Why Investors Shouldn't Be Surprised By Sumitomo Pharma Co., Ltd.'s (TSE:4506) 26% Share Price Plunge

Sumitomo Pharma Co., Ltd. (TSE:4506) shares have had a horrible month, losing 26% after a relatively good period beforehand. Looking at the bigger picture, even after this poor month the stock is up 29% in the last year.

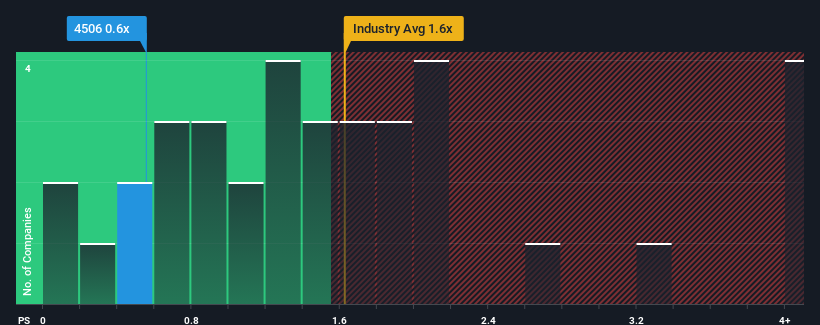

Since its price has dipped substantially, it would be understandable if you think Sumitomo Pharma is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.6x, considering almost half the companies in Japan's Pharmaceuticals industry have P/S ratios above 1.6x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Sumitomo Pharma

How Sumitomo Pharma Has Been Performing

Sumitomo Pharma's revenue growth of late has been pretty similar to most other companies. It might be that many expect the mediocre revenue performance to degrade, which has repressed the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Sumitomo Pharma .Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Sumitomo Pharma's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a decent 13% gain to the company's revenues. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 33% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 1.5% per annum during the coming three years according to the eight analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 4.6% each year, which is noticeably more attractive.

With this in consideration, its clear as to why Sumitomo Pharma's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Sumitomo Pharma's P/S has taken a dip along with its share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Sumitomo Pharma maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Sumitomo Pharma you should know about.

If these risks are making you reconsider your opinion on Sumitomo Pharma, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4506

Sumitomo Pharma

Engages in the manufacture and sale of pharmaceuticals, food ingredients and additives, veterinary medicines, and others in Japan, North America, China, and internationally.

Good value slight.

Similar Companies

Market Insights

Community Narratives