Eisai (TSE:4523): Evaluating Valuation and Growth Sentiment After Latest Product Developments

Reviewed by Simply Wall St

Eisai (TSE:4523) has caught the market’s attention, as recent price action shows shares holding steady for the month with an 8% return. Investors watching the pharmaceuticals group may be considering its latest developments and current valuation trends.

See our latest analysis for Eisai.

After a solid uptick this month, Eisai’s momentum looks to be building, with a 1-month share price return of 8% and a year-to-date return over 12%. Recent headlines around product developments add to a sense of renewed optimism, but the stock’s 1-year total shareholder return of 8.5% and longer-term losses suggest investors are only cautiously shifting sentiment for now.

If Eisai’s recent moves have you interested in broader opportunities, you might want to check out our screener for pharmaceutical firms with big dividend potential: See the full list for free.

The question for investors now is whether Eisai shares are attractively valued given their recent momentum or if the current price already reflects the company’s improving outlook. Is this a buying opportunity, or has the market already priced in future growth?

Most Popular Narrative: 2.6% Undervalued

The latest narrative sets Eisai's fair value slightly above the last close, suggesting cautious optimism but no dramatic discount. Here is a pivotal insight from the most followed narrative driving this view:

The launch and approval of the home-administered SC-AI formulation for LEQEMBI, with high physician and patient anticipation, promises to unlock substantial incremental demand through enhanced convenience, improved treatment adherence, and reduced burden on healthcare systems. This is expected to benefit both topline revenues and margins through operational efficiencies and lower administration costs.

Why does this valuation hold up against the share price? The narrative is powered by ambitious growth in revenue and profit, along with anticipated margin expansion. Discover the bold scenario that sets this fair value; if the assumptions play out, it could reshape investor expectations.

Result: Fair Value of ¥5,026.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, potential pricing pressures or increased competition in the Alzheimer's space could quickly shift Eisai's earnings outlook and alter the current valuation narrative.

Find out about the key risks to this Eisai narrative.

Another View: Multiples Tell a Different Story

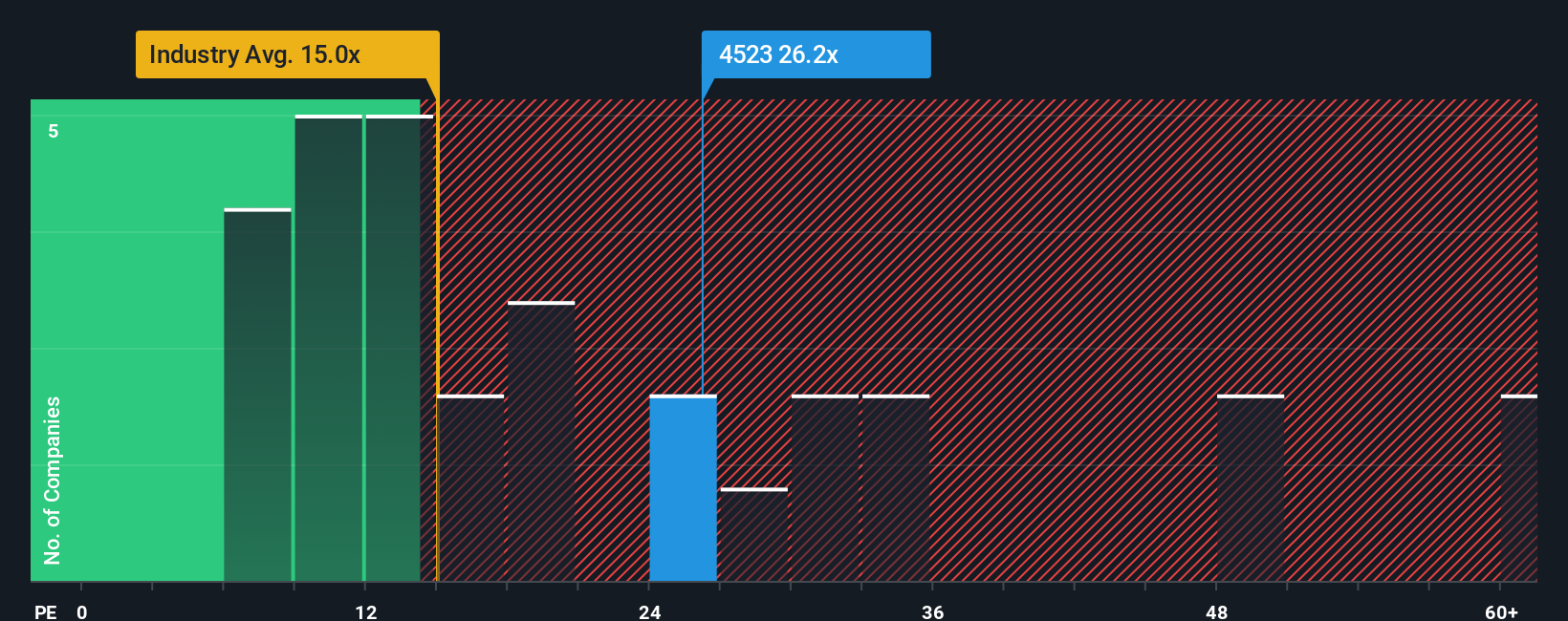

While the most popular narrative points to Eisai being slightly undervalued, the market’s go-to valuation metric paints a more expensive picture. Eisai trades at 28 times earnings, noticeably higher than both the industry average of 16 times and its peers’ 19.8 times. This is also well above the fair ratio of 23.1 times that the market could revert to, adding some risk for buyers at this price. Could this premium reflect confidence in Eisai’s pipeline, or does it signal over-optimism that could unwind if results falter?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Eisai Narrative

If you see things differently or want to dig into the numbers for yourself, it only takes a few minutes to build your own perspective. Do it your way

A great starting point for your Eisai research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart opportunities can slip by fast, so make sure you’re keeping your options open. The Simply Wall Street Screener is packed with ways to discover stocks you might otherwise overlook. Start exploring today and you could spot your next standout investment.

- Tap into the income potential of companies offering generous payouts by checking out these 15 dividend stocks with yields > 3% with robust yields over 3%.

- Catch the buzz of innovation with these 25 AI penny stocks at the forefront of artificial intelligence, transforming everything from healthcare to automation.

- Position yourself for long-term gains by uncovering these 920 undervalued stocks based on cash flows trading below their intrinsic value according to cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eisai might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4523

Eisai

Engages in the research and development, manufacture, sale, and import and export of pharmaceuticals.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.