Takeda Pharmaceutical (TSE:4502): Analyzing Valuation Following Subtle Stock Gains

Reviewed by Simply Wall St

Most Popular Narrative: 10.6% Undervalued

The prevailing narrative rates Takeda Pharmaceutical as undervalued based on forward-looking earnings growth and pipeline momentum, projecting eventual upside compared to the current share price.

The anticipated moderation and eventual stabilization of VYVANSE generic erosion after FY2025 will remove a major headwind for revenues. This would allow Takeda's core growth and launch products to drive top-line and earnings recovery going forward. Rapid progress and positive late-stage data from Takeda's innovative pipeline, especially in high-need therapeutic areas like rare diseases (orexin agonists for narcolepsy, rusfertide for polycythemia vera), set the stage for multiple high-value product launches. These product launches can potentially catalyze multi-year revenue and margin expansion.

Curious what really fuels this bullish take? The magic lies in bold growth forecasts, ambitious margin expansion, and a premium earnings multiple that rivals high-flying industries. Which assumptions make analysts this optimistic about Takeda’s future? Just how aggressive are the revenue and profit projections? Get the full breakdown to see if this valuation logic holds up under scrutiny.

Result: Fair Value of $5056.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, intensifying generic competition and tighter global drug pricing could quickly undermine Takeda’s growth prospects if pipeline breakthroughs or reimbursement trends fall short.

Find out about the key risks to this Takeda Pharmaceutical narrative.Another View: What Do Company Multiples Say?

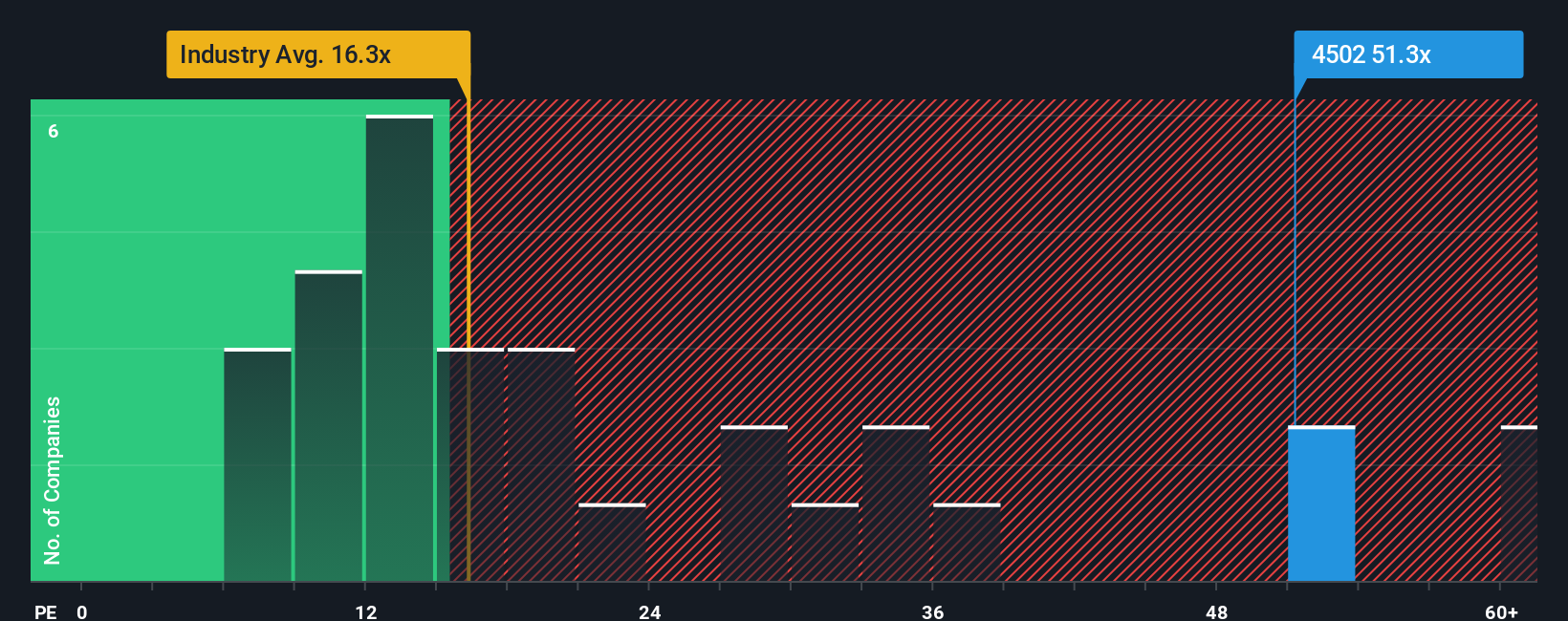

While the fair value approach suggests Takeda is undervalued, a quick look at the current valuation ratio compared to the broader pharmaceuticals industry paints a more expensive picture. Does this signal hidden risks, or is the premium justified by future prospects?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Takeda Pharmaceutical to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Takeda Pharmaceutical Narrative

If you’re not convinced by the expert views above or want to follow your own path, you can craft your personal analysis in just a few minutes, and Do it your way.

A great starting point for your Takeda Pharmaceutical research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more ways to strengthen your portfolio?

Unlock a world of powerful investment opportunities with screens built to spot standout stocks, lucrative trends, and under-the-radar gems. Don’t miss out on these tailored ideas. Your next winning move could be just a click away.

- Find passive income and steady returns when you jump into high-yield picks with dividend stocks with yields > 3%.

- Tap into future breakthroughs by seeking out innovators at the frontier of quantum computing with quantum computing stocks.

- Catch tomorrow’s growth leaders before the crowd with unique value opportunities using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Takeda Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSE:4502

Takeda Pharmaceutical

Engages in the research, development, manufacture, marketing, and out-licensing of pharmaceutical products in Japan and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives