Eisai (TSE:4523) Valuation in Focus After Launch of At-Home Leqembi Alzheimer’s Injection and Support Program

Reviewed by Kshitija Bhandaru

Eisai (TSE:4523) and Biogen have made Leqembi Iqlik, a subcutaneous injection for maintenance Alzheimer’s therapy, available in the U.S. This offers early-stage patients an at-home alternative after completing initial intravenous treatment.

See our latest analysis for Eisai.

Eisai’s push for at-home Alzheimer’s therapies lands amid a volatile run for the stock. Despite a tough year, with a 1-year total shareholder return down nearly 10%, recent regulatory wins and product launches, including the subcutaneous Leqembi option, have helped the share price rally 21% over the past 90 days. This suggests that investor sentiment toward Eisai could be turning a corner.

With Eisai’s innovations making headlines, now is a great moment to discover other healthcare companies shaking up the sector. See the full list for free: See the full list for free.

With shares still trading at a considerable discount to estimated intrinsic value, but having already rebounded recently, the key question for investors is whether Eisai’s upside remains or if the market has already accounted for future growth.

Most Popular Narrative: 1.5% Undervalued

With Eisai’s fair value pegged just above its recent closing price, the narrative signals a market that is nearly in equilibrium but leaves just enough room for upside. The consensus hinges on forward-looking growth drivers rather than today's metrics, hinting at what could lie ahead for this pharma innovator.

*The launch and approval of the home-administered SC-AI formulation for LEQEMBI, with high physician and patient anticipation, promises to unlock substantial incremental demand through enhanced convenience, improved treatment adherence, and reduced burden on healthcare systems, benefiting both topline revenues and margins through operational efficiencies and lower administration costs.*

Which single financial projection underpins this razor-thin valuation gap? A bullish narrative can hinge on a single metric—maybe it is margin improvement, or a fresh forecast for global demand. Find out what gives this fair value its edge and see if the consensus view is as solid as it seems.

Result: Fair Value of ¥4,858 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, downward pressure on drug prices globally or increased competition in Alzheimer’s therapies could quickly put Eisai’s current growth narrative to the test.

Find out about the key risks to this Eisai narrative.

Another View: Multiples Signal a Premium Price

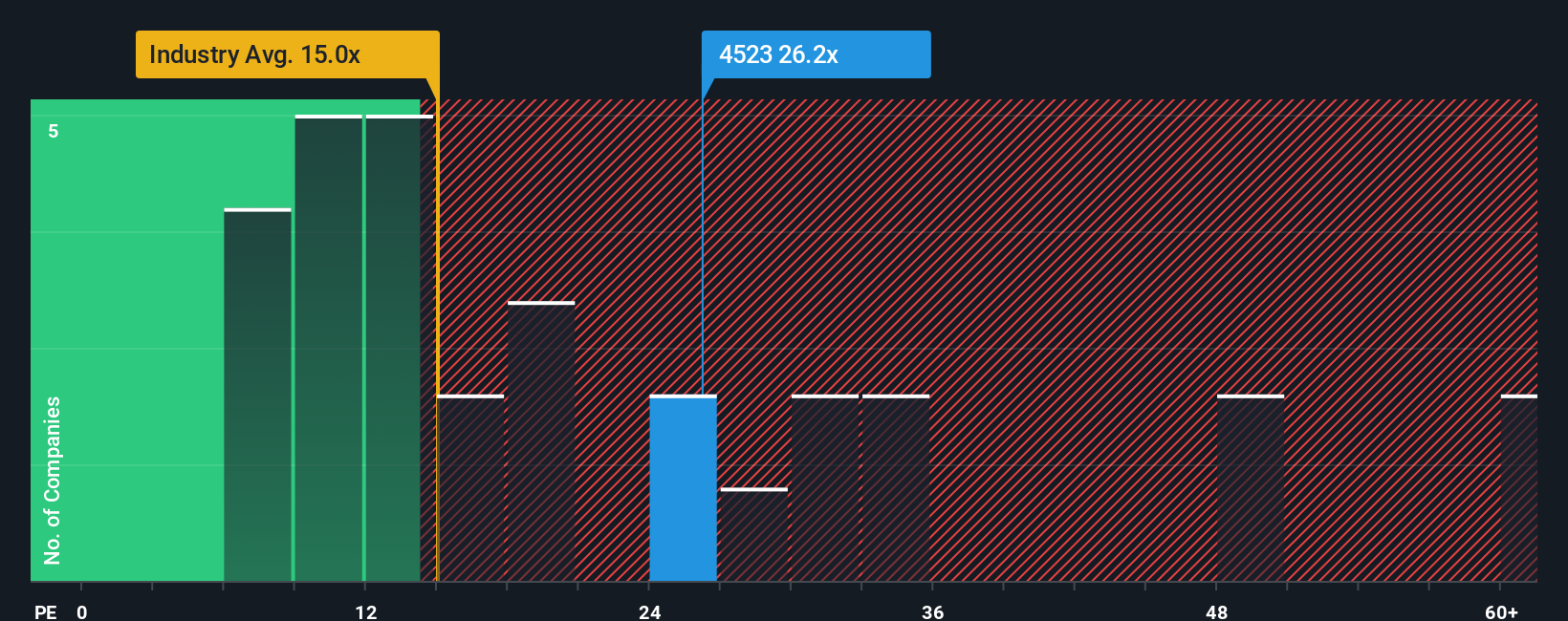

While analysts call Eisai's shares just slightly undervalued, our usual valuation yardstick tells a different story. Eisai trades at a price-to-earnings ratio of 26.8, which is well above the industry average of 15.7 and even exceeds the fair ratio of 23.6. This means investors are paying a significant premium for future growth, which raises the stakes for any stumble in the company's outlook. Is the market's optimism justified, or are shares priced for perfection?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Eisai Narrative

If you have your own perspective or want to investigate the numbers firsthand, you can build a personal narrative from scratch in just a few minutes. Do it your way

A great starting point for your Eisai research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Take Action: Unmissable Stock Ideas Await

Don’t let opportunity pass you by. Power up your portfolio with fresh stock ideas tailored to your interests. These strategies might be just what you need to get ahead.

- Boost your income with steady returns and start tracking these 19 dividend stocks with yields > 3% offering attractive yields above 3%.

- Ride the tech revolution and spot your next winner among these 25 AI penny stocks on the front lines of artificial intelligence innovation.

- Catch undervalued gems before the crowd by sifting through these 895 undervalued stocks based on cash flows with strong fundamentals and potential for upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eisai might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4523

Eisai

Engages in the research and development, manufacture, sale, and import and export of pharmaceuticals.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives