As global markets navigate a landscape marked by tariff uncertainties and fluctuating economic indicators, investors are increasingly seeking stability amidst volatility. With U.S. job growth falling short of expectations and trade tensions impacting market sentiment, dividend stocks have emerged as a potentially attractive option for those looking to balance risk with steady income.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.92% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.12% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.20% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.83% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.51% | ★★★★★★ |

| Archer-Daniels-Midland (NYSE:ADM) | 4.51% | ★★★★★★ |

Click here to see the full list of 1973 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Tsumura (TSE:4540)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tsumura & Co. manufactures and sells pharmaceutical products from plant-derived crude drugs in Japan and internationally, with a market cap of ¥331.10 billion.

Operations: Tsumura & Co. generates revenue primarily from its pharmaceutical products segment, amounting to ¥171.79 billion.

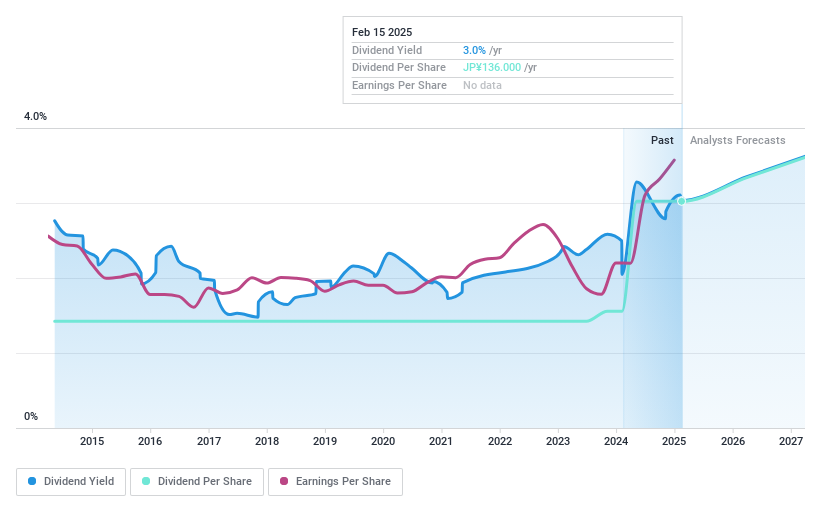

Dividend Yield: 3.1%

Tsumura's dividend payments have been stable and reliable over the past decade, though its 3.08% yield is lower than top-tier dividend payers in Japan. Despite a low payout ratio of 33%, dividends aren't well covered by free cash flow due to a high cash payout ratio of 174.4%. Recent guidance revisions show improved profit forecasts, with earnings expected to grow annually by 6.14%, supporting potential future dividend sustainability amidst current valuation below fair value estimates.

- Click here to discover the nuances of Tsumura with our detailed analytical dividend report.

- According our valuation report, there's an indication that Tsumura's share price might be on the cheaper side.

Chugin Financial GroupInc (TSE:5832)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chugin Financial Group, Inc., operating through its subsidiary The Chugoku Bank, Limited, offers a range of financial services to both corporate and individual clients in Japan and has a market capitalization of ¥283.93 billion.

Operations: Chugin Financial Group, Inc., via The Chugoku Bank, Limited, generates revenue through a variety of financial services aimed at corporate and individual customers in Japan.

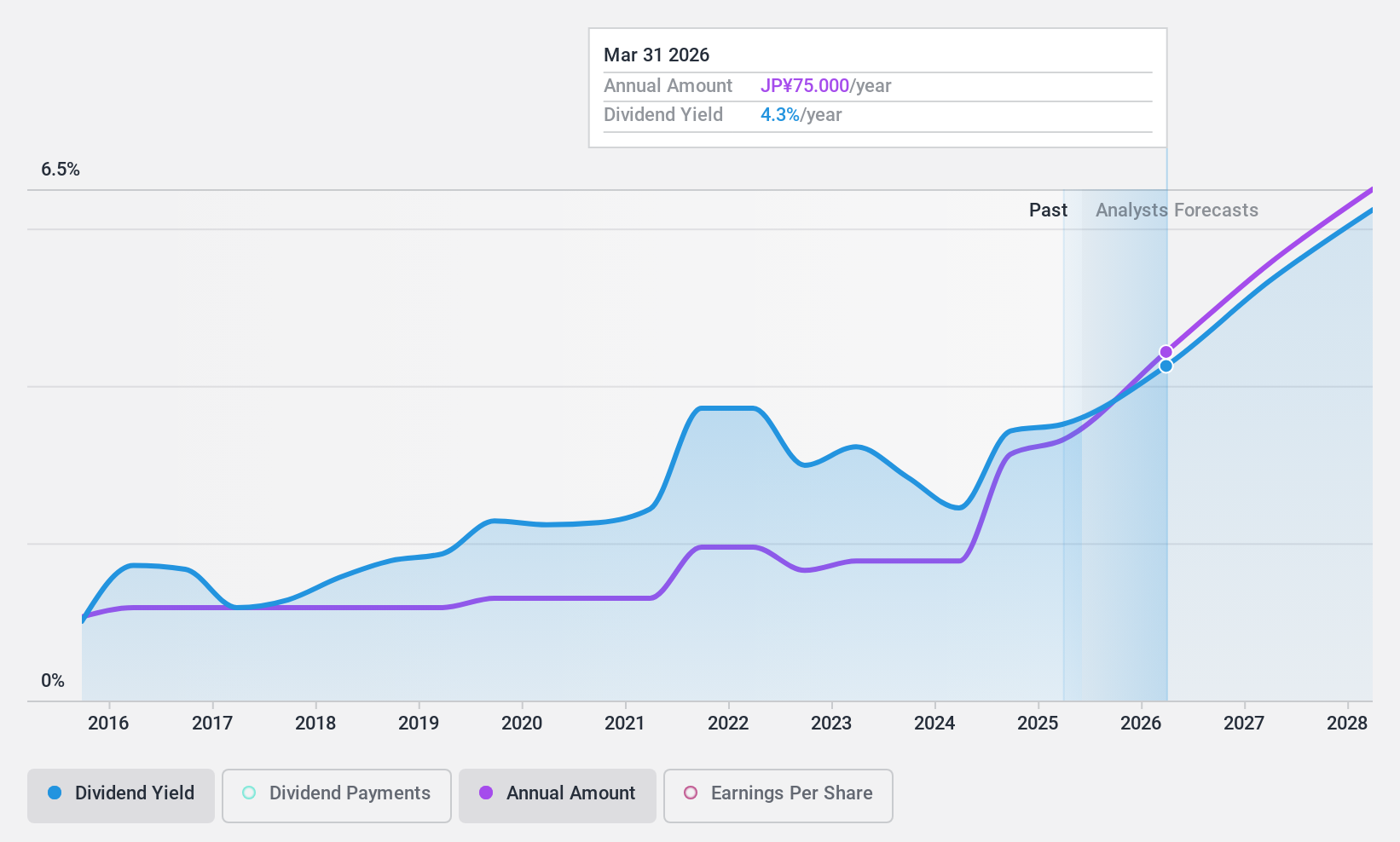

Dividend Yield: 3.5%

Chugin Financial Group's dividend has been stable and reliable over the past decade, with a yield of 3.53%, slightly below Japan's top-tier payers. The payout ratio is modest at 45.1%, indicating earnings cover dividends well, though future coverage remains uncertain. Recent guidance projects ¥212 billion in revenue and ¥25 billion profit for fiscal year ending March 2025, supporting potential dividend sustainability as earnings have grown annually by 13.8% over five years amidst a valuation below fair value estimates.

- Dive into the specifics of Chugin Financial GroupInc here with our thorough dividend report.

- Our expertly prepared valuation report Chugin Financial GroupInc implies its share price may be lower than expected.

ZERO (TSE:9028)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ZERO Co., Ltd., along with its subsidiaries, offers vehicle transportation and maintenance services in Japan, with a market cap of ¥42.55 billion.

Operations: ZERO Co., Ltd. generates revenue through its Domestic Car Related Business (¥66.47 billion), Overseas Related Business (¥48.69 billion), Human Resource Business (¥23.92 billion), and General Cargo Transportation (¥6.46 billion) segments in Japan.

Dividend Yield: 4.2%

ZERO's dividend payments are well covered by both earnings and cash flows, with payout ratios of 19.5% and 23.1% respectively, suggesting sustainability. However, the dividends have been volatile over the past decade, indicating unreliability despite recent growth in payouts. The stock trades significantly below its estimated fair value and offers a yield of 4.2%, placing it among the top dividend payers in Japan's market despite an unstable track record.

- Delve into the full analysis dividend report here for a deeper understanding of ZERO.

- The analysis detailed in our ZERO valuation report hints at an deflated share price compared to its estimated value.

Next Steps

- Dive into all 1973 of the Top Dividend Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tsumura might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4540

Tsumura

Manufactures and sells pharmaceutical products from crude drugs derived from plants and other natural products in Japan and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives