A Look at Kyowa Kirin (TSE:4151) Valuation Following Major Ziftomenib Clinical Milestones and FDA Priority Review

Reviewed by Kshitija Bhandaru

Kyowa Kirin (TSE:4151) and Kura Oncology have announced major progress with ziftomenib, their investigational menin inhibitor for acute myeloid leukemia. Recent milestones include a high-profile journal publication, initiation of Phase 3 trials, and FDA priority review.

See our latest analysis for Kyowa Kirin.

This string of clinical milestones has put Kyowa Kirin back in the spotlight. While the latest share price of ¥2,394.5 is holding steady, the 1-year total shareholder return of -0.07% reflects the stock’s muted long-term performance. Momentum has not yet picked up despite recent breakthroughs, suggesting the market is waiting for more evidence of sustainable growth from these advances.

If Kyowa Kirin’s clinical progress got your attention, now is an ideal moment to check out other pharma leaders with robust pipelines and yields. See See the full list for free..

With the stock lagging its pharma peers despite headline-making clinical progress, investors are left to consider whether Kyowa Kirin is trading at an unwarranted discount or if the market is already pricing in the promise of its pipeline.

Price-to-Earnings of 32.6x: Is it justified?

Kyowa Kirin trades at a price-to-earnings (P/E) ratio of 32.6x, well above both its industry average and its own history. With a last close price of ¥2,394.5, investors are paying a premium for each yen of earnings relative to peers.

The P/E ratio measures how much investors are willing to pay for each unit of earnings. In pharmaceuticals, a higher multiple can reflect optimism about future growth, the strength of the drug pipeline, or defensive characteristics. However, it can also signal over-enthusiasm if earnings growth or margins are not keeping pace.

Compared to the JP Pharmaceuticals industry average of 15.5x and a peer group average of 23.2x, Kyowa Kirin’s P/E stands out as expensive. Notably, the estimated “fair” P/E for the company is 23.2x. This suggests the market may be overpricing expectations for near-term profits. If sentiment shifts to align closer to sector norms or the fair ratio, the stock’s valuation could move accordingly.

Explore the SWS fair ratio for Kyowa Kirin

Result: Price-to-Earnings of 32.6x (OVERVALUED)

However, persistent weak longer-term returns and any stall in clinical trial momentum could quickly shift sentiment, which could challenge the current valuation premium.

Find out about the key risks to this Kyowa Kirin narrative.

Another View: What Does the SWS DCF Model Say?

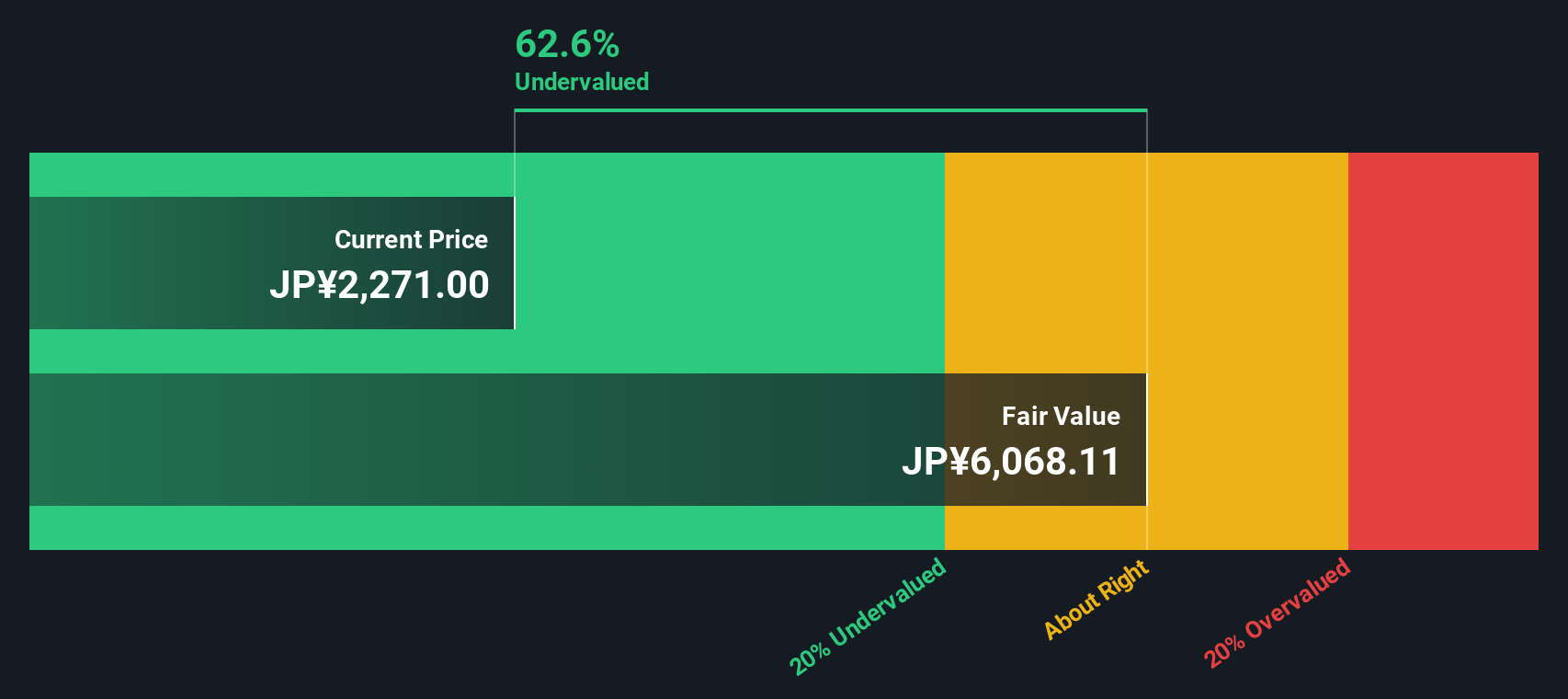

While Kyowa Kirin’s valuation seems high by earnings multiples, the SWS DCF model offers a dramatically different perspective. Based on this method, the company is trading around 60% below its estimated fair value. This suggests deep undervaluation relative to its potential future cash flows. Could the market be overlooking a longer-term opportunity, or does it see risks in those projections?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kyowa Kirin for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kyowa Kirin Narrative

If you see things differently or want to draw your own conclusions from the numbers, you can craft a personal view in just a few minutes. Do it your way

A great starting point for your Kyowa Kirin research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Level up your portfolio now by focusing on stocks with strong potential, innovative sectors, and dependable returns using these powerful screening tools:

- Target stocks with rapid growth stories and see which companies stand out among these 3569 penny stocks with strong financials for their financial strength and big upside.

- Tap into tomorrow’s breakthroughs by browsing these 26 quantum computing stocks, and find frontrunners developing quantum technology for real-world solutions.

- Collect compelling regular income by checking out these 19 dividend stocks with yields > 3% that consistently deliver yields above 3% and have solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kyowa Kirin might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4151

Kyowa Kirin

Engages in the research, development, manufacturing, sells, and import/export of pharmaceuticals products worldwide.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives