Takeda Pharmaceutical (TSE:4502): Exploring Valuation as Investors Weigh Long-Term Prospects

Reviewed by Kshitija Bhandaru

Takeda Pharmaceutical (TSE:4502) shares have experienced modest moves recently, with the stock showing a slight dip over the past month. Investors are weighing the company's steady performance and considering how Takeda fits into a long-term strategy.

See our latest analysis for Takeda Pharmaceutical.

Takeda Pharmaceutical's share price has edged lower over the last month, but its 12-month total shareholder return is still a positive 2.5%, with long-term investors seeing a robust 50% total return over five years. Recent activity hints at shifting sentiment, as short-term caution contrasts with the company’s history of compounding gains for patient shareholders.

If you're curious about standout performers in the sector, now is a great time to explore the latest opportunities with our pharma and big dividend stocks screener: See the full list for free.

With Takeda trading below analyst price targets and posting consistent returns, the key question is whether the market is missing value here or if current prices already reflect the company’s growth prospects. Could there be a genuine buying opportunity?

Most Popular Narrative: 16.2% Undervalued

Takeda Pharmaceutical's current share price sits notably below the widely-followed fair value calculation, setting the stage for debate on whether the market is underestimating the company’s future. The narrative's fair value stands out against how shares are trading right now, sparking curiosity among investors eyeing the company’s next move.

The anticipated moderation and eventual stabilization of VYVANSE generic erosion after FY2025 will remove a major headwind for revenues, allowing Takeda's core growth and launch products to drive top-line and earnings recovery going forward.

Wondering what fuels this upbeat outlook? The narrative hinges on bold projections for revenue rebound, widening margins, and an ambitious profit target few anticipate. Which of these assumptions tip the scale most in favor of Takeda’s valuation? Only the full story reveals the answer. Dive in to see which catalysts and forecasts matter most.

Result: Fair Value of ¥5,002.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heightened generic competition or regulatory changes could derail Takeda’s outlook, raising questions about whether projected gains will fully materialize.

Find out about the key risks to this Takeda Pharmaceutical narrative.

Another View: What Do Valuation Ratios Say?

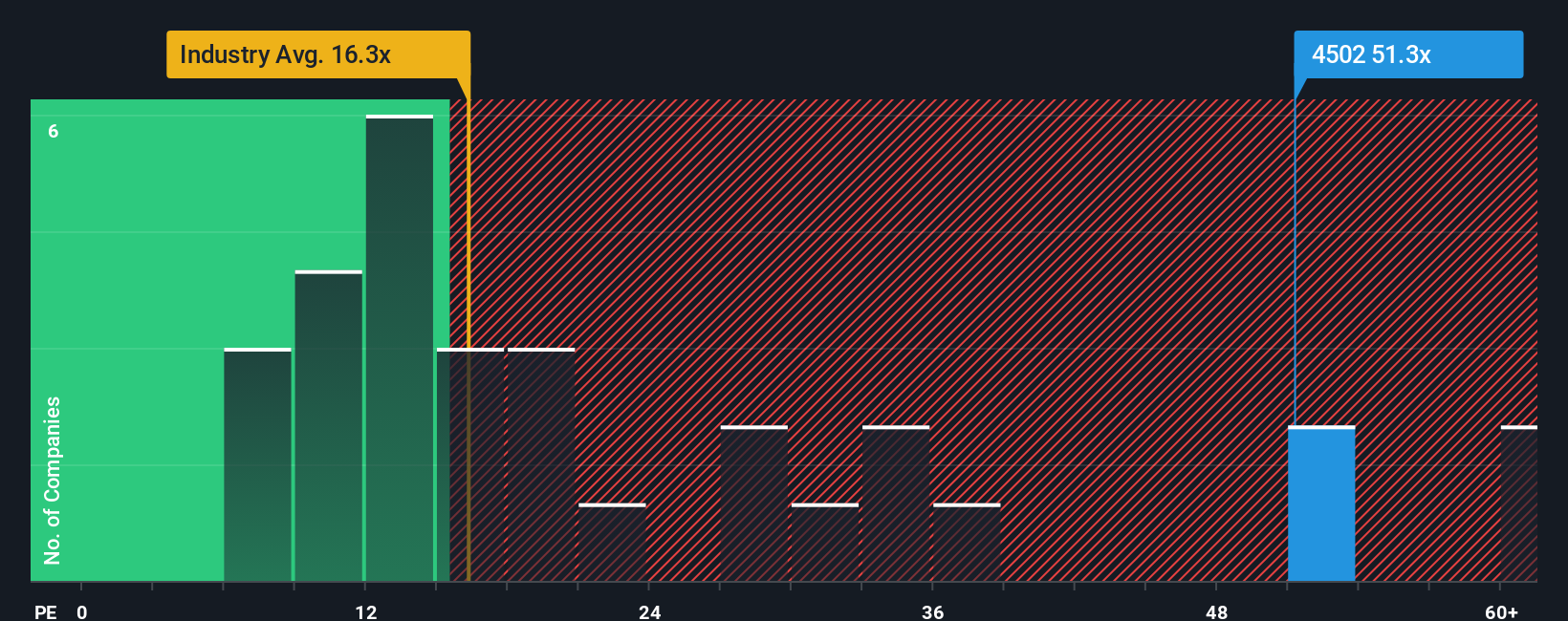

Looking at simple valuation ratios instead, Takeda’s price-to-earnings ratio stands at 47.8x. This is far higher than the Japan Pharmaceuticals industry average of 15x, the peer average of 24.9x, and the fair ratio estimate of 29.5x. Such a premium could mean higher risk if expectations fall short. Is the market’s optimism justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Takeda Pharmaceutical Narrative

If you think the story is different or want to investigate the data on your own terms, you can shape your own view in under three minutes with Do it your way.

A great starting point for your Takeda Pharmaceutical research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Keep your strategy ahead of the curve and spark new investing possibilities using the Simply Wall Street Screener. Smart choices today can set you up for tomorrow’s wins. Don’t let the next opportunity pass you by.

- Accelerate your search for sustainable income by checking out these 18 dividend stocks with yields > 3% that offer strong yields and consistent payouts for steady portfolio growth.

- Spot the next tech disruptors early by evaluating these 24 AI penny stocks pioneering artificial intelligence, automation, and digital transformation across industries.

- Maximize value by uncovering these 878 undervalued stocks based on cash flows whose prices may not yet reflect their true earnings potential or market position.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Takeda Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4502

Takeda Pharmaceutical

Engages in the research, development, manufacture, marketing, and out-licensing of pharmaceutical products in Japan and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives