earnings before interest and tax. We usually like to see faster growth from unprofitable companies, but each to their own.

So How Risky Is D. Western Therapeutics Institute?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And the fact is that over the last twelve months D. Western Therapeutics Institute lost money at the earnings before interest and tax (EBIT) line. Indeed, in that time it burnt through JP¥600m of cash and made a loss of JP¥1.0b. But at least it has JP¥394.0m on the balance sheet to spend on growth, near-term. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 3 warning signs for D. Western Therapeutics Institute you should be aware of, and 1 of them is a bit unpleasant.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you're looking to trade D. Western Therapeutics Institute, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4576

D. Western Therapeutics Institute

A biotechnology company, focuses on discovery and development of various drugs.

Medium-low with mediocre balance sheet.

Market Insights

Community Narratives