Eisai (TSE:4523) gains momentum with LEQEMBI approval in Mexico, enhancing global market presence

Reviewed by Simply Wall St

Click here to discover the nuances of Eisai with our detailed analytical report.

Core Advantages Driving Sustained Success for Eisai

With revenue growing by 3% year-on-year to reach JPY 385 billion, Eisai's pharmaceutical segment, particularly the "3 Ls"—Lenvima, Dayvigo, and LEQEMBI—has shown strong performance. Haruo Naito, CEO, noted that these products collectively saw a 21% increase in revenue, surpassing JPY 200 billion. This growth underscores Eisai's strategic focus on high-demand therapeutics. Additionally, the company's operational efficiency has improved, as evidenced by a JPY 2.7 billion increase in profits due to enhanced R&D investment efficiency. Financially, Eisai is forecasted to grow earnings at 13.3% annually, outpacing the JP market average of 7.9%, and it maintains a strong balance sheet with more cash than debt, indicating solid financial health.

Challenges Constraining Eisai's Potential

However, Eisai faces challenges such as a low Return on Equity (ROE) of 5.1%, expected to rise only slightly to 6.7% in three years. The company has experienced a 23% annual decline in earnings over the past five years, with a 14.8% drop last year. This trend is compounded by a high dividend payout ratio of 111.6%, suggesting dividends are not well covered by earnings. Operationally, infusion capacity bottlenecks in the U.S. have delayed treatments for 6,000 patients, impacting sales progression. The increase in SG&A expenses due to the launch of LEQEMBI and profit-sharing with Lenvima further strains resources.

Emerging Markets or Trends for Eisai

Despite these challenges, Eisai is actively expanding its infusion capacity, aiming to accommodate more patients by the end of the fiscal year, which could boost sales. The development of subcutaneous autoinjectors and blood-based biomarkers presents opportunities to streamline treatment pathways and expand market reach. Recently, Eisai and Biogen announced the approval of LEQEMBI in Mexico for early Alzheimer's treatment, following successful Phase 3 trials. This approval, along with ongoing reviews in 16 other countries, highlights Eisai's potential to capitalize on emerging markets and enhance its global footprint.

Competitive Pressures and Market Risks Facing Eisai

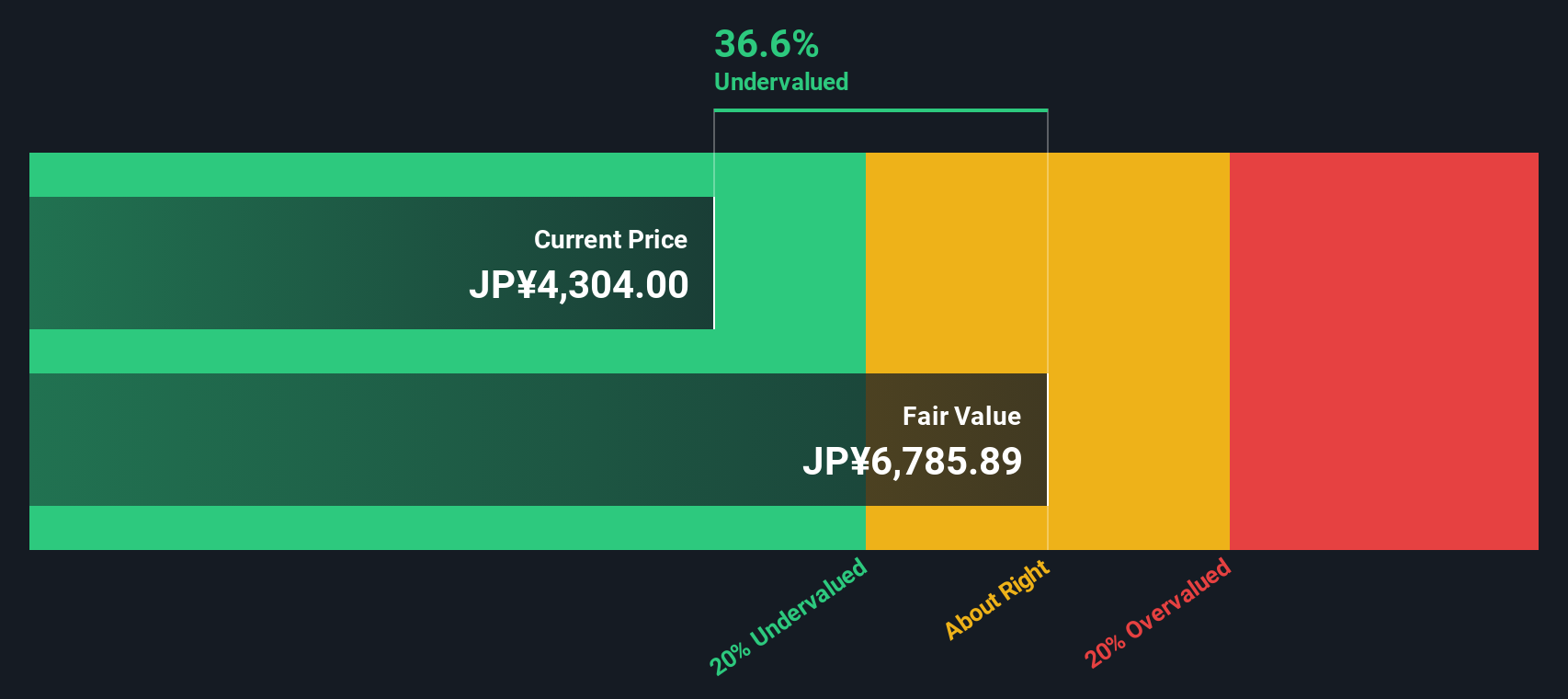

The regulatory environment poses significant risks, particularly with the European Medicines Agency's ongoing reexamination of LEQEMBI, which could delay market expansion. Additionally, Eisai's Price-To-Earnings Ratio of 30.7x, significantly higher than the industry average, raises concerns about potential overvaluation. Competition in securing infusion capacity further threatens Eisai's market positioning. Nevertheless, the company's current trading price of ¥4462, below the estimated fair value of ¥8857.7, suggests it may be undervalued, offering a potential cushion against these pressures.

See what the latest analyst reports say about Eisai's future prospects and potential market movements.Conclusion

Eisai's strategic focus on high-demand therapeutics, as evidenced by the impressive 21% revenue increase from its key products Lenvima, Dayvigo, and LEQEMBI, positions the company for sustained growth, with earnings projected to rise at 13.3% annually. Challenges such as low Return on Equity and operational bottlenecks persist, but Eisai's initiatives to expand infusion capacity and develop innovative treatment methods signal a proactive approach to overcoming these hurdles. The company's trading price of ¥4462, significantly below its estimated fair value of ¥8857.7, suggests potential for future appreciation, especially as it capitalizes on emerging markets and navigates regulatory reviews. This potential for growth, coupled with a strong balance sheet, indicates a promising outlook for Eisai's long-term performance.

Where To Now?

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eisai might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4523

Eisai

Engages in the research and development, manufacture, sale, and import and export of pharmaceuticals in Japan.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives