- Japan

- /

- Entertainment

- /

- TSE:9697

High Growth Tech Stocks in Japan to Watch This September 2024

Reviewed by Simply Wall St

As Japan's stock markets wrapped up a volatile month with gains in both the Nikkei 225 and TOPIX indices, investors are increasingly looking towards high-growth tech stocks to capitalize on the country's economic momentum. In this environment, strong fundamentals, innovative business models, and resilience in fluctuating market conditions are key attributes that can make a tech stock particularly attractive.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 50.99% | 61.55% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| f-code | 22.70% | 22.62% | ★★★★★☆ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| GMO AD Partners | 69.79% | 97.87% | ★★★★★☆ |

| Material Group | 17.82% | 28.74% | ★★★★★☆ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| ExaWizards | 22.69% | 62.99% | ★★★★★★ |

| Money Forward | 20.68% | 68.12% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

JMDC (TSE:4483)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: JMDC Inc. offers medical statistics data services in Japan and has a market cap of ¥305.40 billion.

Operations: The company generates revenue primarily from Healthcare-Big Data (¥27.17 billion), Tele-Medicine (¥5.77 billion), and Dispensing Pharmacy Support (¥1.22 billion). The most significant revenue stream is Healthcare-Big Data, contributing the majority of the total income.

JMDC, a notable player in Japan's tech sector, projects consolidated earnings for the six months ending September 30, 2024, with revenue expected at ¥18.70 billion and operating profit at ¥2.80 billion. Despite a net profit margin drop to 9.7% from last year's 19.3%, the firm anticipates annual earnings growth of 25.3%, significantly outpacing the JP market's forecasted growth of 8.6%. With revenue projected to grow by 17.5% annually and robust R&D investments bolstering innovation, JMDC is positioned for substantial future gains in healthcare services technology.

- Navigate through the intricacies of JMDC with our comprehensive health report here.

Explore historical data to track JMDC's performance over time in our Past section.

Trend Micro (TSE:4704)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Trend Micro Incorporated develops and sells security-related software for computers and related services in Japan and internationally, with a market cap of ¥1.15 trillion.

Operations: The company generates revenue primarily from security-related software and services, with significant contributions from Japan (¥84.17 billion), Asia Pacific (¥126.28 billion), Europe (¥63.59 billion), and the Americas (¥70.46 billion). The Asia Pacific region leads in revenue generation followed by Japan, showcasing a strong international presence.

Trend Micro, a prominent player in Japan's cybersecurity landscape, is making significant strides with its AI-driven innovations. The company’s R&D expenses have consistently increased, reaching ¥39.10 billion this year, reflecting a strong commitment to innovation. Revenue growth is projected at 6.2% annually, outpacing the JP market's 4.2%. Despite a net profit margin decrease to 6.4% from last year's 11.2%, earnings are expected to grow at an impressive rate of 21.9% per year over the next three years. Recent partnerships and product announcements highlight Trend Micro’s focus on AI security solutions and deepfake detection technology within its Trend Vision One™ platform, enhancing both enterprise and consumer protection against emerging threats. The company's proactive approach includes joining the Coalition for Secure AI (COSAI) alongside industry giants like Google and NVIDIA, underscoring its leadership in responsible AI deployment and cybersecurity innovation amidst evolving digital landscapes.

- Click here and access our complete health analysis report to understand the dynamics of Trend Micro.

Gain insights into Trend Micro's past trends and performance with our Past report.

Capcom (TSE:9697)

