- China

- /

- Electronic Equipment and Components

- /

- SHSE:688686

Exploring Three High Growth Tech Stocks In Asia

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by steady interest rates and mixed economic indicators, Asian tech stocks continue to capture attention with their potential for high growth. In this dynamic environment, identifying promising stocks often involves looking at companies that demonstrate strong innovation capabilities and adaptability to changing market conditions.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 29.78% | 30.32% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.44% | 23.48% | ★★★★★★ |

| Fositek | 27.37% | 35.14% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.31% | 28.63% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| PharmaResearch | 24.65% | 26.40% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| Marketingforce Management | 26.39% | 112.30% | ★★★★★★ |

| JNTC | 54.24% | 87.93% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

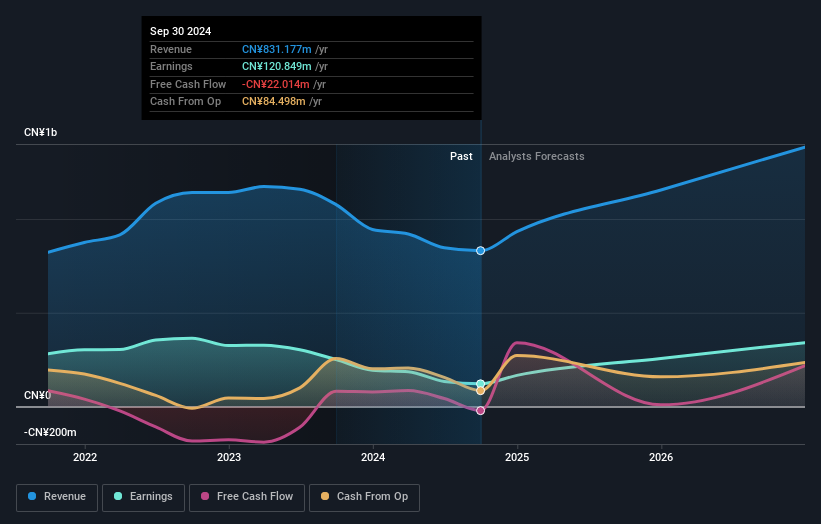

OPT Machine Vision Tech (SHSE:688686)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OPT Machine Vision Tech Co., Ltd. develops and supplies components and software for factory automation worldwide, with a market cap of CN¥11.31 billion.

Operations: OPT Machine Vision Tech generates revenue primarily from its photographic equipment and supplies segment, which contributes CN¥952.39 million.

Despite a challenging year with a 26.2% dip in earnings, OPT Machine Vision Tech remains poised for significant growth, with projected annual revenue and earnings increases of 19.6% and 35.8%, respectively—both outpacing broader market averages of 12.3% and 23.1%. This robust growth trajectory is further underscored by its recent active participation in industry conferences and an upcoming annual general meeting, signaling ongoing strategic initiatives to bolster its market position in Asia's tech landscape. Moreover, the company's commitment to shareholder returns is evident from its scheduled cash dividend payout, reinforcing its financial stability amidst fluctuating market conditions.

- Unlock comprehensive insights into our analysis of OPT Machine Vision Tech stock in this health report.

Assess OPT Machine Vision Tech's past performance with our detailed historical performance reports.

