A Piece Of The Puzzle Missing From Sumitomo Pharma Co., Ltd.'s (TSE:4506) 28% Share Price Climb

Those holding Sumitomo Pharma Co., Ltd. (TSE:4506) shares would be relieved that the share price has rebounded 28% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 41% in the last twelve months.

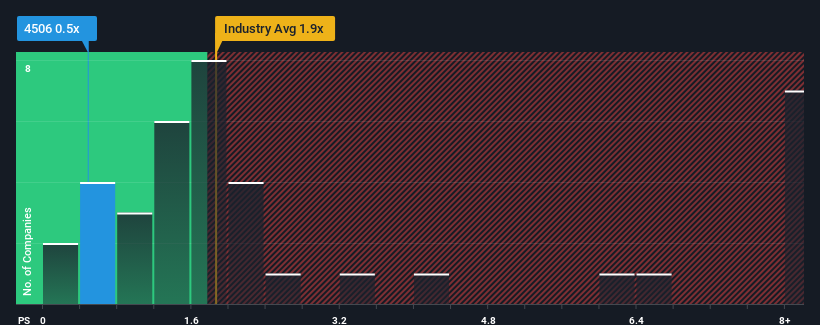

Even after such a large jump in price, Sumitomo Pharma's price-to-sales (or "P/S") ratio of 0.5x might still make it look like a buy right now compared to the Pharmaceuticals industry in Japan, where around half of the companies have P/S ratios above 1.9x and even P/S above 5x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Sumitomo Pharma

How Has Sumitomo Pharma Performed Recently?

While the industry has experienced revenue growth lately, Sumitomo Pharma's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Sumitomo Pharma will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Sumitomo Pharma would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 43%. The last three years don't look nice either as the company has shrunk revenue by 39% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 5.4% per year over the next three years. That's shaping up to be similar to the 6.8% per annum growth forecast for the broader industry.

With this in consideration, we find it intriguing that Sumitomo Pharma's P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Final Word

The latest share price surge wasn't enough to lift Sumitomo Pharma's P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It looks to us like the P/S figures for Sumitomo Pharma remain low despite growth that is expected to be in line with other companies in the industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

Before you take the next step, you should know about the 2 warning signs for Sumitomo Pharma that we have uncovered.

If you're unsure about the strength of Sumitomo Pharma's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4506

Sumitomo Pharma

Engages in the manufacture and sale of pharmaceuticals, food ingredients and additives, veterinary medicines, and others in Japan, North America, China, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives