Further Upside For GNI Group Ltd. (TSE:2160) Shares Could Introduce Price Risks After 40% Bounce

GNI Group Ltd. (TSE:2160) shares have had a really impressive month, gaining 40% after a shaky period beforehand. The annual gain comes to 253% following the latest surge, making investors sit up and take notice.

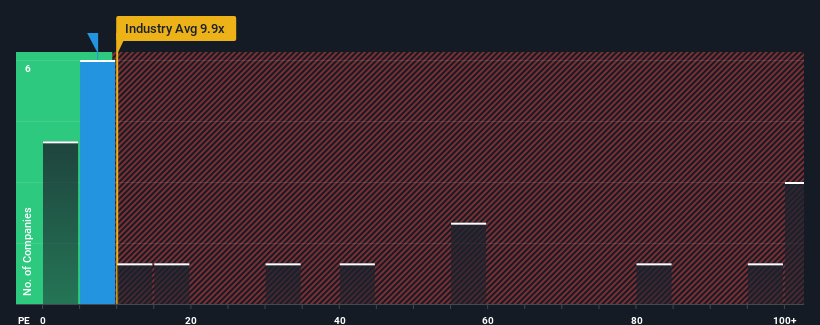

Although its price has surged higher, GNI Group may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 7.3x, since almost half of all companies in the Biotechs industry in Japan have P/S ratios greater than 9.9x and even P/S higher than 57x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for GNI Group

What Does GNI Group's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, GNI Group has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on GNI Group will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like GNI Group's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 49% last year. Pleasingly, revenue has also lifted 166% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 22% per year during the coming three years according to the one analyst following the company. With the industry predicted to deliver 22% growth per annum, the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that GNI Group's P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From GNI Group's P/S?

The latest share price surge wasn't enough to lift GNI Group's P/S close to the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It looks to us like the P/S figures for GNI Group remain low despite growth that is expected to be in line with other companies in the industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

You need to take note of risks, for example - GNI Group has 4 warning signs (and 3 which can't be ignored) we think you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2160

GNI Group

Engages in the research, development, manufacture, and sale of pharmaceutical drugs in Japan and internationally.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives