Here's Why Daiichi Sankyo Company (TSE:4568) Has Caught The Eye Of Investors

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Daiichi Sankyo Company (TSE:4568), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Daiichi Sankyo Company

How Quickly Is Daiichi Sankyo Company Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Recognition must be given to the that Daiichi Sankyo Company has grown EPS by 39% per year, over the last three years. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

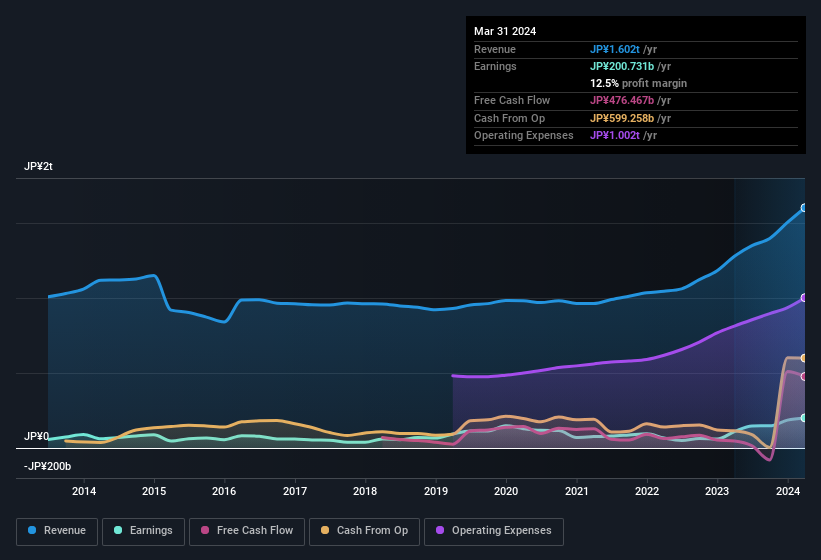

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The good news is that Daiichi Sankyo Company is growing revenues, and EBIT margins improved by 5.2 percentage points to 13%, over the last year. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Daiichi Sankyo Company's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Daiichi Sankyo Company Insiders Aligned With All Shareholders?

Owing to the size of Daiichi Sankyo Company, we wouldn't expect insiders to hold a significant proportion of the company. But thanks to their investment in the company, it's pleasing to see that there are still incentives to align their actions with the shareholders. As a matter of fact, their holding is valued at JP¥2.1b. This considerable investment should help drive long-term value in the business. Despite being just 0.02% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Should You Add Daiichi Sankyo Company To Your Watchlist?

Daiichi Sankyo Company's earnings per share have been soaring, with growth rates sky high. This level of EPS growth does wonders for attracting investment, and the large insider investment in the company is just the cherry on top. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. Based on the sum of its parts, we definitely think its worth watching Daiichi Sankyo Company very closely. Another important measure of business quality not discussed here, is return on equity (ROE). Click on this link to see how Daiichi Sankyo Company shapes up to industry peers, when it comes to ROE.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in JP with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4568

Daiichi Sankyo Company

Manufactures and sells pharmaceutical products in Japan, North America, Europe, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives