Nxera Pharma Co., Ltd. (TSE:4565) Stocks Pounded By 25% But Not Lagging Industry On Growth Or Pricing

Nxera Pharma Co., Ltd. (TSE:4565) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 17% in that time.

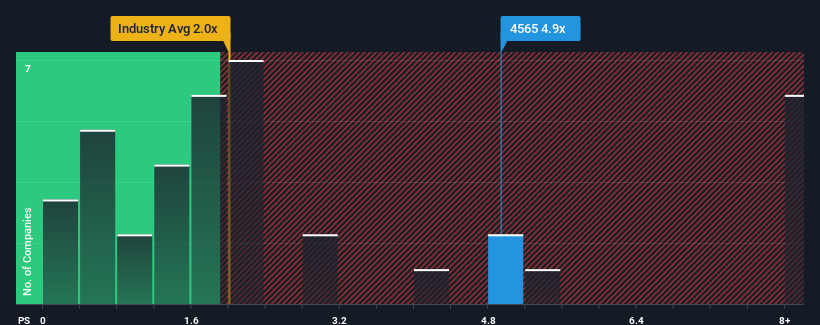

Even after such a large drop in price, given around half the companies in Japan's Pharmaceuticals industry have price-to-sales ratios (or "P/S") below 2x, you may still consider Nxera Pharma as a stock to avoid entirely with its 4.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Nxera Pharma

How Nxera Pharma Has Been Performing

Recent times have been advantageous for Nxera Pharma as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Nxera Pharma.How Is Nxera Pharma's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Nxera Pharma's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 53% last year. Pleasingly, revenue has also lifted 147% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the ten analysts covering the company suggest revenue should grow by 25% per year over the next three years. With the industry only predicted to deliver 6.0% each year, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Nxera Pharma's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Nxera Pharma's P/S?

Nxera Pharma's shares may have suffered, but its P/S remains high. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into Nxera Pharma shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Nxera Pharma you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Nxera Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4565

Nxera Pharma

Develops and sells pharmaceutical products in Japan, the United States, Germany, Switzerland, Bermuda, and the United Kingdom.

Reasonable growth potential with imperfect balance sheet.

Market Insights

Community Narratives