- Japan

- /

- Professional Services

- /

- TSE:4792

Top Japanese Dividend Stocks To Watch In September 2024

Reviewed by Simply Wall St

Japan's stock markets have shown resilience, with the Nikkei 225 Index gaining 0.7% and the broader TOPIX Index up 1.0% by the end of August, recovering from earlier volatility driven by interest rate adjustments and global economic concerns. As we head into September, investors are keenly watching dividend stocks for their potential to offer steady income amidst these fluctuating market conditions. A good dividend stock typically combines a strong track record of consistent payouts with a robust financial foundation, making them particularly attractive in times of economic uncertainty.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.22% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.12% | ★★★★★★ |

| Globeride (TSE:7990) | 4.29% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.86% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.93% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.86% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.57% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.19% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.60% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.29% | ★★★★★★ |

Click here to see the full list of 461 stocks from our Top Japanese Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

YAMADA Consulting GroupLtd (TSE:4792)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: YAMADA Consulting Group Co., Ltd. offers a range of consulting services across Japan, Asia, the United States, and internationally, with a market cap of ¥45.37 billion.

Operations: YAMADA Consulting Group Ltd. generates revenue primarily from its Consulting segment, which accounts for ¥18.88 billion, and its Investment Segment, contributing ¥5.15 billion.

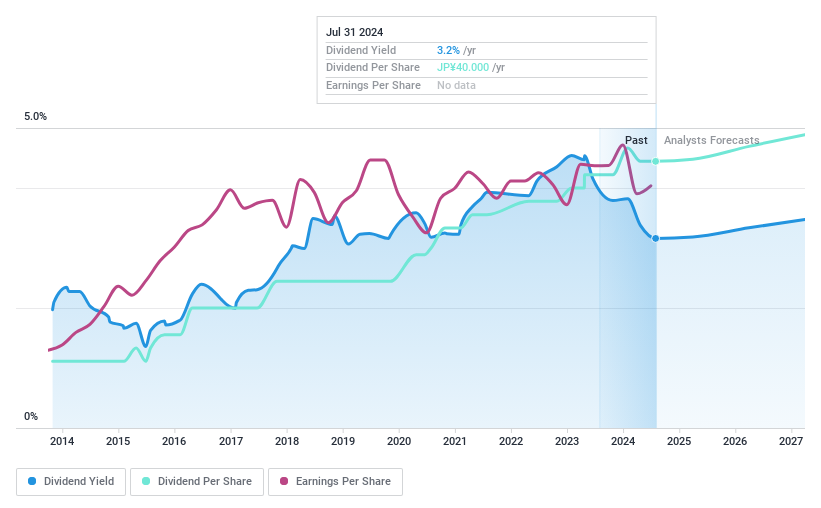

Dividend Yield: 3.2%

YAMADA Consulting Group Ltd. has a dividend payout ratio of 36.9%, indicating dividends are well covered by earnings, and a cash payout ratio of 24.8%, showing strong coverage by cash flows. However, its dividend track record is unstable with past volatility over the last decade despite recent increases in quarterly dividends to JPY 38 per share from JPY 33. The company projects net sales of ¥21.1 billion and operating profit of ¥3.73 billion for FY2025, but overall dividend reliability remains a concern.

- Get an in-depth perspective on YAMADA Consulting GroupLtd's performance by reading our dividend report here.

- Our expertly prepared valuation report YAMADA Consulting GroupLtd implies its share price may be too high.

Fullcast Holdings (TSE:4848)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fullcast Holdings Co., Ltd. and its subsidiaries offer human resource solutions in Japan, with a market cap of ¥55.39 billion.

Operations: Fullcast Holdings Co., Ltd. generates revenue through its Short-Term Operational Support Business (¥56.88 billion), Food and Beverage Business (¥7.01 billion), Sales Support Business (¥3.25 billion), and Security, Other Businesses (¥2.40 billion).

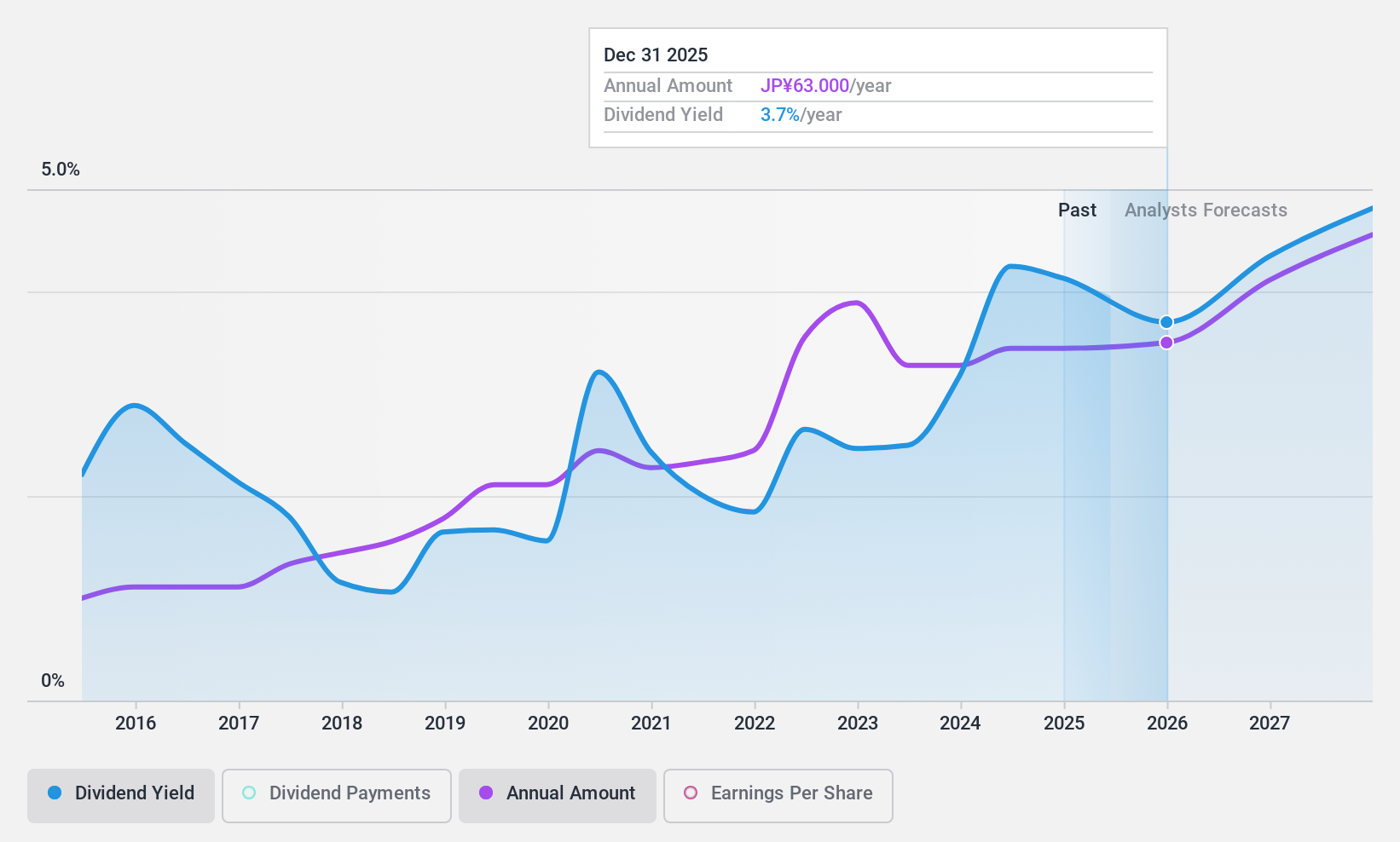

Dividend Yield: 3.9%

Fullcast Holdings' dividend payments are well covered by earnings (18.2% payout ratio) and cash flows (29.7% cash payout ratio), with a recent increase to ¥31 per share for the interim dividend. Despite being in the top 25% of JP market payers, its dividends have been volatile over the past decade, raising concerns about reliability. The stock trades at 74.3% below its estimated fair value, presenting good relative value compared to peers and industry standards.

- Navigate through the intricacies of Fullcast Holdings with our comprehensive dividend report here.

- Our valuation report here indicates Fullcast Holdings may be undervalued.

Aichi (TSE:6345)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aichi Corporation manufactures and sells mechanized vehicles for electric utilities, telecommunications, construction, cargo handling, shipbuilding, and rail industries worldwide with a market cap of ¥84.99 billion.

Operations: Aichi Corporation generates revenue from the sale of mechanized vehicles across electric utilities, telecommunications, construction, cargo handling, shipbuilding, and rail industries worldwide.

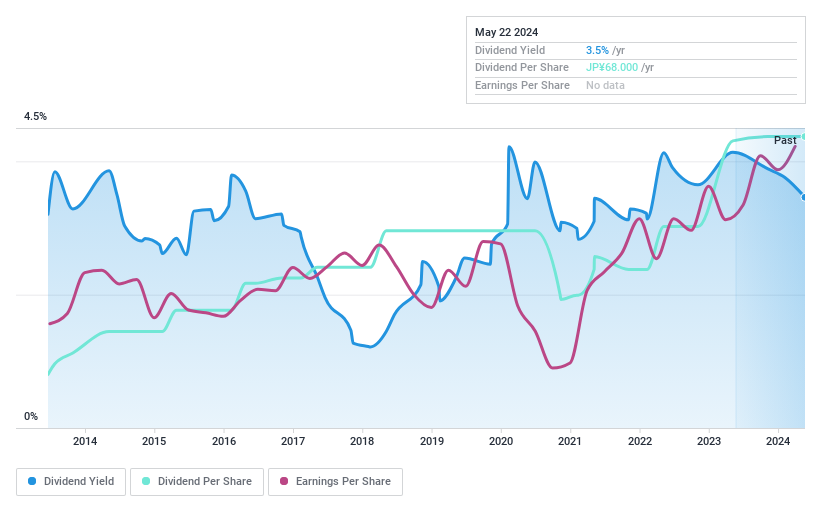

Dividend Yield: 3.5%

Aichi Corporation's dividends are covered by earnings (56.4% payout ratio) and cash flows (82.6% cash payout ratio). The company recently increased its quarterly dividend to ¥20 per share, though the year-end dividend is expected to decrease to ¥20 per share from ¥21 last year. Despite trading at 54.4% below estimated fair value, Aichi's dividends have been volatile over the past decade, raising concerns about their stability and reliability for investors seeking consistent income.

- Dive into the specifics of Aichi here with our thorough dividend report.

- According our valuation report, there's an indication that Aichi's share price might be on the cheaper side.

Summing It All Up

- Dive into all 461 of the Top Japanese Dividend Stocks we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4792

YAMADA Consulting GroupLtd

Provides various consulting services in Japan, Asia, the United States, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.