Does Takeda Still Offer Value After Pipeline Progress and a 43% Five Year Gain?

Reviewed by Bailey Pemberton

- If you are wondering whether Takeda Pharmaceutical is still a solid buy at today’s price, or if the easy gains are behind it, you are in the right place to unpack what the market is really paying for this business.

- The stock is up 12.0% over the last year and 43.0% over five years, even after a recent 2.0% dip over the past week and a 6.1% rise in the last month. This suggests sentiment is quietly shifting rather than exploding.

- Recent headlines have focused on Takeda’s late stage pipeline progress and regulatory milestones, alongside strategic moves in its core therapeutic areas. All of these can change how investors think about its future cash flows. At the same time, industry wide attention on drug pricing and innovation cycles has added a layer of uncertainty that helps explain some of the recent volatility.

- Right now, Takeda scores a 5 out of 6 on our valuation checks, suggesting the market may still be underestimating parts of the story. We will walk through those valuation approaches before finishing with a more holistic way to judge whether the current price really makes sense.

Approach 1: Takeda Pharmaceutical Discounted Cash Flow (DCF) Analysis

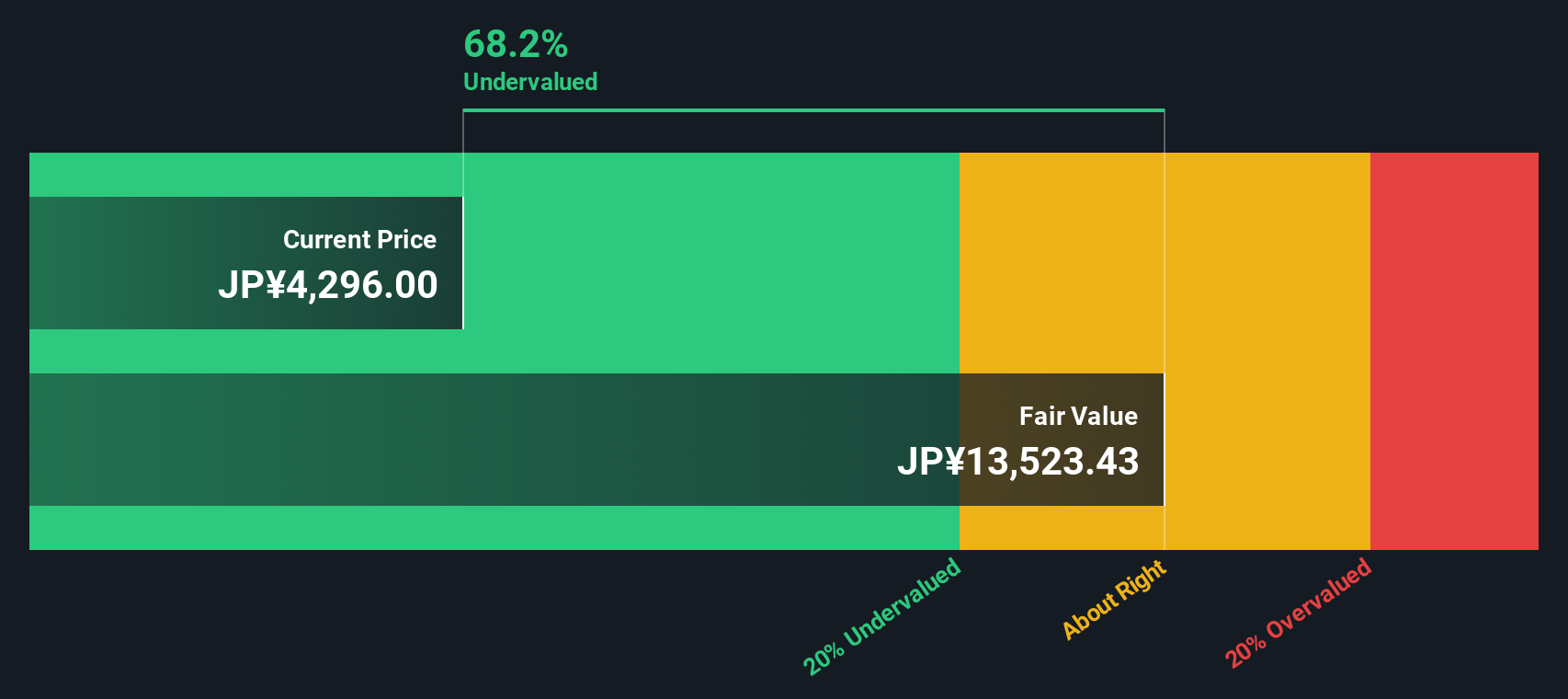

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and discounting those cash flows back to today’s value. For Takeda Pharmaceutical, the model starts from last twelve months free cash flow of about ¥711 billion and then applies analyst forecasts and extrapolated estimates to map out how that figure could evolve.

