Astellas Pharma (TSE:4503): Evaluating Valuation After VYLOY Funding Win in Canada and New Oncology Updates

Reviewed by Kshitija Bhandaru

Astellas Pharma (TSE:4503) announced that VYLOY, a drug for certain advanced gastric and gastroesophageal cancers, is now funded in Ontario and Quebec. This move broadens patient access and highlights the company’s ongoing expansion in targeted oncology treatments.

See our latest analysis for Astellas Pharma.

The recent Ontario and Quebec funding win for VYLOY comes shortly after conditional approval for IZERVAY in Japan and high-profile clinical trial announcements scheduled for the upcoming ESMO congress. This series of developments highlights Astellas Pharma’s consistent stream of R&D milestones. Despite this momentum in innovation, the stock’s performance has been modest, with a 1-year total shareholder return that is nearly flat and a 5-year total shareholder return of almost 30 percent. This suggests that renewed investor interest may depend on the company’s ability to turn breakthroughs into sustained growth.

Inspired by Astellas’s progress? This could be the right time to find other pharmaceutical and biotech leaders with similar potential using our See the full list for free.

With shares having delivered modest long-term returns and a valuation still below analyst targets, the key question is whether Astellas is now undervalued and presenting a buying opportunity, or if the market has already priced in its future growth.

Most Popular Narrative: 5.7% Undervalued

With Astellas Pharma’s consensus fair value recently raised to ¥1,725, and the last close at ¥1,627, the narrative frames a rare value window amidst sector headwinds. This sets up a compelling case to re-examine expectations.

Cost optimization initiatives (SMT) are running ahead of schedule, with early realized reductions in SG&A and R&D costs directly improving net margins and underlying profitability even as growth investments are maintained.

Curious what drives this value call? The most popular narrative quietly relies on sharp margin expansion and upside from operational discipline. Want the inside scoop on what financial shifts really underpin this target? Unlock the full story now.

Result: Fair Value of ¥1,725 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising global drug pricing pressures and potential patent expirations could challenge Astellas Pharma’s margin expansion and stall its current growth trajectory.

Find out about the key risks to this Astellas Pharma narrative.

Another View: What Do Multiples Say?

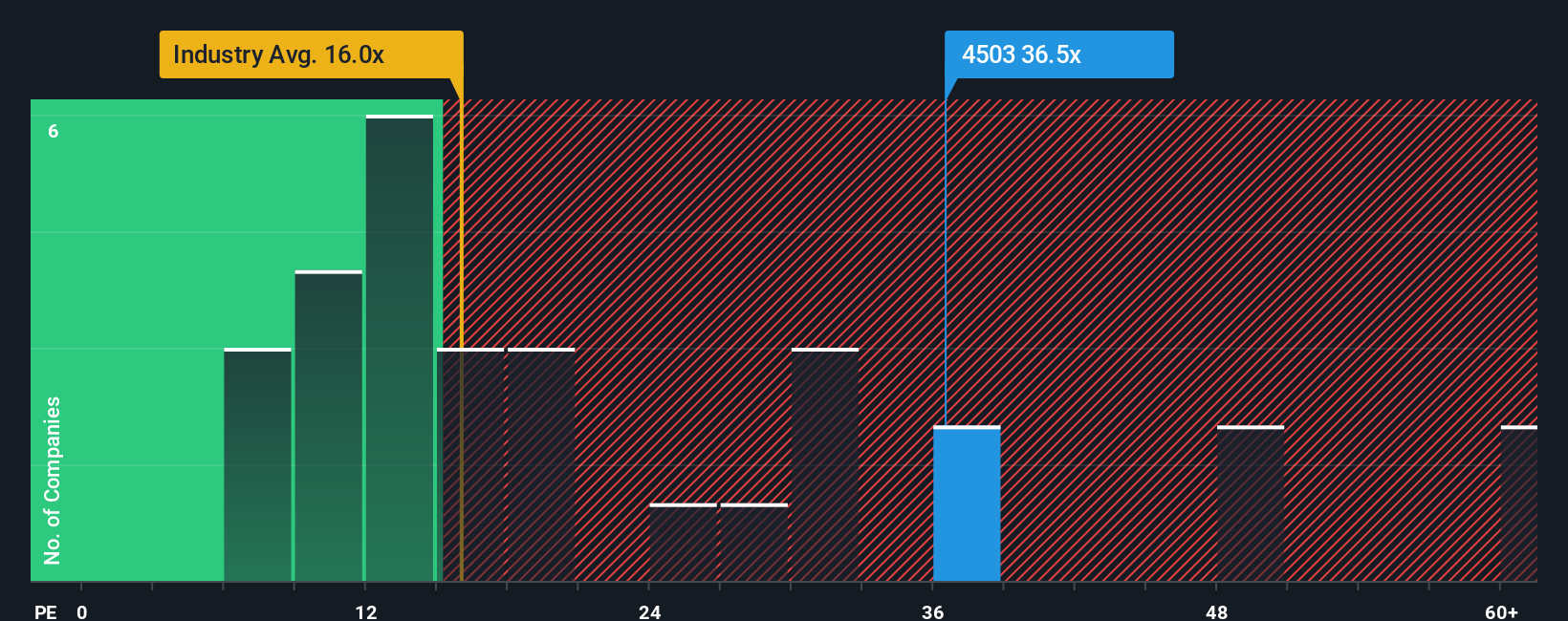

Looking through another lens, Astellas Pharma’s price-to-earnings ratio stands at 35.7x, which is notably higher than the peer average of 19.6x and the industry’s 15.5x. This sharp gap suggests the market could be overpricing future growth and carries valuation risk if sentiment shifts. If market multiples revert, could today’s “discount” quickly disappear?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Astellas Pharma Narrative

If you want a different perspective or would rather draw your own conclusions from the facts, it’s easy to craft a personal take in just minutes. Do it your way

A great starting point for your Astellas Pharma research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that real outperformance comes from seizing the right opportunities before everyone else does. Don’t miss out on these standout prospects. Your portfolio could thank you later.

- Catch the next wave of profit potential by scanning these 24 AI penny stocks powering advances in artificial intelligence across industries from healthcare to finance.

- Unlock reliable income streams and market resilience with these 19 dividend stocks with yields > 3% that offer attractive yields above 3 percent and robust fundamentals.

- Stay ahead of the curve with these 3569 penny stocks with strong financials poised to disrupt markets thanks to solid financials and room for explosive growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4503

Astellas Pharma

Manufactures, markets, and imports and exports pharmaceuticals in Japan and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives