Chugai Pharmaceutical (TSE:4519) Margins Remain Strong, Reinforcing Bullish Narratives Despite Slower Earnings Growth

Reviewed by Simply Wall St

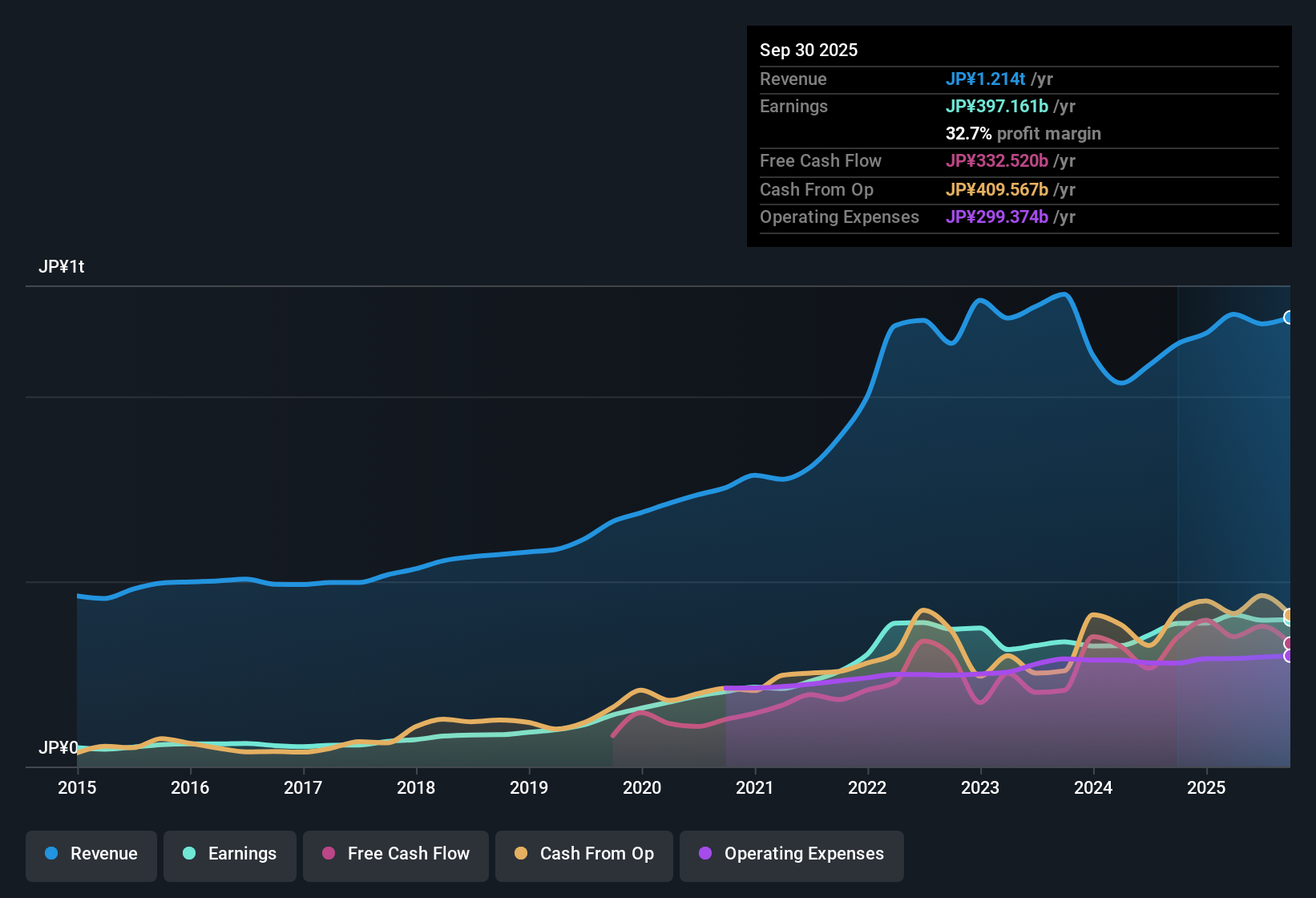

Chugai Pharmaceutical (TSE:4519) posted earnings growth of 2.6% in the last year and has grown at an average rate of 10.7% annually over the past five years. Its net profit margin eased slightly to 32.7% from last year’s 33.9%, while analysts expect revenue and earnings to keep moving ahead of local industry averages. As investors consider the company’s robust margins and projected above-market growth, recent moderation in growth rates and share price trends may play a key role in shaping sentiment around valuation.

See our full analysis for Chugai Pharmaceutical.The next section takes these results and puts them head-to-head with the current market narratives, spotlighting where the numbers confirm expectations and where they complicate the story.

See what the community is saying about Chugai Pharmaceutical

Profit Margins Projected to Climb

- Analysts expect Chugai’s profit margins to increase from 33.1% today to 37.4% in three years, signaling further upside for operating leverage as the business grows.

- According to the analysts' consensus view, this margin boost is underpinned by Chugai’s investment in advanced manufacturing facilities and a strategic push toward innovative biologics, which

- should help scale higher-value products and control production costs. This would support long-term profitability,

- while also aligning with the global healthcare trend toward more specialized, high-margin therapies.

- What stands out is how consensus sees Chugai's expanding margins powering sustained profit growth even as pipeline pressure and industry headwinds linger. 📊 Read the full Chugai Pharmaceutical Consensus Narrative.

Narrow Product Focus Heightens Risk

- Chugai’s future earnings are heavily tied to just a few drugs, namely Hemlibra and Actemra, putting the company at significant risk if these blockbusters face patent expirations or biosimilar competition in the coming years.

- Bearish critics highlight that this reliance could expose revenue and earnings to pronounced downside if pipeline innovation lags or if generic penetration accelerates, as

- the recent discontinuation of multiple R&D projects and delays in candidate launches could stem the flow of new drivers needed to offset maturing product lines,

- raising the threat of stagnating growth as the company faces mounting regulatory and pricing headwinds.

Share Price Lags, Valuation Offers a Discount

- Chugai’s current share price of ¥6,935.00 sits below both its analyst target price of ¥8,092.86 and the DCF fair value estimate of ¥8,845.28, implying a notable discount despite a premium price-to-earnings ratio compared to the broader Japanese pharmaceuticals sector.

- Consensus narrative notes that, while Chugai trades at 28.7x earnings, which is above the industry’s 15.2x, its forward multiples are justified by above-market growth forecasts, resilient high margins, and anticipated expansion in both domestic and global markets. However, persistent share price weakness could test investor confidence.

- This valuation gap suggests that if the company delivers on forecast growth and margin improvements, there is room for the stock to catch up to fair value,

- yet mixed share price performance may reflect the market’s caution over concentration risks and future pipeline strength.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Chugai Pharmaceutical on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something others might miss? You can turn fresh insights into your personal narrative in just a few minutes. Do it your way

A great starting point for your Chugai Pharmaceutical research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Chugai Pharmaceutical’s heavy reliance on a narrow set of products could magnify risks if competition intensifies and growth from new drugs stalls.

If you want broader stability and steady performance, check out stable growth stocks screener (2095 results) where you can find companies delivering consistent growth without overreliance on a single product line.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4519

Chugai Pharmaceutical

Engages in the research, development, manufacture, sale, importation, and exportation of pharmaceuticals in Japan and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives