- Japan

- /

- Entertainment

- /

- TSE:9697

Exploring Three High Growth Tech Stocks with Strong Potential

Reviewed by Simply Wall St

In a week marked by volatility, U.S. stocks managed to close higher, buoyed by positive earnings reports and easing trade tensions between the U.S. and China, while dovish signals from Federal Reserve officials suggested further monetary policy easing could be on the horizon. Amid these shifting market dynamics, identifying high growth tech stocks with strong potential involves looking for companies that can capitalize on technological advancements and maintain resilience in fluctuating economic conditions.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| Fositek | 35.21% | 46.95% | ★★★★★★ |

| Zhongji Innolight | 28.99% | 31.11% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| KebNi | 23.54% | 74.03% | ★★★★★★ |

| Hacksaw | 26.01% | 37.61% | ★★★★★★ |

| CD Projekt | 35.69% | 41.57% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

Presight AI Holding (ADX:PRESIGHT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Presight AI Holding PLC is a big data analytics company utilizing generative artificial intelligence to serve clients in the United Arab Emirates and internationally, with a market cap of AED20.98 billion.

Operations: Presight AI Holding PLC generates revenue primarily from artificial intelligence, machine learning, data analytics, and hosting services, totaling AED2.70 billion. With a focus on leveraging generative AI technology, the company serves both domestic and international clients.

Presight AI Holding's strategic initiatives, including recent MoUs with Azerbaijan and partnerships like the one with Dow Jones Factiva, underscore its commitment to integrating AI into diverse sectors such as education and risk compliance. These agreements not only expand its operational footprint but also align with global AI adoption trends, enhancing its market position. Despite a challenging earnings growth rate of -9.4% over the past year compared to the IT industry's 12%, Presight has demonstrated resilience with a notable revenue increase of 21.1% per year and is set to outpace the AE market forecast of 7.2%. Moreover, while profit margins have dipped from last year’s 32% to 20.1%, the company’s strategic direction, evidenced by significant collaborations and an expanded service offering in critical financial infrastructure alongside CBUAE, suggests potential for future recovery and growth in emerging markets.

argenx (ENXTBR:ARGX)

Simply Wall St Growth Rating: ★★★★★★

Overview: argenx SE is a commercial-stage biopharmaceutical company focused on developing therapies for autoimmune diseases across multiple international markets, with a market cap of €44.68 billion.

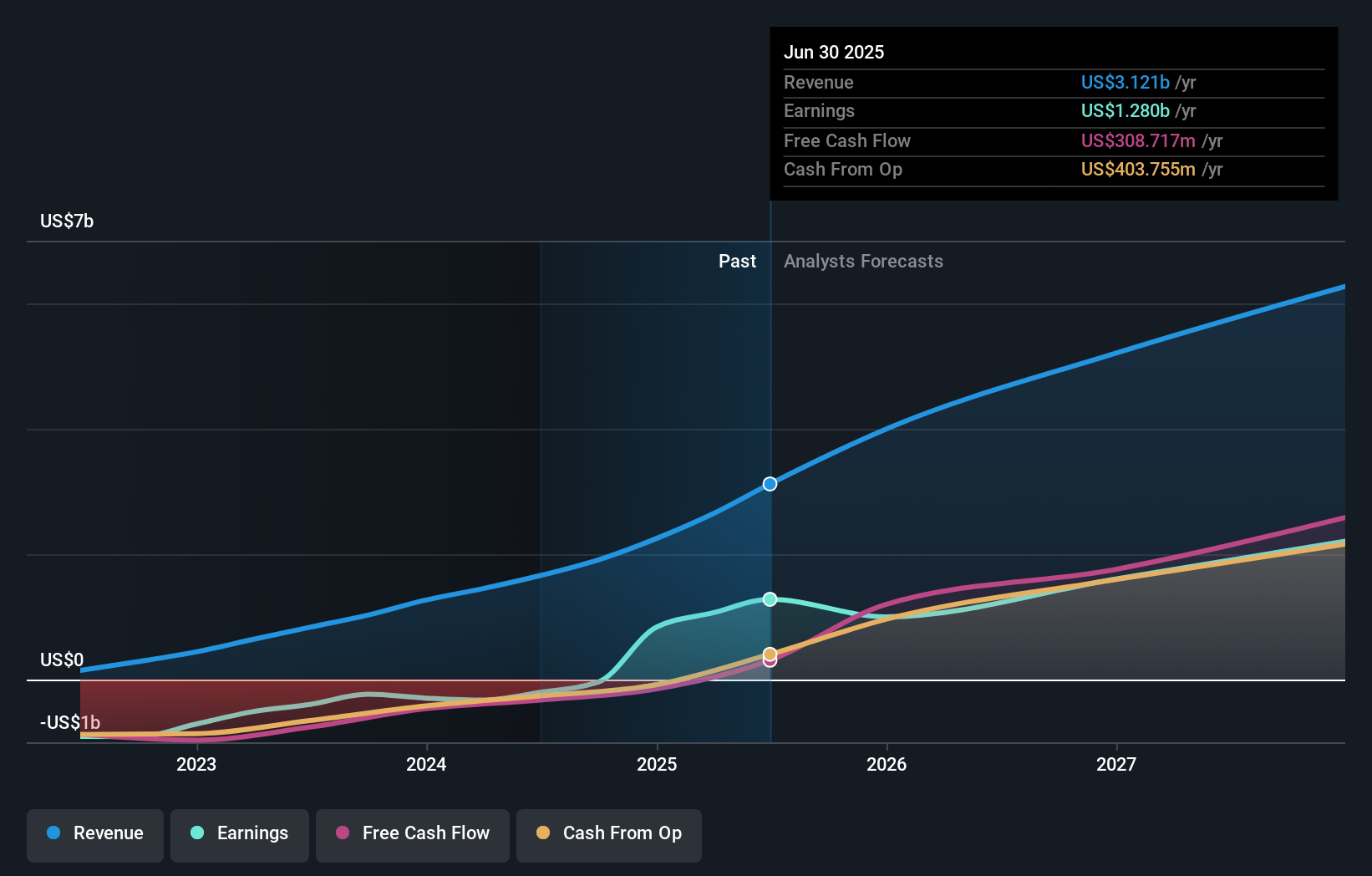

Operations: argenx SE generates revenue primarily from its biotechnology segment, amounting to $3.12 billion. The company operates in the United States, Japan, China, the Netherlands, and other international markets.

Armed with a robust pipeline and strategic partnerships, argenx SE stands out in the biotech landscape. The company's recent collaboration with FUJIFILM Biotechnologies to expand global manufacturing capabilities underscores its commitment to enhancing treatment accessibility for autoimmune diseases. This move is pivotal as it leverages FUJIFILM’s kojoX network, ensuring agile supply chain management crucial for meeting clinical and commercial demands. Furthermore, argenx's revenue soared to $1.77 billion in the first half of 2025, a significant leap from $901.94 million the previous year, reflecting a strong market demand for its innovative therapies like VYVGART®?. These strategic initiatives coupled with a promising financial trajectory—turning a net loss into a substantial net income of $414.83 million—position argenx favorably within the high-growth biotech sector.

- Unlock comprehensive insights into our analysis of argenx stock in this health report.

Examine argenx's past performance report to understand how it has performed in the past.

Capcom (TSE:9697)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Capcom Co., Ltd. is a Japanese company engaged in the planning, development, manufacturing, sales, and distribution of home video games, online games, mobile games, and arcade games both domestically and internationally with a market cap of ¥1.75 trillion.

Operations: Capcom generates revenue primarily from Digital Content, which accounts for ¥133.57 billion, followed by Arcade Operations and Amusement Equipment at ¥23.49 billion and ¥21.21 billion respectively. The focus on digital content highlights a significant aspect of the company's business model in the gaming industry.

Capcom's recent strategic maneuvers, including a unique promotional collaboration with Beard Papa's for "Monster Hunter Wilds," exemplify its innovative approach to engaging consumers beyond traditional gaming platforms. This initiative, coupled with the announcement of "Resident Evil Requiem" set for a multi-platform release, underscores Capcom’s commitment to expanding its footprint across new and existing gaming consoles. Financially, Capcom has demonstrated robust growth with earnings surging by 58.3% over the past year, significantly outpacing the industry average of 12.2%. Additionally, its R&D expenses have been pivotal in sustaining this momentum, ensuring that Capcom remains at the forefront of technological advancements and content richness in gaming.

- Dive into the specifics of Capcom here with our thorough health report.

Gain insights into Capcom's historical performance by reviewing our past performance report.

Next Steps

- Navigate through the entire inventory of 248 Global High Growth Tech and AI Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9697

Capcom

Plans, develops, manufactures, sells, and distributes home video games, online games, mobile games, and arcade games in Japan and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion