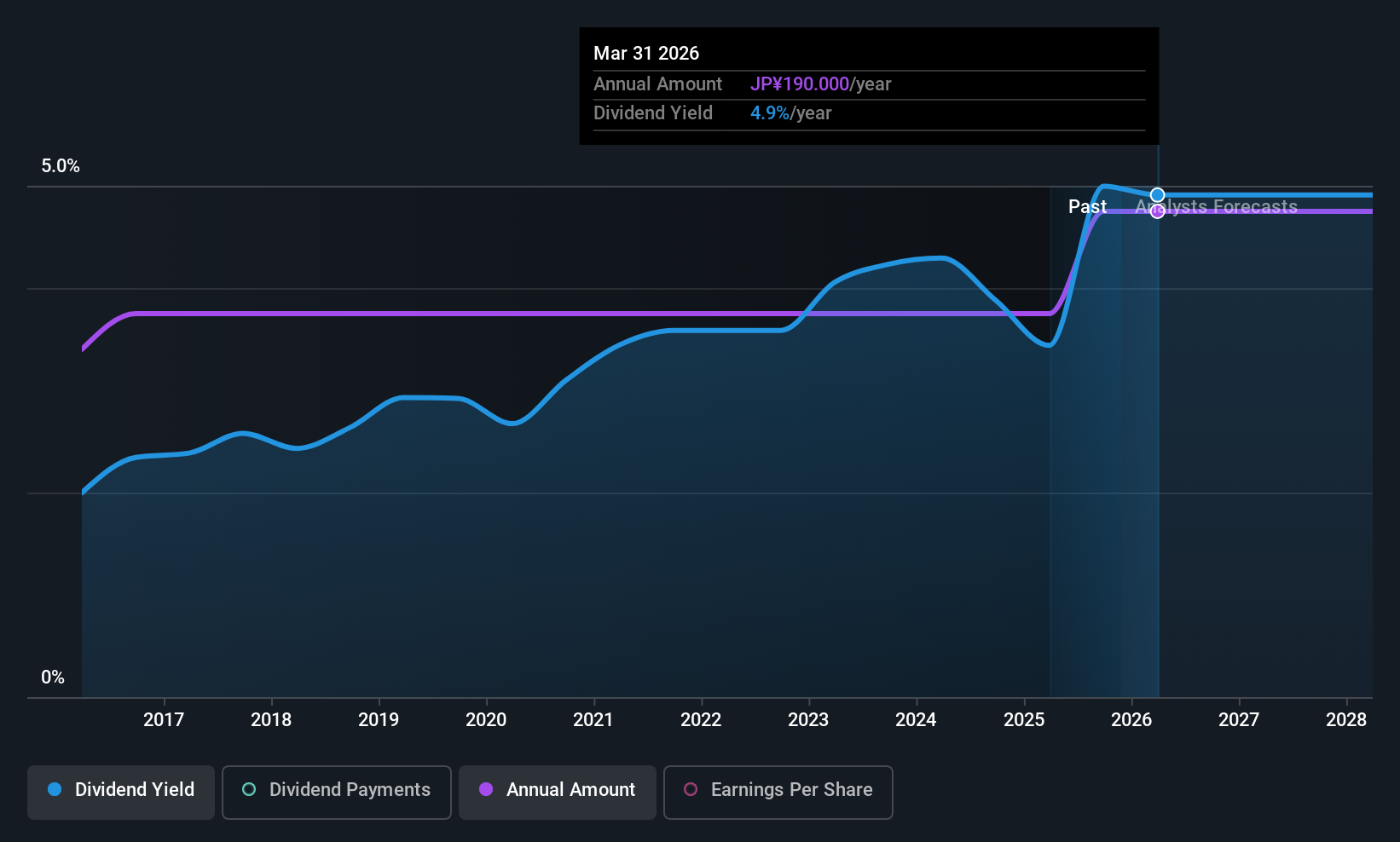

Kaken Pharmaceutical Co., Ltd. (TSE:4521) will pay a dividend of ¥95.00 on the 30th of June. This takes the dividend yield to 4.9%, which shareholders will be pleased with.

Estimates Indicate Kaken Pharmaceutical's Could Struggle to Maintain Dividend Payments In The Future

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Prior to this announcement, the dividend made up 440% of earnings, and the company was generating negative free cash flows. Paying out such a large dividend compared to earnings while also not generating any free cash flow would definitely be difficult to keep up.

Earnings per share is forecast to rise by 10.1% over the next year. If the dividend continues on its recent course, the company could be paying out several times what it earns in the next 12 months, which could start applying pressure to the balance sheet.

View our latest analysis for Kaken Pharmaceutical

Kaken Pharmaceutical Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. Since 2015, the annual payment back then was ¥108.00, compared to the most recent full-year payment of ¥190.00. This implies that the company grew its distributions at a yearly rate of about 5.8% over that duration. Dividends have grown at a reasonable rate over this period, and without any major cuts in the payment over time, we think this is an attractive combination as it provides a nice boost to shareholder returns.

The Dividend Has Limited Growth Potential

Investors could be attracted to the stock based on the quality of its payment history. Unfortunately things aren't as good as they seem. Over the past five years, it looks as though Kaken Pharmaceutical's EPS has declined at around 48% a year. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this becomes a long term trend.

Kaken Pharmaceutical's Dividend Doesn't Look Sustainable

In summary, while it's always good to see the dividend being raised, we don't think Kaken Pharmaceutical's payments are rock solid. We can't deny that the payments have been very stable, but we are a little bit worried about the very high payout ratio. We would be a touch cautious of relying on this stock primarily for the dividend income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Just as an example, we've come across 3 warning signs for Kaken Pharmaceutical you should be aware of, and 1 of them is concerning. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Kaken Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4521

Kaken Pharmaceutical

Produces, markets, and sells medical products, medical devices, and agrochemicals in Japan and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.