Simply Wall St Growth Rating: ★★★★☆☆

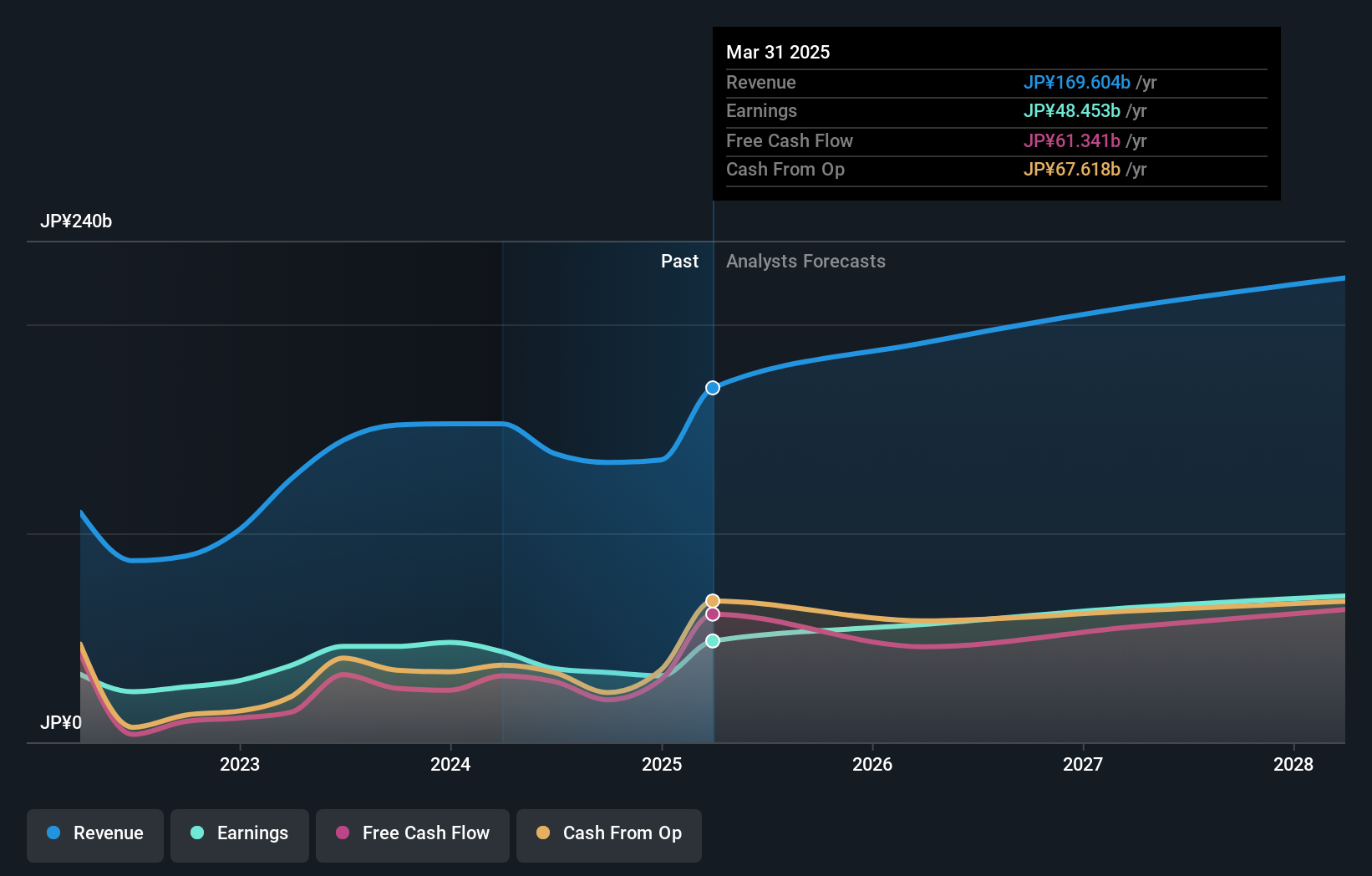

Overview: Capcom Co., Ltd. is a Japanese company engaged in the planning, development, manufacturing, sales, and distribution of home video games, online games, mobile games, and arcade games both domestically and internationally with a market cap of ¥1.33 trillion.

Operations: Capcom generates revenue primarily through its Digital Content segment, which brought in ¥103.38 billion, and also has significant contributions from Amusement Facilities at ¥20.09 billion and Amusement Equipment at ¥10.34 billion. The company's business model focuses on a diverse range of gaming platforms including home video games, online games, mobile games, and arcade games across both domestic and international markets.

Capcom is experiencing notable growth in Japan's tech landscape, driven by robust R&D investments and innovative game development. The company’s R&D expenses surged to ¥39.10 billion this year, underscoring a strong focus on innovation. Capcom's revenue is forecasted to grow at 9.5% annually, outpacing the JP market's 4.2%, while earnings are expected to increase by 14.5% per year, surpassing the market average of 8.6%. Recent announcements highlight Capcom’s commitment to expanding its gaming portfolio and enhancing user engagement through cutting-edge technology. The company's Monster Hunter series continues to be a significant revenue driver, contributing substantially to overall earnings and positioning Capcom favorably within the competitive gaming industry. Additionally, recent share repurchases reflect confidence in future performance and shareholder value enhancement strategies. With a diverse portfolio and strategic investments in AI-driven game development, Capcom remains well-poised for sustained growth amidst evolving industry dynamics.

- Click here to discover the nuances of Capcom with our detailed analytical health report.

Review our historical performance report to gain insights into Capcom's's past performance.

Where To Now?

- Get an in-depth perspective on all 126 Japanese High Growth Tech and AI Stocks by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9697

Capcom

Plans, develops, manufactures, sells, and distributes home video games, online games, mobile games, and arcade games in Japan and internationally.

Flawless balance sheet with reasonable growth potential and pays a dividend.