Sumitomo Pharma (TSE:4506): Valuation in Focus After Index Inclusion and Upgraded Outlook

Reviewed by Kshitija Bhandaru

Sumitomo Pharma (TSE:4506) is getting more attention from investors after its recent addition to the FTSE All-World Index and a business outlook upgrade from one of the major investment banks. Both events signal a shift in how the market views the company’s future potential.

See our latest analysis for Sumitomo Pharma.

Sumitomo Pharma’s inclusion in the FTSE All-World Index, combined with a business outlook upgrade, has brought fresh momentum to its shares as investor sentiment improves and institutional attention grows. With a latest share price of ¥1,794.0 and a 1-year total shareholder return of 1.76%, the stock has shown modest gains, suggesting cautiously building momentum rather than a dramatic rally.

If the renewed interest in Sumitomo Pharma has you thinking about what else is making moves, it might be the perfect time to discover See the full list for free.

With the stock gaining traction but still trading below some analyst targets, is Sumitomo Pharma now an undervalued play? Or are the recent gains a sign that the market is already factoring in its future growth?

Price-to-Earnings of 37.7x: Is it justified?

Sumitomo Pharma trades at a price-to-earnings (P/E) ratio of 37.7x, which is meaningfully higher than both its industry peers and historical norms. The last close was ¥1,794, indicating that the market is assigning a significant premium to its future earnings potential.

The P/E ratio gives investors a snapshot of how much they are paying today for a unit of current earnings. In the pharmaceutical sector, higher multiples can sometimes be justified by breakthrough pipelines or profit acceleration. However, sustained high multiples require real growth delivery.

Compared to the Japanese pharmaceuticals industry average of 15.5x and the peer average of 23.7x, Sumitomo Pharma’s P/E stands out as expensive. Against our estimated fair P/E ratio of 30.5x, the stock also appears overvalued on this metric, suggesting the market might be pricing in optimistic forecasts that are yet to materialize.

Explore the SWS fair ratio for Sumitomo Pharma

Result: Price-to-Earnings of 37.7x (OVERVALUED)

However, slow revenue growth and a discount to analyst price targets remain risks that could challenge the recent positive momentum surrounding Sumitomo Pharma.

Find out about the key risks to this Sumitomo Pharma narrative.

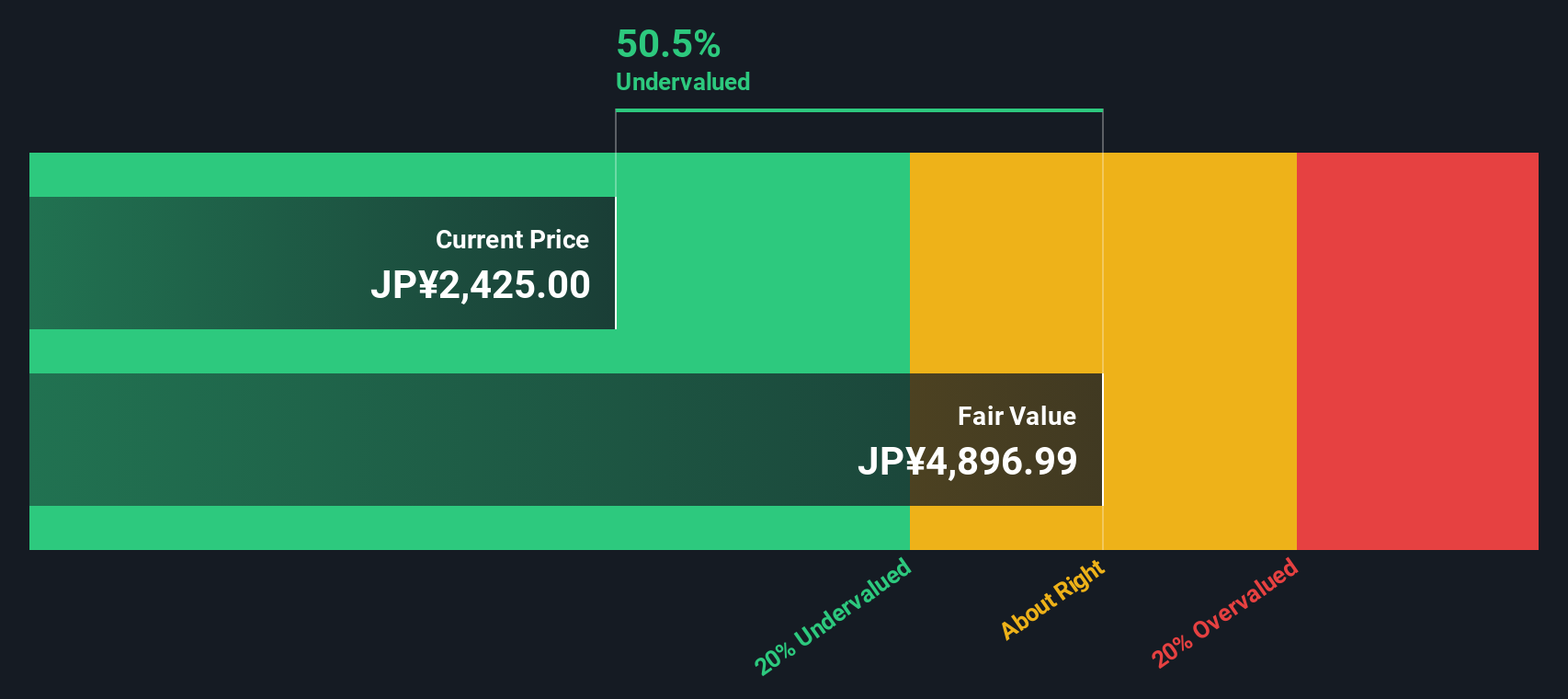

Another View: SWS DCF Model Says Undervalued

Looking beyond earnings multiples, our DCF model estimates Sumitomo Pharma’s fair value at ¥4,300.63, which is significantly higher than its current share price. According to this method, the shares are trading at a 58% discount. This raises the question: does this disconnect present a rare value opportunity, or is the DCF missing something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sumitomo Pharma for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sumitomo Pharma Narrative

If you want to interpret the fundamentals differently or take an independent approach, you can easily craft your own narrative in just a few minutes. Do it your way

A great starting point for your Sumitomo Pharma research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't settle for just one angle on your portfolio when standout opportunities are just a click away. Act on these timely ideas before the window closes:

- Snap up reliable income faster by checking out these 19 dividend stocks with yields > 3% with higher yields and robust payout histories.

- Tap into potential market disruptions early with these 24 AI penny stocks positioned to benefit from the artificial intelligence mega-trend.

- Catch tomorrow’s high-growth possibilities with these 3563 penny stocks with strong financials showing financial resilience and breakout potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4506

Sumitomo Pharma

Engages in manufacture, purchase, and sale of pharmaceutical products for medical treatment in Japan, North America, and Asia.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives