How Investors Are Reacting To Nippon Shinyaku (TSE:4516) Advancing Rare Disease Pipeline and Safety Platform Integration

Reviewed by Sasha Jovanovic

- In recent developments, ArisGlobal announced that Nippon Shinyaku has chosen its LifeSphere® Safety platform to streamline global safety workflows, and Nippon Shinyaku provided clinical trial updates for experimental therapies in Duchenne Muscular Dystrophy and Eosinophilic Granulomatosis With Polyangiitis.

- These actions underline Nippon Shinyaku's commitment to advancing treatments for rare diseases while investing in next-generation safety data management and compliance.

- We'll examine how clinical advances in Duchenne Muscular Dystrophy are shaping Nippon Shinyaku's investment narrative and future growth potential.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

What Is Nippon Shinyaku's Investment Narrative?

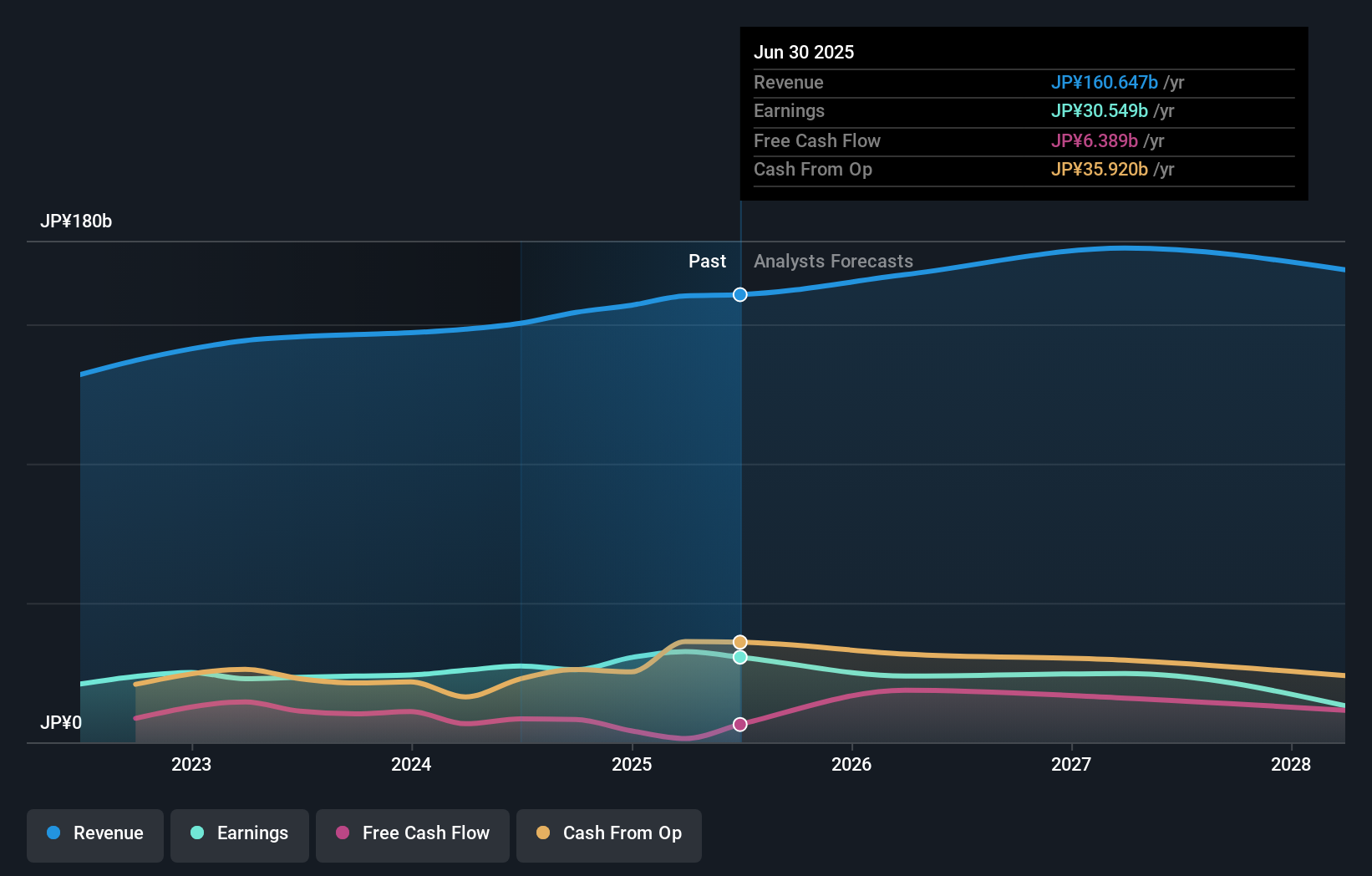

For shareholders of Nippon Shinyaku, the core belief centers on the company’s ability to move the needle in rare disease therapies, especially through its focused clinical pipeline in Duchenne Muscular Dystrophy (DMD). The latest updates, including early clinical progress in DMD and Eosinophilic Granulomatosis With Polyangiitis, and the decision to adopt ArisGlobal’s LifeSphere® Safety platform, underscore an intent to drive innovation and modernize operations. These steps could modestly improve its investment story, offering incremental catalysts ahead of key earnings dates. Still, with long-term earnings projected to decline and sluggish revenue growth compared to the broader Japanese market, the biggest risks remain whether experimental therapies meet expectations and if margin pressures persist. While recent news signals intent to change, near-term upside appears limited unless pipeline outcomes surprise the market.

Yet, it's important not to overlook some governance and growth concerns that warrant investor attention.

Exploring Other Perspectives

Explore another fair value estimate on Nippon Shinyaku - why the stock might be worth as much as ¥1736!

Build Your Own Nippon Shinyaku Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nippon Shinyaku research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Nippon Shinyaku research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nippon Shinyaku's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Shinyaku might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4516

Nippon Shinyaku

Manufactures and sells pharmaceuticals and foodstuffs in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives