- Japan

- /

- Entertainment

- /

- TSE:9697

Top Japanese Growth Stocks With Insider Ownership In October 2024

Reviewed by Simply Wall St

In October 2024, Japan's stock markets experienced a decline, with the Nikkei 225 Index and TOPIX Index both falling amidst easing domestic inflation and speculation about the Bank of Japan's interest rate strategy. As investors navigate these uncertain conditions, identifying growth companies with high insider ownership can be advantageous, as these stocks often demonstrate strong alignment between management interests and shareholder value.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| Micronics Japan (TSE:6871) | 15.3% | 31.5% |

| Hottolink (TSE:3680) | 26.1% | 61.5% |

| Kasumigaseki CapitalLtd (TSE:3498) | 34.7% | 40.2% |

| Medley (TSE:4480) | 34% | 30.4% |

| Inforich (TSE:9338) | 19.1% | 29.8% |

| Kanamic NetworkLTD (TSE:3939) | 25% | 28.3% |

| ExaWizards (TSE:4259) | 22% | 75.2% |

| Money Forward (TSE:3994) | 21.4% | 71.3% |

| AeroEdge (TSE:7409) | 10.7% | 25.3% |

| Soracom (TSE:147A) | 16.5% | 54.1% |

Here we highlight a subset of our preferred stocks from the screener.

JTOWER (TSE:4485)

Simply Wall St Growth Rating: ★★★★☆☆

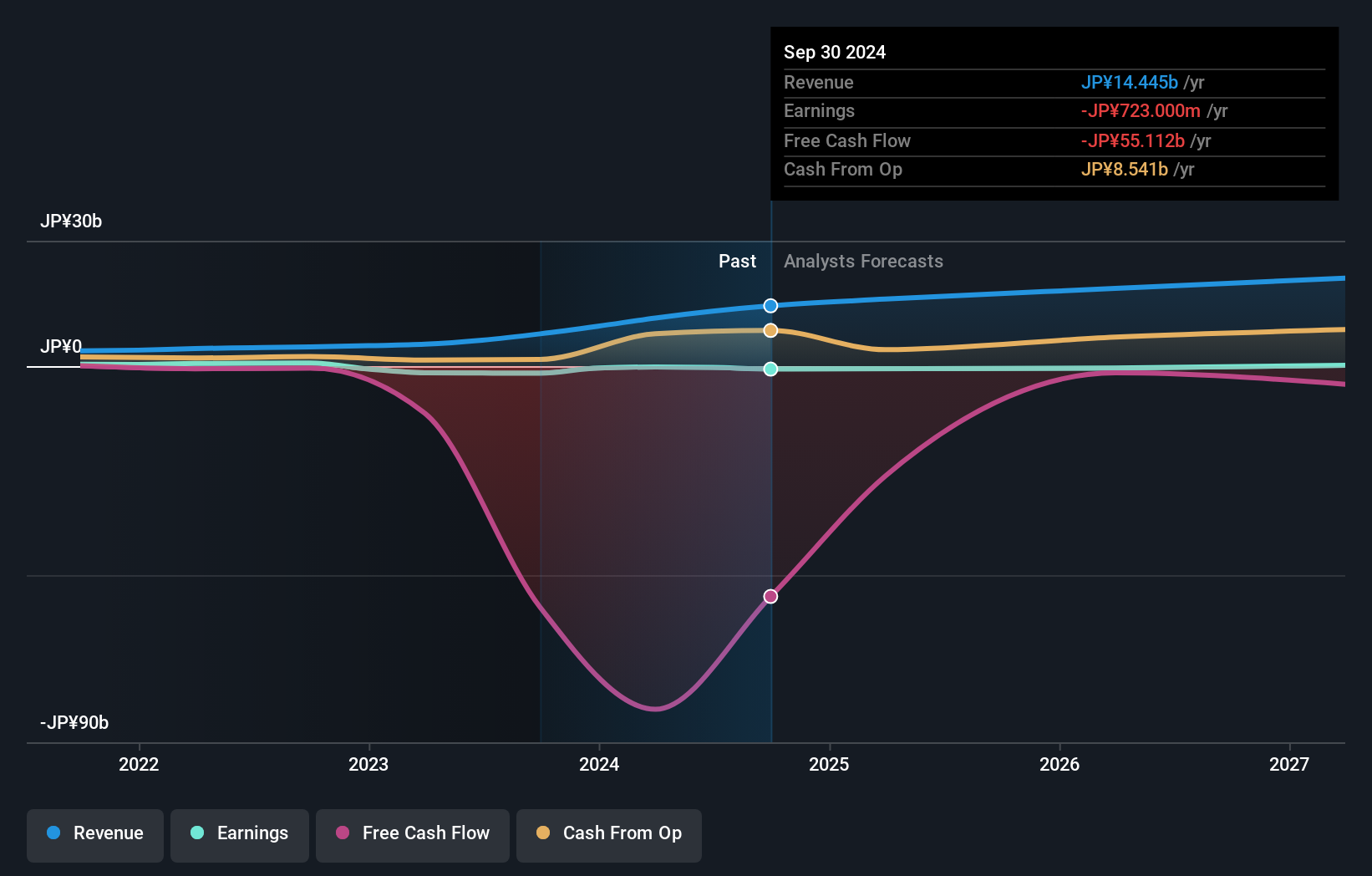

Overview: JTOWER Inc. offers infrastructure sharing services in Japan and has a market cap of ¥92.14 billion.

Operations: The company's revenue primarily comes from its Telecommunications Infrastructure Sharing Business, generating ¥13.15 billion.

Insider Ownership: 18.2%

Earnings Growth Forecast: 64.6% p.a.

JTOWER, a Japanese growth company with significant insider ownership, has seen recent developments including DigitalBridge's acquisition of a 75.62% stake and strategic alliances with KDDI for telecom infrastructure sharing. Despite its volatile share price and revised earnings guidance indicating increased losses, JTOWER is forecasted to achieve profitability within three years, outpacing average market growth. However, its revenue growth is expected to be moderate at 16% annually, below the ideal threshold for high-growth companies in Japan.

- Unlock comprehensive insights into our analysis of JTOWER stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of JTOWER shares in the market.

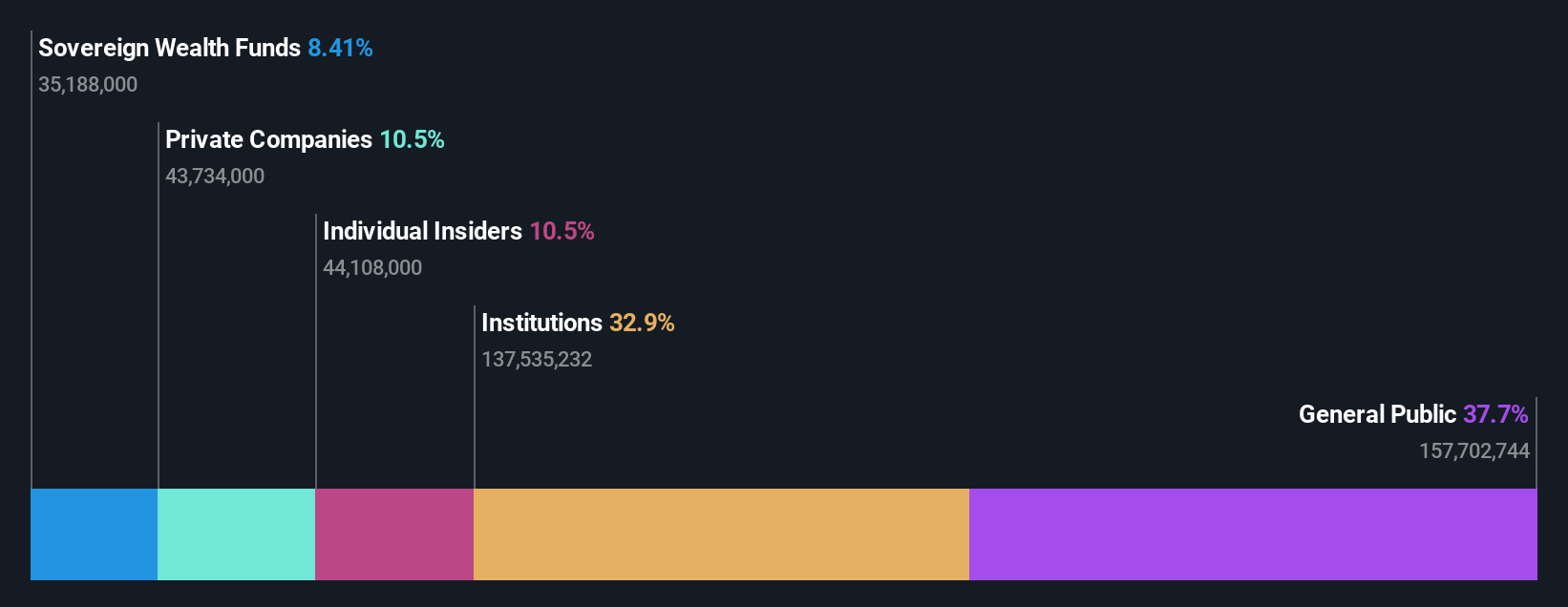

OptorunLtd (TSE:6235)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Optorun Co., Ltd. specializes in the manufacture, distribution, and import/export of vacuum coating machines and related products in Japan, with a market cap of ¥82.88 billion.

Operations: The company generates revenue primarily from its Film Deposition Equipment Business, amounting to ¥32.56 billion.

Insider Ownership: 10.6%

Earnings Growth Forecast: 27% p.a.

Optorun Ltd. is experiencing significant earnings growth, forecasted at 27% annually, surpassing the Japanese market's average. Despite slower revenue growth of 10.9%, it still exceeds the market rate. The company's recent share repurchase program aims to enhance capital efficiency and shareholder returns but has yet to execute any buybacks as of late September 2024. However, its return on equity is expected to remain modest at 13.8% in three years, and dividend sustainability is questionable due to inadequate free cash flow coverage.

- Click here to discover the nuances of OptorunLtd with our detailed analytical future growth report.

- According our valuation report, there's an indication that OptorunLtd's share price might be on the expensive side.

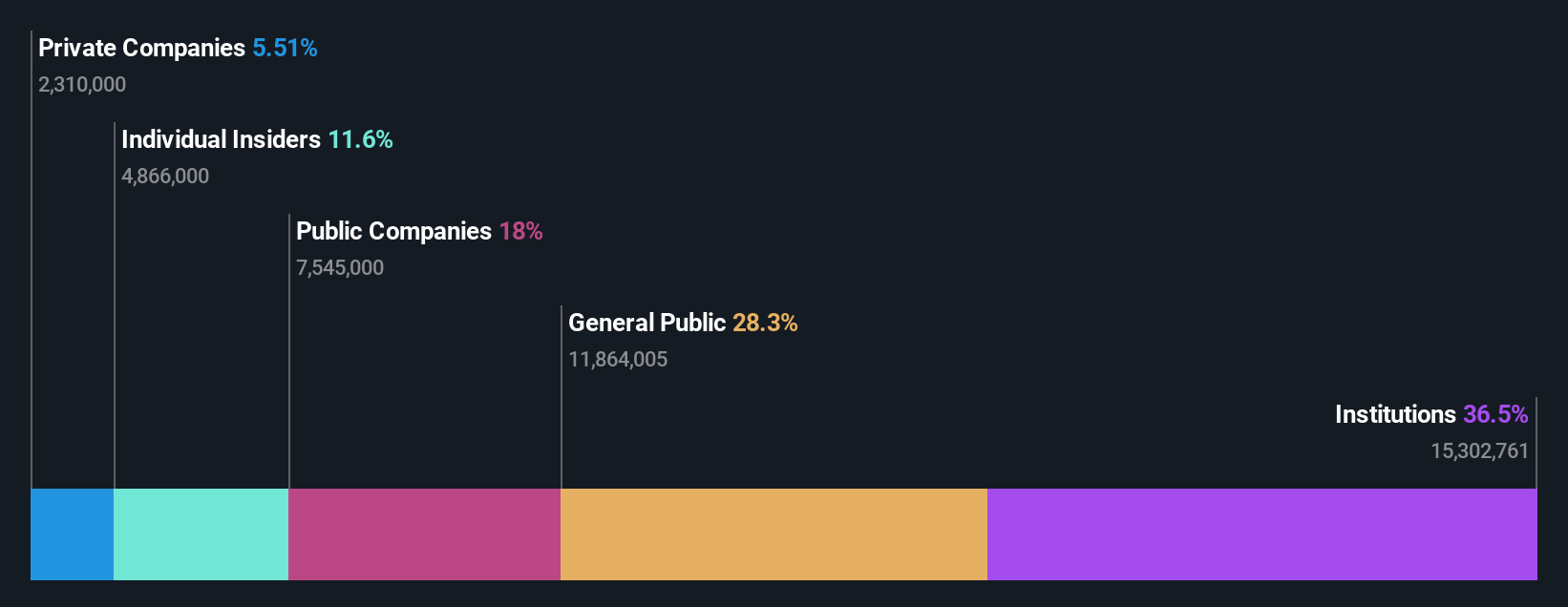

Capcom (TSE:9697)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Capcom Co., Ltd. is engaged in the planning, development, manufacturing, sale, and distribution of home video games, online games, mobile games, and arcade games both in Japan and internationally with a market cap of ¥1.35 trillion.

Operations: The company's revenue segments include Digital Content at ¥103.38 billion, Amusement Equipment at ¥10.34 billion, and Amusement Facilities at ¥20.09 billion.

Insider Ownership: 11.5%

Earnings Growth Forecast: 14.6% p.a.

Capcom is poised for growth with forecasted earnings increasing at 14.6% annually, outpacing the Japanese market average. Revenue growth is projected at 9.6%, slower than significant benchmarks but still above the market rate. The company enjoys a high forecasted return on equity of 20.3% in three years, although its share price has been highly volatile recently. There has been no substantial insider trading activity over the past three months to indicate shifts in insider sentiment.

- Dive into the specifics of Capcom here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Capcom is trading beyond its estimated value.

Summing It All Up

- Reveal the 102 hidden gems among our Fast Growing Japanese Companies With High Insider Ownership screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9697

Capcom

Plans, develops, manufactures, sells, and distributes home video games, online games, mobile games, and arcade games in Japan and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives