- South Korea

- /

- Pharma

- /

- KOSE:A000100

3 Asian Stocks That Might Be Trading At Discounts Of Up To 19%

Reviewed by Simply Wall St

As global markets navigate a period of volatility, Asian stock markets have been particularly impacted by ongoing trade tensions and economic uncertainties. In this environment, identifying undervalued stocks can be crucial for investors seeking opportunities; these stocks may offer potential value due to their current trading prices being lower than their perceived intrinsic worth.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhejiang Century Huatong GroupLtd (SZSE:002602) | CN¥19.10 | CN¥38.01 | 49.7% |

| Tongguan Gold Group (SEHK:340) | HK$2.75 | HK$5.49 | 49.9% |

| Tibet GaoZheng Explosive (SZSE:002827) | CN¥39.50 | CN¥76.84 | 48.6% |

| Teikoku Sen-i (TSE:3302) | ¥3410.00 | ¥6729.50 | 49.3% |

| TaewoongLtd (KOSDAQ:A044490) | ₩31100.00 | ₩61902.66 | 49.8% |

| Ningxia Building Materials GroupLtd (SHSE:600449) | CN¥13.37 | CN¥26.43 | 49.4% |

| Kinsus Interconnect Technology (TWSE:3189) | NT$146.50 | NT$285.68 | 48.7% |

| Insource (TSE:6200) | ¥937.00 | ¥1811.07 | 48.3% |

| HD Hyundai Construction Equipment (KOSE:A267270) | ₩104000.00 | ₩201910.55 | 48.5% |

| Aecc Aero Science and TechnologyLtd (SHSE:600391) | CN¥27.07 | CN¥54.10 | 50% |

Let's uncover some gems from our specialized screener.

Yuhan (KOSE:A000100)

Overview: Yuhan Corporation manufactures and sells prescription drugs, over-the-counter drugs, veterinary drugs, and household goods in South Korea and internationally, with a market cap of ₩8.86 trillion.

Operations: The company's revenue segments include prescription drugs, over-the-counter drugs, veterinary drugs, household goods, and biotechnology startups totaling ₩2.17 billion.

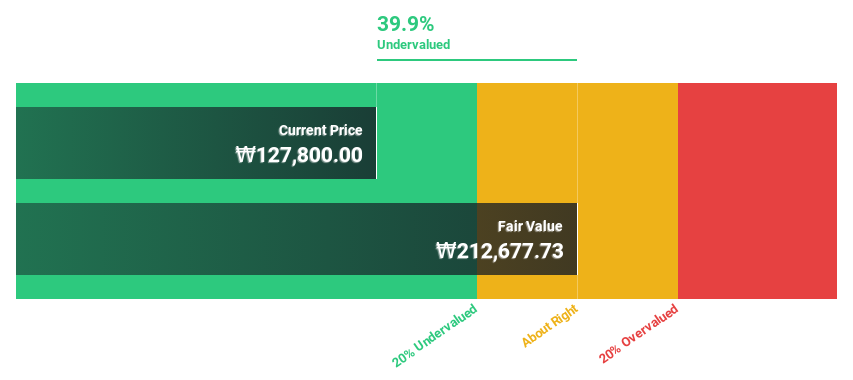

Estimated Discount To Fair Value: 17.6%

Yuhan is trading at ₩118,400, about 17.6% below its estimated fair value of ₩143,628.19, suggesting it might be undervalued based on cash flows. The company's recent earnings report showed improved net income and sales compared to the previous year. Although profit margins have decreased from 7.9% to 3.7%, earnings are projected to grow significantly at 43.2% annually over the next three years, outpacing the Korean market's growth rate of 26.5%.

- Our growth report here indicates Yuhan may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Yuhan.

Chugai Pharmaceutical (TSE:4519)

Overview: Chugai Pharmaceutical Co., Ltd. is involved in the research, development, manufacture, sale, importation, and exportation of pharmaceuticals both in Japan and internationally; it has a market cap of ¥11.90 billion.

Operations: The company generates revenue from its pharmaceuticals segment, amounting to ¥1.20 billion.

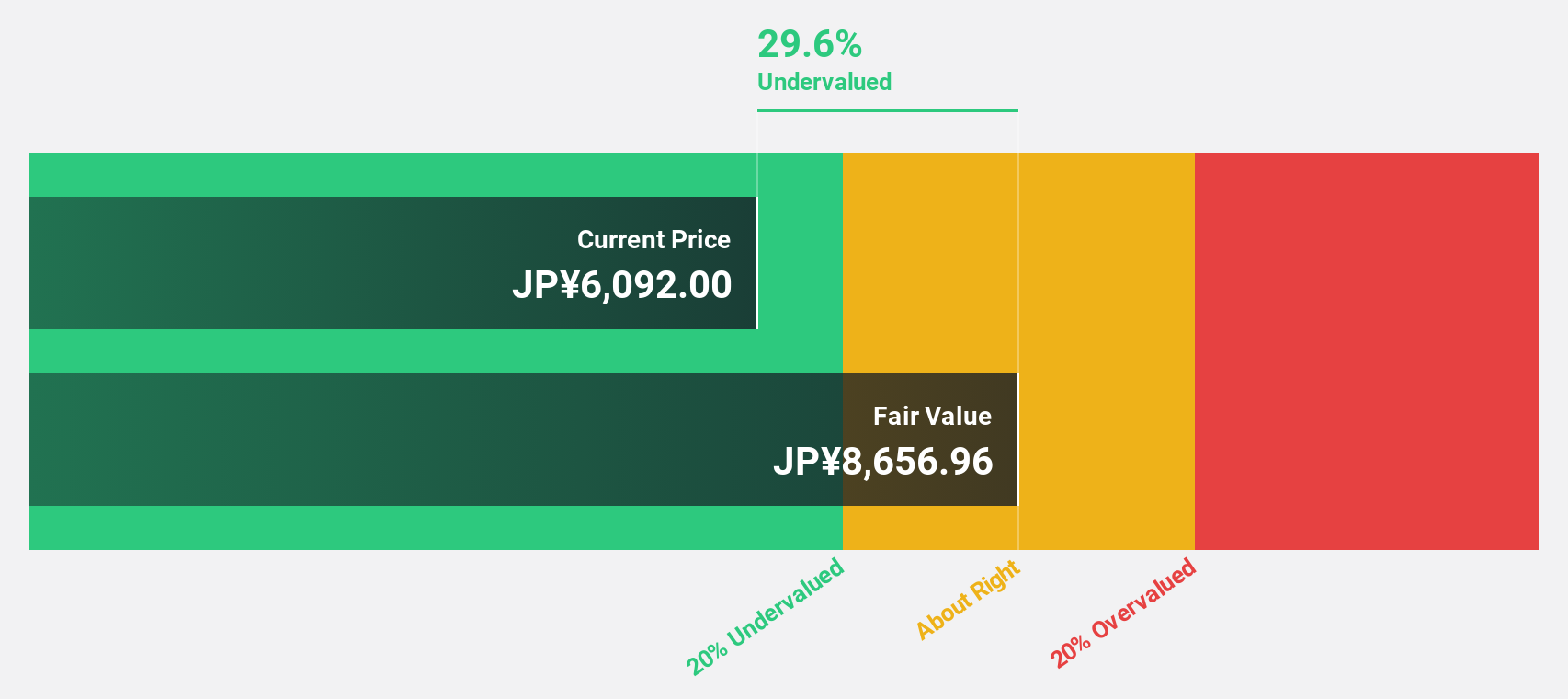

Estimated Discount To Fair Value: 19%

Chugai Pharmaceutical is trading at ¥7,228, approximately 19% below its estimated fair value of ¥8,918.88. Despite recent share price volatility, its earnings have grown 12% annually over the past five years and are forecast to grow at 8.57% per year, outpacing the Japanese market's average growth rate of 8%. Recent collaborations and clinical trial successes could enhance future cash flows and support revenue growth above the market average.

- Our expertly prepared growth report on Chugai Pharmaceutical implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Chugai Pharmaceutical with our detailed financial health report.

Digital Garage (TSE:4819)

Overview: Digital Garage, Inc. operates as a context company in Japan with a market cap of ¥157.92 billion.

Operations: The company's revenue segments include Platform Solutions generating ¥24.57 billion and Long-Term Incubation contributing ¥13.04 billion, while Global Investment Incubation reports a negative contribution of -¥3.58 billion.

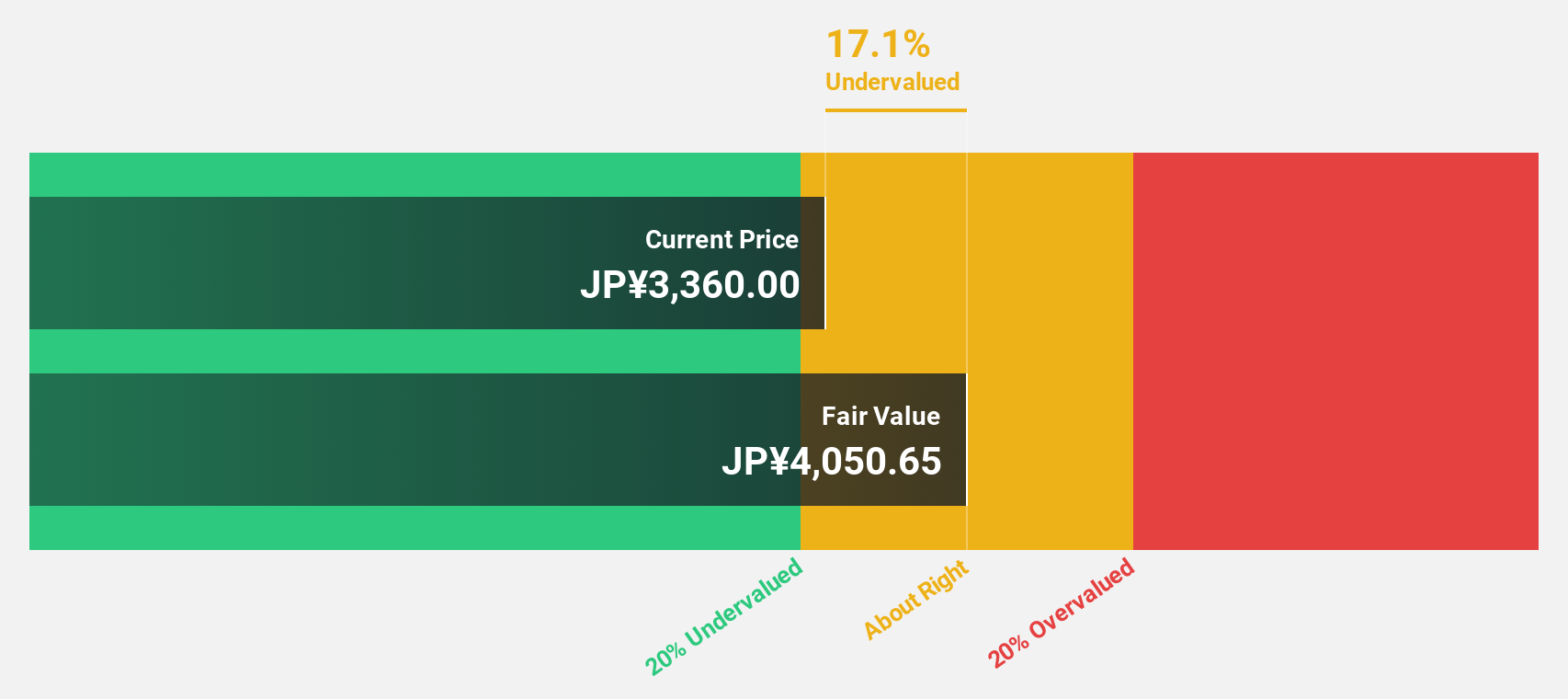

Estimated Discount To Fair Value: 15.5%

Digital Garage is trading at ¥3,445, below its estimated fair value of ¥4,078.50. The company's earnings are projected to grow significantly at 47.49% annually over the next three years, with revenue growth expected to outpace the Japanese market at 10% per year. Recent strategic alliances and a share acquisition by Resona Holdings could bolster its cash flow potential and enhance global expansion opportunities for game publishers through innovative monetization models.

- Our comprehensive growth report raises the possibility that Digital Garage is poised for substantial financial growth.

- Get an in-depth perspective on Digital Garage's balance sheet by reading our health report here.

Taking Advantage

- Click through to start exploring the rest of the 270 Undervalued Asian Stocks Based On Cash Flows now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A000100

Yuhan

Manufactures and sells prescription drugs, over-the-counter drugs, veterinary drugs, and household goods in South Korea and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives