S Foods And 2 Other Japanese Stocks Estimated To Be Trading Below Fair Value

Reviewed by Simply Wall St

Japan's stock markets have shown resilience, with the Nikkei 225 Index and the broader TOPIX Index recovering most of their losses from earlier in the month. Amid this volatile environment, investors are increasingly looking for undervalued stocks that offer potential long-term value. Identifying stocks trading below their fair value can be an effective strategy in such market conditions, as these investments may provide a cushion against volatility while offering growth opportunities.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hagiwara Electric Holdings (TSE:7467) | ¥3485.00 | ¥6785.18 | 48.6% |

| Densan System Holdings (TSE:4072) | ¥2691.00 | ¥5362.25 | 49.8% |

| Kotobuki Spirits (TSE:2222) | ¥1787.00 | ¥3434.73 | 48% |

| Taiyo Yuden (TSE:6976) | ¥3241.00 | ¥6044.47 | 46.4% |

| KeePer Technical Laboratory (TSE:6036) | ¥4030.00 | ¥7879.85 | 48.9% |

| Kadokawa (TSE:9468) | ¥2962.50 | ¥5632.90 | 47.4% |

| West Holdings (TSE:1407) | ¥2636.00 | ¥5126.17 | 48.6% |

| Infomart (TSE:2492) | ¥324.00 | ¥618.26 | 47.6% |

| Ohara (TSE:5218) | ¥1368.00 | ¥2608.55 | 47.6% |

| CIRCULATIONLtd (TSE:7379) | ¥650.00 | ¥1282.70 | 49.3% |

We'll examine a selection from our screener results.

S Foods (TSE:2292)

Overview: S Foods Inc. is a Japanese meat company involved in the manufacture, wholesaling, retailing, and food servicing of meat-related products with a market cap of ¥85.35 billion.

Operations: S Foods Inc. generates revenue through its manufacturing, wholesaling, retailing, and food servicing of meat-related products in Japan.

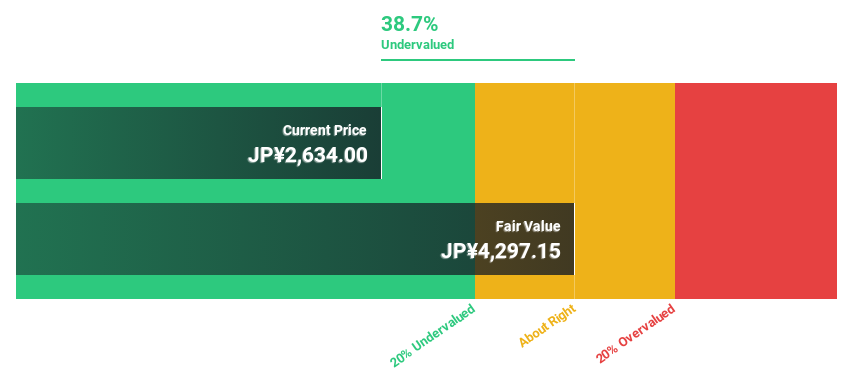

Estimated Discount To Fair Value: 37.2%

S Foods, trading at ¥2698, appears undervalued based on discounted cash flow analysis with a fair value estimate of ¥4297.15. Despite profit margins decreasing from 2.7% to 1.4% over the past year, earnings are forecast to grow significantly at 22.4% annually, outpacing the JP market's 8.6%. However, its dividend yield of 3.3% is not well covered by free cash flows, raising sustainability concerns despite strong revenue growth projections of 7.8%.

- The growth report we've compiled suggests that S Foods' future prospects could be on the up.

- Unlock comprehensive insights into our analysis of S Foods stock in this financial health report.

BuySell TechnologiesLtd (TSE:7685)

Overview: BuySell Technologies Co., Ltd. operates in the kimono and branded goods reuse business in Japan, with a market cap of ¥79.86 billion.

Operations: The company generates revenue of ¥51.73 billion from its reuse business for kimonos and branded products in Japan.

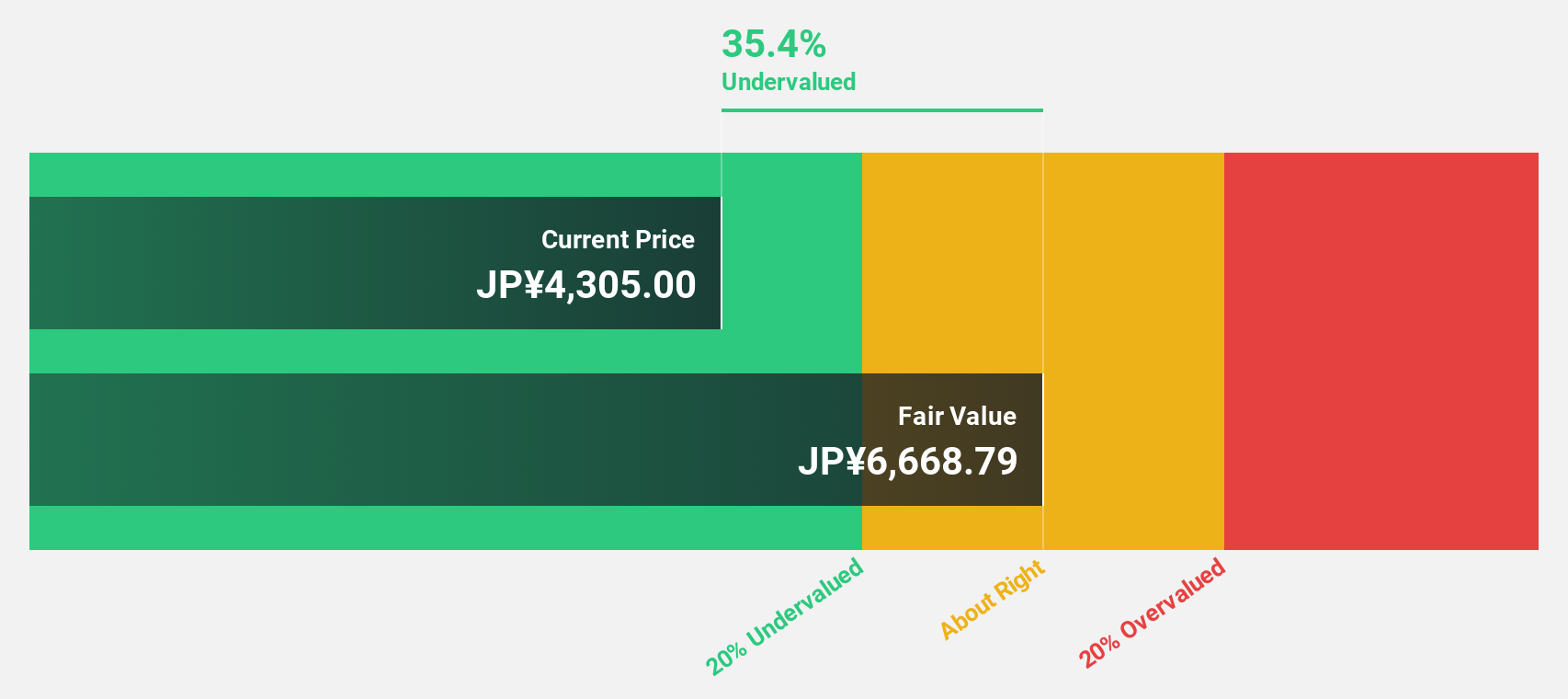

Estimated Discount To Fair Value: 31.8%

BuySell Technologies Ltd., trading at ¥5580, is significantly undervalued with a fair value estimate of ¥8186.52. Despite high volatility in its share price, the company’s earnings have grown 15.9% annually over the past five years and are forecast to grow 23.54% per year, outpacing the JP market's 8.6%. Recent guidance revisions show increased net sales and operating profit expectations for FY2024, reinforcing its strong financial position despite debt coverage concerns from operating cash flows.

- Our growth report here indicates BuySell TechnologiesLtd may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in BuySell TechnologiesLtd's balance sheet health report.

Kadokawa (TSE:9468)

Overview: Kadokawa Corporation operates as an entertainment company in Japan with a market cap of ¥398.35 billion.

Operations: Kadokawa Corporation generates revenue from various segments, including ¥28.63 billion from games, ¥143.28 billion from publications, ¥20.44 billion from web services, ¥46.36 billion from animation/film, and ¥13.83 billion from education/edtech.

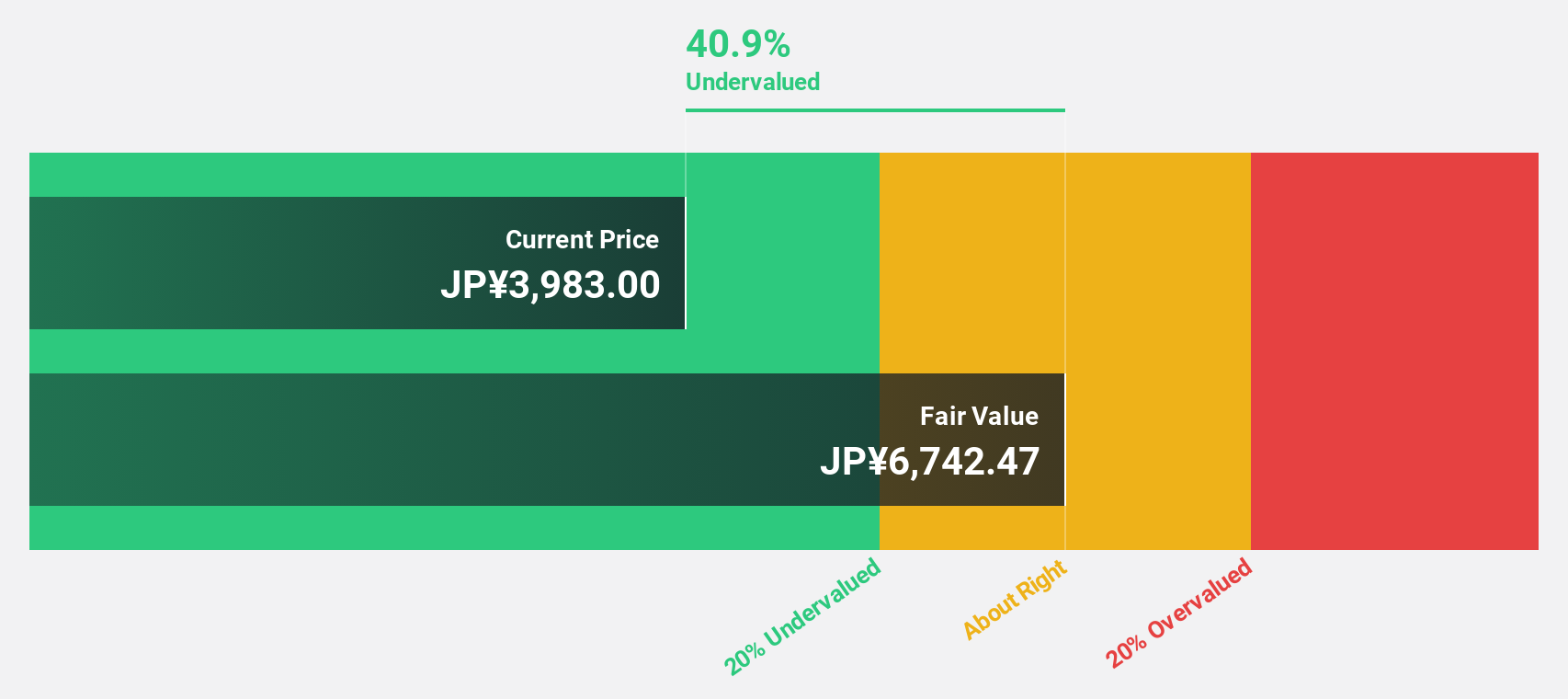

Estimated Discount To Fair Value: 47.4%

Kadokawa, currently trading at ¥2962.5, is significantly undervalued with a fair value estimate of ¥5632.9 based on discounted cash flow analysis. Despite recent volatility in its share price, the company's earnings grew 23.8% last year and are forecast to grow 21.67% annually over the next three years, outpacing the JP market's average growth rate of 8.6%. However, Kadokawa's revenue growth is expected to be modest at 6.5% per year.

- In light of our recent growth report, it seems possible that Kadokawa's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Kadokawa.

Make It Happen

- Get an in-depth perspective on all 85 Undervalued Japanese Stocks Based On Cash Flows by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kadokawa might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9468

Flawless balance sheet with solid track record.