Analysts see free cash flow remaining robust, with projections stepping up to roughly ¥914 billion by 2026. Beyond the explicit analyst window, Simply Wall St extrapolates the trend, with free cash flow expected to be about ¥855 billion in 2030. These projected cash flows, together with a terminal value, are discounted back using a required rate of return to reach an estimated intrinsic value per share of around ¥12,447.

Compared with the current market price, this indicates Takeda is trading at a 64.5% discount to its calculated fair value, which can suggest that investors are still pricing in a lot of caution.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Takeda Pharmaceutical is undervalued by 64.5%. Track this in your watchlist or portfolio, or discover 914 more undervalued stocks based on cash flows.

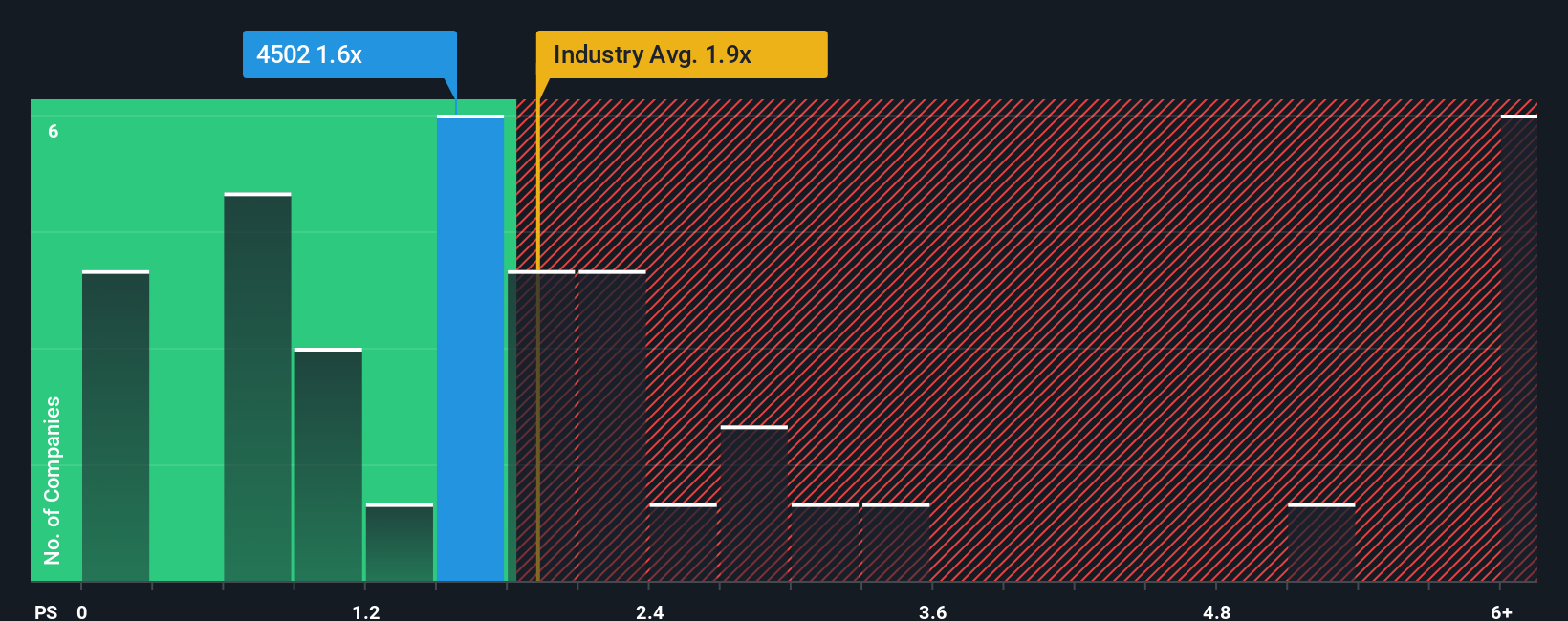

Approach 2: Takeda Pharmaceutical Price vs Sales

For a large, diversified pharmaceutical company like Takeda that is already profitable, the price to sales multiple is a useful way to judge valuation because it ties the share price directly to the scale of its revenue base. This can be more stable than earnings in a sector where profits can swing with R and D cycles and one off items.

In general, faster growth and lower perceived risk justify a higher price to sales ratio, while slower growth or higher uncertainty call for a lower one. Takeda currently trades on a price to sales multiple of about 1.58x, which is slightly below the broader Pharmaceuticals industry average of 1.85x and far below the peer group average of around 4.55x. Simply Wall St also calculates a Fair Ratio of 3.80x, a proprietary estimate of what Takeda’s price to sales multiple could be once its growth outlook, profitability, risk profile, industry and market cap are all factored in.

This Fair Ratio provides a more tailored benchmark than simple peer or industry comparisons because it adjusts for company specific strengths and risks rather than assuming all drug makers deserve similar multiples. With Takeda’s current 1.58x sitting well below the 3.80x Fair Ratio, the shares appear meaningfully undervalued on this metric.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Takeda Pharmaceutical Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework that lets you attach a clear story about Takeda Pharmaceutical’s future to the numbers you are using for revenue, earnings, margins, and ultimately fair value.

A Narrative connects three pieces: the business story you believe, the financial forecast that follows from that story, and the fair value those forecasts imply, turning scattered assumptions into a single, repeatable investment view.

On Simply Wall St’s Community page, used by millions of investors, Narratives are an easy, accessible tool that help you decide when to buy or sell by continuously comparing your Fair Value to the live market price. They automatically update as new information such as earnings results, drug trial news or leadership changes flows in.

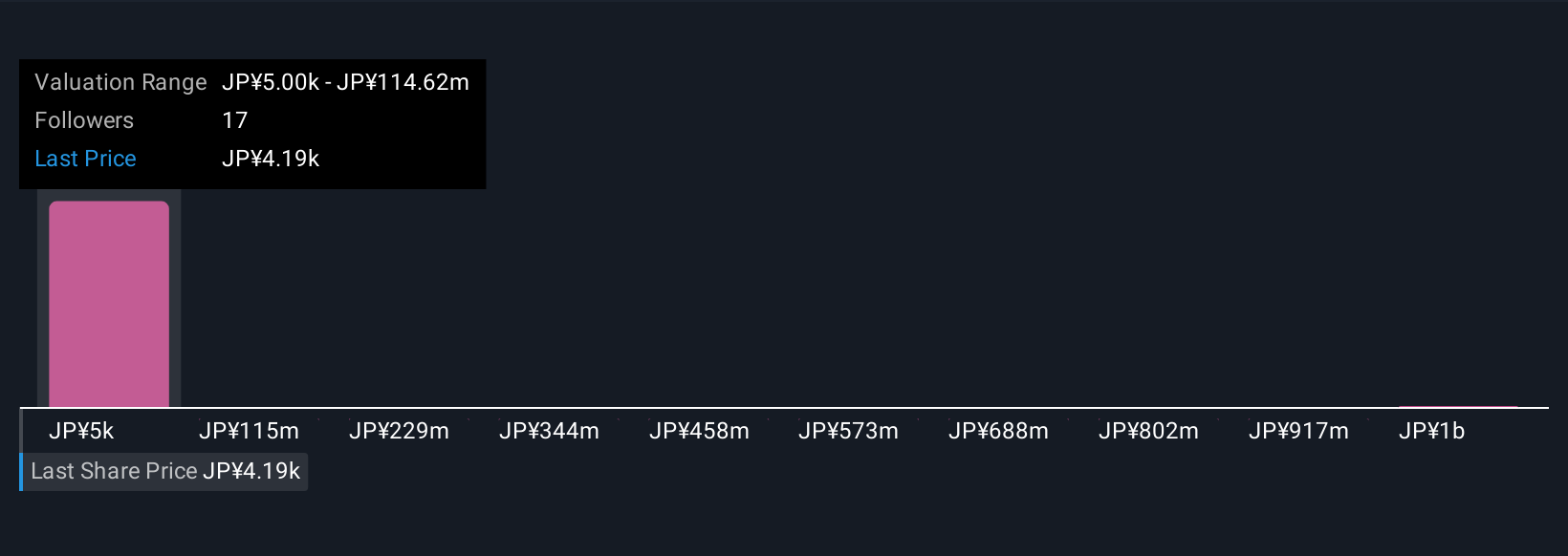

For example, one Takeda Narrative on the platform might lean optimistic, assuming pipeline wins, easing generic erosion and a fair value near ¥5,900. A more cautious Narrative might emphasize pricing pressure, competition and execution risk to arrive closer to ¥4,500, and the difference between those two perspectives is exactly what helps you clarify your own stance and timing.

Do you think there's more to the story for Takeda Pharmaceutical? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Takeda Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4502

Takeda Pharmaceutical

Engages in the research, development, manufacture, marketing, and out-licensing of pharmaceutical products in Japan and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026