- Japan

- /

- Entertainment

- /

- TSE:9766

Konami (TSE:9766) Valuation Check After BOMBERMAN Slot Launch and New Solstice Cabinet Debut

Reviewed by Simply Wall St

Konami Group (TSE:9766) just rolled out its BOMBERMAN slot games in a world premiere at Graton Resort and Casino, a showcase that spotlights its new Solstice cabinet and growing US casino ambitions.

See our latest analysis for Konami Group.

The launch comes after a strong run, with Konami’s year to date share price return of 47.32% and a three year total shareholder return of 270.69% suggesting momentum is still broadly intact despite the recent pullback.

If Konami’s latest casino push has caught your attention, this could be a good moment to scout other gaming and entertainment names via fast growing stocks with high insider ownership.

With earnings still climbing, shares trading at a discount to analyst targets, and casino ambitions accelerating, the key question now is whether Konami remains mispriced value or if the market has already baked in the next leg of growth.

Price-to-Earnings of 34.1x: Is it justified?

On traditional valuation, Konami’s last close of ¥21,340 comes with a rich price-to-earnings ratio of 34.1x, signaling investors are paying a premium versus peers.

The price-to-earnings multiple compares the current share price to the company’s earnings per share, making it a simple gauge of how much the market is willing to pay today for each unit of current profit. For a content heavy entertainment group like Konami, it often reflects expectations for future titles, platform monetisation, and the stability of recurring cash flows from gaming systems.

Here, the market seems to be pricing in elevated growth and profitability, with Konami trading well above both its industry and peer benchmarks. The stock’s 34.1x multiple stands notably higher than the estimated fair price-to-earnings ratio of 31.1x. This is a level the market could gravitate toward if enthusiasm cools and expectations normalise.

Compared with the broader JP Entertainment industry average of 18.4x, Konami’s valuation looks materially more expensive. It also surpasses the peer average of 28.3x by a clear margin. That wide gap underscores how much additional growth and durability investors are currently assuming in Konami’s earnings stream versus other entertainment names.

Explore the SWS fair ratio for Konami Group

Result: Price-to-Earnings of 34.1x (OVERVALUED)

However, risks remain, including a valuation de rating if growth slows, or setbacks in Konami’s casino and digital content pipelines that could temper sentiment.

Find out about the key risks to this Konami Group narrative.

Another View on Value

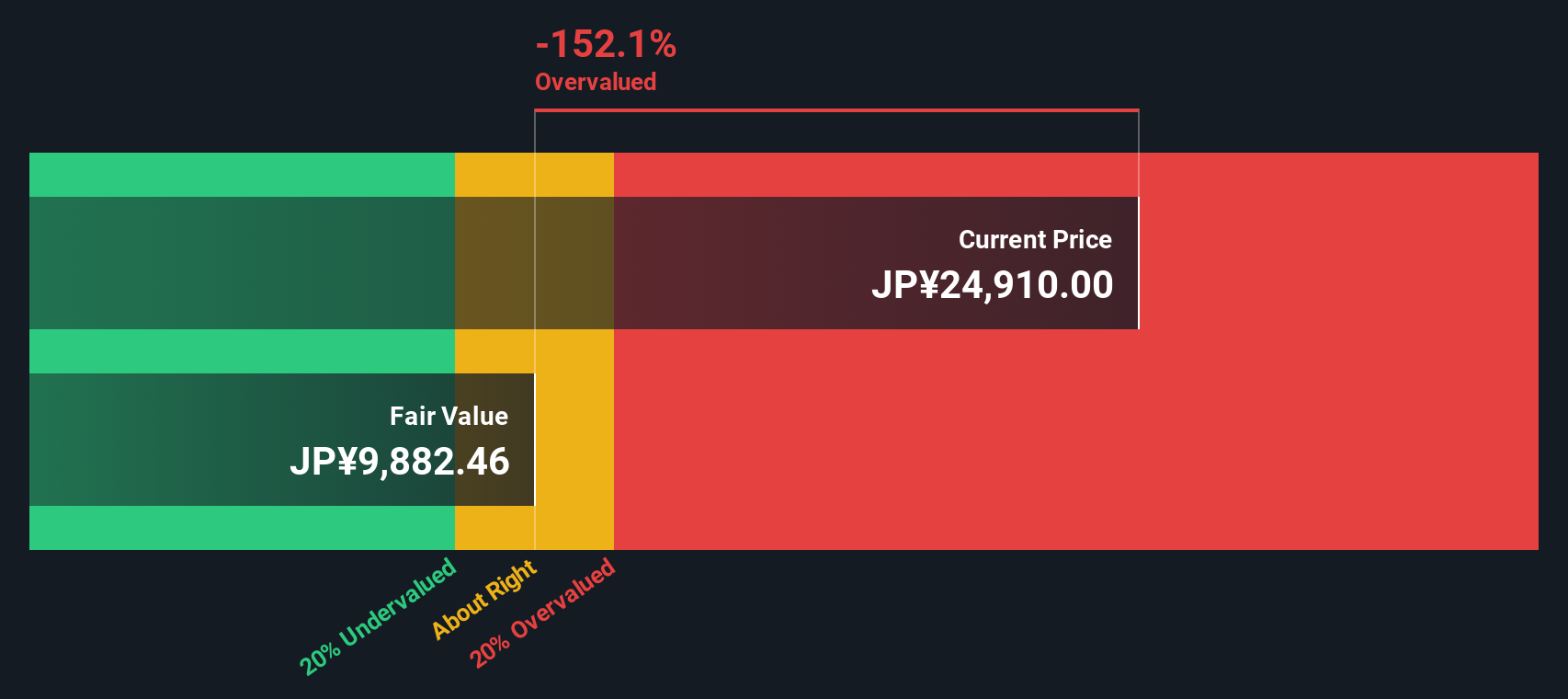

Our DCF model paints a very different picture to the earnings multiple. On that view, Konami looks overvalued, with the current ¥21,340 share price sitting well above an estimated fair value of about ¥9,898. Could today's premium be leaning more on narrative than cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Konami Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 915 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Konami Group Narrative

If you see the story differently or want to stress test the numbers yourself, you can quickly build a custom view in under three minutes: Do it your way.

A great starting point for your Konami Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Konami may be compelling, but you will kick yourself later if you ignore other opportunities that match your strategy and are already getting institutional attention.

- Spot potential multi baggers early by scanning these 3623 penny stocks with strong financials where small share prices meet strong underlying numbers and real business traction.

- Position yourself for the next productivity wave by focusing on companies in these 29 healthcare AI stocks that blend medical expertise with scalable AI platforms.

- Secure stronger income potential by reviewing these 13 dividend stocks with yields > 3% offering reliable payouts that could complement growth names like Konami in a balanced portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Konami Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9766

Konami Group

Primarily engages in the digital entertainment, amusement, gaming and systems, and sports businesses in Japan, Asia/Oceania countries, the United States, and Europe.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion