Ono Pharmaceutical (TSE:4528): Valuation in Focus Following Harness Therapeutics Collaboration on Rare Disease Therapies

Reviewed by Kshitija Bhandaru

Ono Pharmaceutical (TSE:4528) caught investor attention after its venture arm announced a new collaboration with Harness Therapeutics. The partnership aims to develop therapies for a rare genetic disorder and includes upfront funding as well as an exclusivity option.

See our latest analysis for Ono Pharmaceutical.

The partnership with Harness Therapeutics spotlights Ono Pharmaceutical’s determination to expand its pipeline in rare genetic disorders, but the market response has yet to reflect new momentum. Over the past year, total shareholder return is essentially flat at -0.09%, while share price performance shows only modest fluctuations. These are clear signs that investors remain cautious as they wait for tangible results from these innovative initiatives.

If this bold venture in rare diseases inspires you to see what else is out there, now’s a great opportunity to discover See the full list for free.

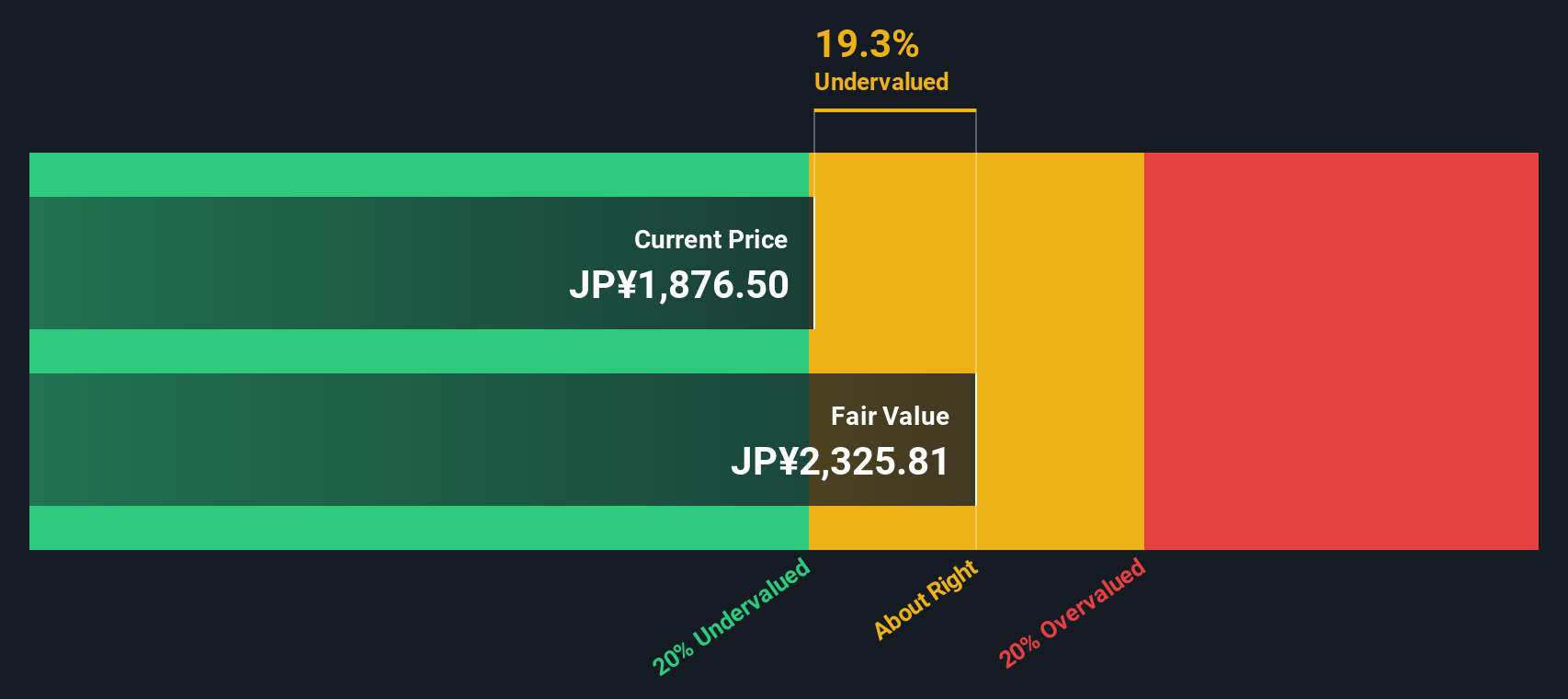

With shares holding steady and analysts setting price targets only slightly below current levels, the question now is whether Ono Pharmaceutical is actually undervalued or if the market has accurately priced in all the potential upside from its latest moves.

Price-to-Earnings of 19.1x: Is it justified?

Ono Pharmaceutical’s shares currently trade at a price-to-earnings (P/E) ratio of 19.1x, which is almost identical to its estimated fair P/E of 19.2x. The comparison suggests today’s price is in line with fair value models, reflecting neither marked optimism nor deep pessimism from the market.

The price-to-earnings ratio is a key benchmark for this sector, signaling how much investors are willing to pay for current earnings. For pharmaceutical companies with established cash flows and consistent profitability, this multiple is an important gauge of sentiment about future growth.

In a broader context, Ono Pharmaceutical’s P/E is considerably lower than the industry peer average of 28.6x but is slightly higher than the JP Pharmaceuticals sector average of 16x. This indicates the market is assigning a value that acknowledges steady profits but stops short of any growth premium. With the fair P/E ratio almost a perfect match, the market may be signaling it views analyst or model-based fundamentals as largely priced in, with little divergence expected in the near term.

Explore the SWS fair ratio for Ono Pharmaceutical

Result: Price-to-Earnings of 19.1x (ABOUT RIGHT)

However, ongoing revenue declines or weaker net income growth could quickly challenge the current valuation narrative. This may prompt the market to reassess its outlook.

Find out about the key risks to this Ono Pharmaceutical narrative.

Another View: Discounted Cash Flow Signals Undervaluation

Looking from a different angle, our DCF model values Ono Pharmaceutical at ¥3,432.42 per share. This suggests the stock is trading 49% below that estimate. This method sees significantly more upside. Could the market be missing something, or is the DCF model being too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ono Pharmaceutical for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ono Pharmaceutical Narrative

If you have your own perspective or want to dig deeper into the numbers, you can build a personalized view in just a few minutes, Do it your way

A great starting point for your Ono Pharmaceutical research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Opportunities move fast in today’s market. Make sure you’re not missing out on strategies that could give your portfolio an edge. Look beyond familiar names and get inspired with some of these game-changing themes:

- Tap into the potential for higher returns by using these 3579 penny stocks with strong financials with strong financials and promising outlooks that other investors may have overlooked.

- Uncover tomorrow’s breakthroughs in artificial intelligence through these 25 AI penny stocks that are redefining what’s possible in technology and automation.

- Generate more consistent income as you explore these 19 dividend stocks with yields > 3% featuring companies with attractive yields and a track record of rewarding shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4528

Ono Pharmaceutical

Produces, purchases, and sells pharmaceuticals and diagnostic reagents worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives