Assessing Eisai’s Valuation After Recent Gains and Alzheimer’s Treatment Milestones

Reviewed by Bailey Pemberton

- If you are wondering whether Eisai is quietly turning into a value opportunity or still a value trap after a tough few years, this article will walk you through what the current share price is really baking in.

- Despite a painful longer term slide of about 46.9% over three years and 30.5% over five years, the stock is up 7.5% over the last month, 6.8% year to date and 8.3% over the past year, even after a recent 4.7% pullback in the last week.

- Recent sentiment around Eisai has been shaped by developments in its Alzheimer's treatment partnership and regulatory milestones in key markets. These have shifted how investors think about its long term growth runway. At the same time, evolving views on drug pricing, competition in neurology, and Japan's wider pharma landscape are feeding into the stock's risk profile.

- Right now Eisai scores 2 out of 6 on our valuation checks, suggesting pockets of undervaluation but not a screaming bargain. In this article we will unpack what different valuation approaches say about the stock today and then finish with a smarter way to think about Eisai's true worth.

Eisai scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Eisai Discounted Cash Flow (DCF) Analysis

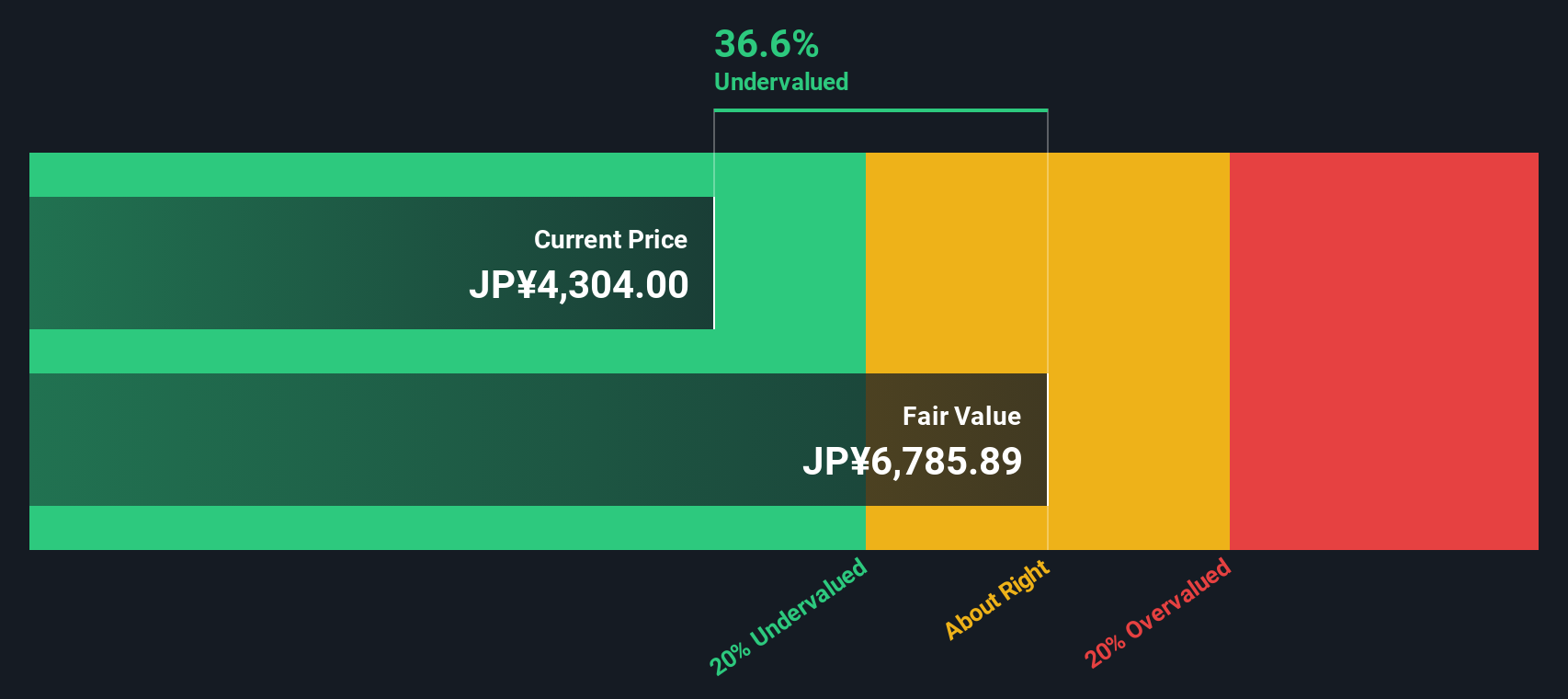

A Discounted Cash Flow model estimates what a business is worth by projecting its future cash flows and then discounting them back to today, using a required rate of return. For Eisai, the model uses a 2 Stage Free Cash Flow to Equity approach, starting from last twelve months free cash flow of about ¥26.3 billion and building up through analyst forecasts and longer term extrapolations.

Analysts currently see Eisai’s free cash flow rising into the mid ¥40 billion to ¥70 billion range over the next decade, with Simply Wall St extending those projections beyond the five year analyst window to reach around ¥91.1 billion by 2035. On this basis, the estimated intrinsic value comes out at roughly ¥6,739 per share, using the projected stream of cash flows and an appropriate discount rate.

Compared with the current share price, this implies Eisai is trading at about a 30.7% discount to its DCF derived fair value. This suggests that the market may be underpricing the company’s long term cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Eisai is undervalued by 30.7%. Track this in your watchlist or portfolio, or discover 905 more undervalued stocks based on cash flows.

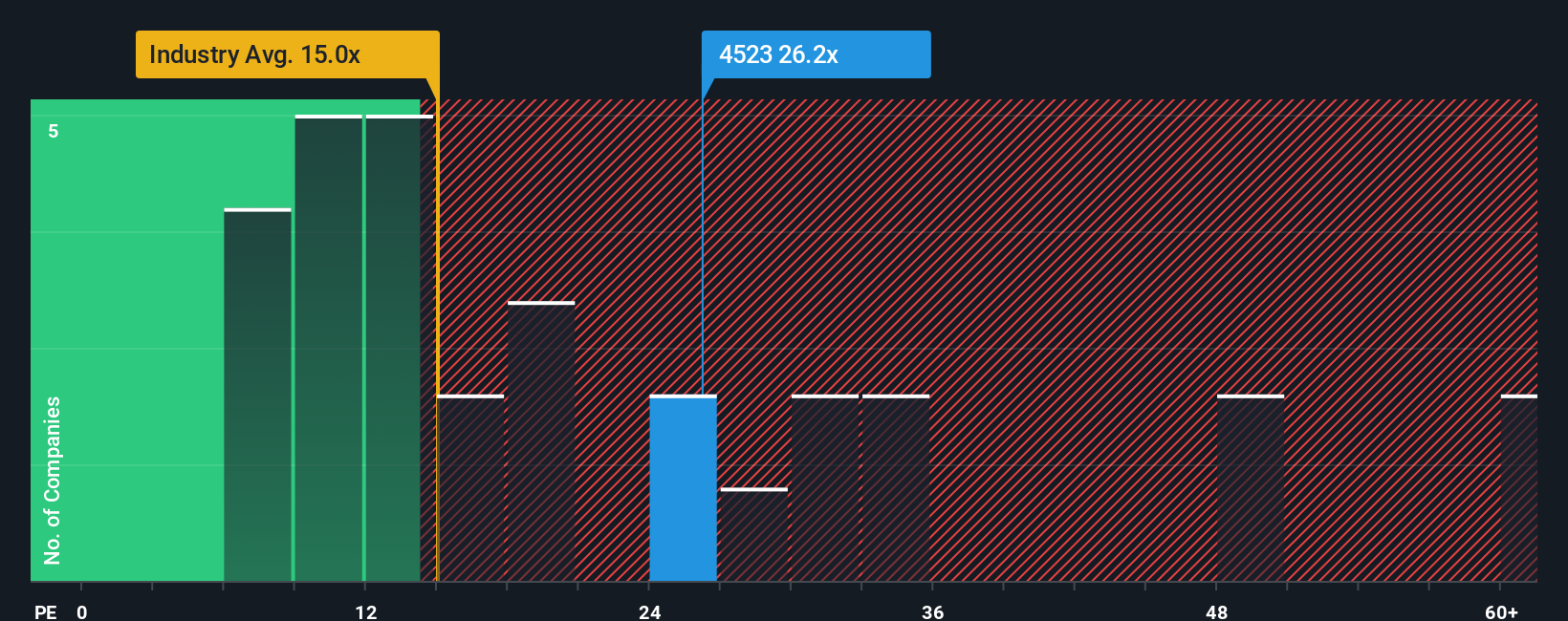

Approach 2: Eisai Price vs Earnings

For a profitable business like Eisai, the price to earnings ratio, or PE, is a useful way to gauge how much investors are paying for each unit of current earnings. In general, stronger and more reliable earnings growth, combined with lower perceived risk, can justify a higher PE, while slower growth or elevated uncertainty typically call for a lower, more conservative multiple.

Eisai currently trades on a PE of around 26.7x. That is notably richer than the broader Pharmaceuticals industry average of about 15.5x and also above the peer group average of roughly 19.1x. This suggests investors are already paying a premium for its earnings profile. Simply Wall St’s proprietary Fair Ratio model, which estimates what a “normal” PE should be after accounting for factors like earnings growth, margins, industry, market cap and risk, points to a Fair PE of about 22.9x for Eisai.

Because the Fair Ratio bakes in company specific drivers rather than just comparing against blunt industry or peer averages, it offers a more tailored view of what Eisai should trade at. On this basis, Eisai’s current PE sits above its Fair Ratio. This indicates the shares look somewhat expensive on earnings.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

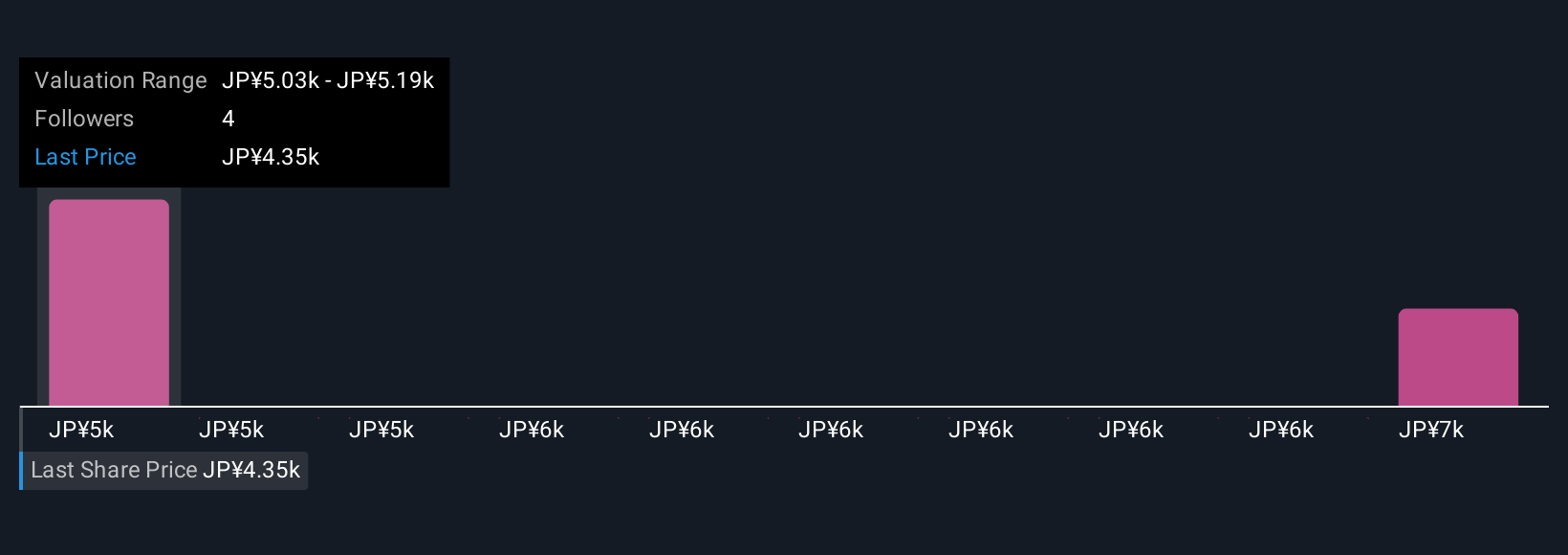

Upgrade Your Decision Making: Choose your Eisai Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple way to put your personal story about Eisai into numbers by connecting your view of its future revenue, earnings and margins to a financial forecast and, ultimately, to a fair value that you can compare with today’s share price when deciding whether to buy, hold or sell.

On Simply Wall St’s Community page, used by millions of investors, Narratives make this process accessible by guiding you to set assumptions, instantly showing how your fair value changes as new information such as earnings or Alzheimer’s trial updates comes in, and updating dynamically so your thesis never goes stale.

For example, one investor might build a bullish Eisai Narrative around rapid global adoption of LEQEMBI, home based Alzheimer’s treatments and improving margins that supports a fair value near ¥6,000. Another might focus on pricing pressure, regulatory risk and product concentration to arrive at a more cautious fair value closer to ¥3,600, and both perspectives are made explicit, comparable and testable through their Narratives.

Do you think there's more to the story for Eisai? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eisai might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4523

Eisai

Engages in the research and development, manufacture, sale, and import and export of pharmaceuticals.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026