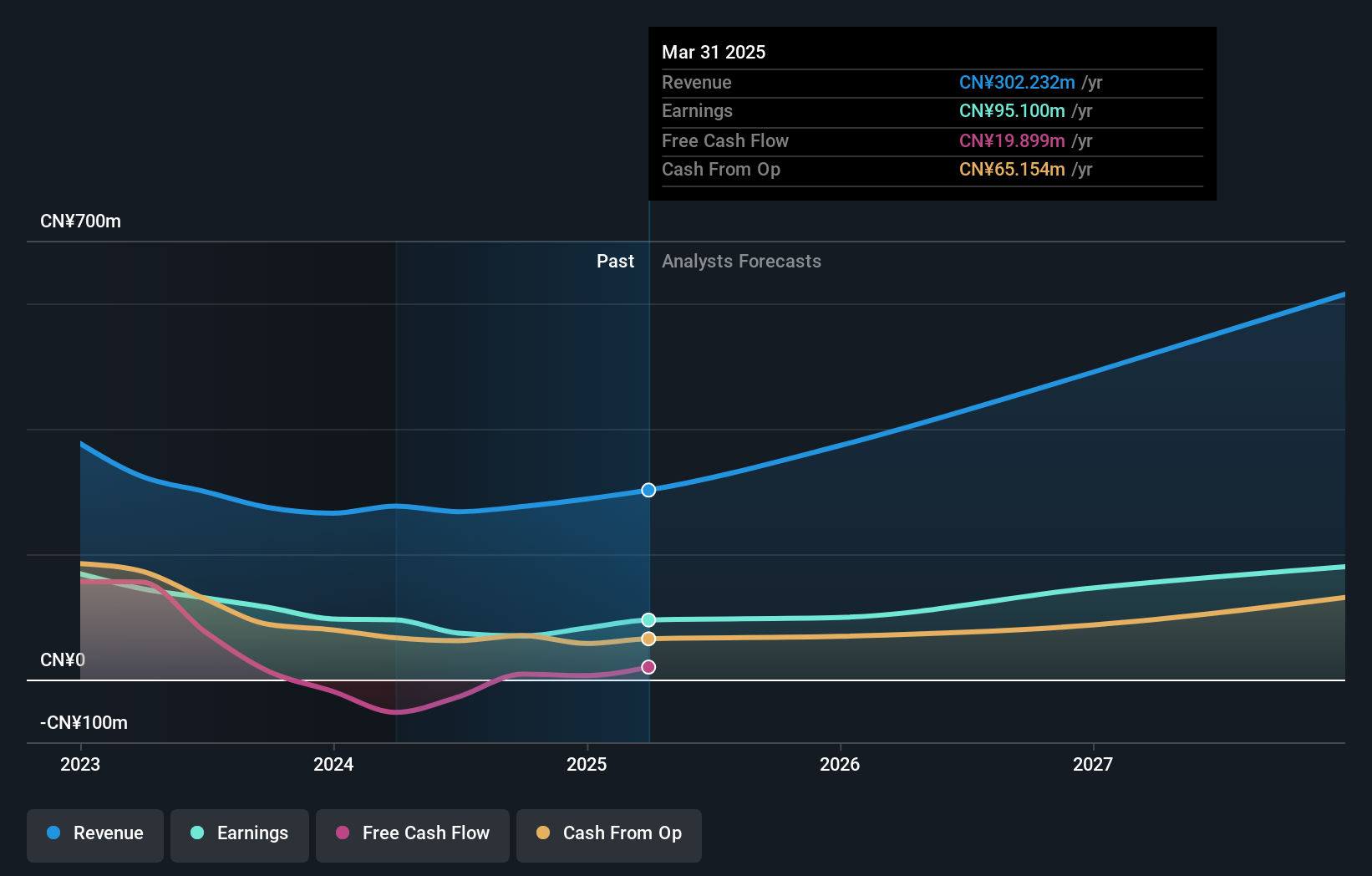

Long Young Electronic (Kunshan) (SZSE:301389)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Long Young Electronic (Kunshan) Co., Ltd. operates in the packaging and containers industry with a market capitalization of CN¥7.13 billion.

Operations: The company generates revenue primarily from its packaging and containers segment, totaling CN¥302.23 million.

Long Young Electronic (Kunshan) is making significant strides in Asia's high-tech sector, with a notable 25.7% annual revenue growth and an earnings increase of 25.4% per year, both figures surpassing the broader Chinese market trends. This growth is underpinned by robust R&D investments aimed at innovation and market expansion, evidenced by a recent announcement on April 24, where Q1 sales jumped to CNY 73.38 million from CNY 59.09 million in the previous year. The company also demonstrated its commitment to shareholder returns with a dividend payout announced on April 15, despite a slight decrease in dividend per share later in April, reflecting strategic financial management amid rapid expansion phases.

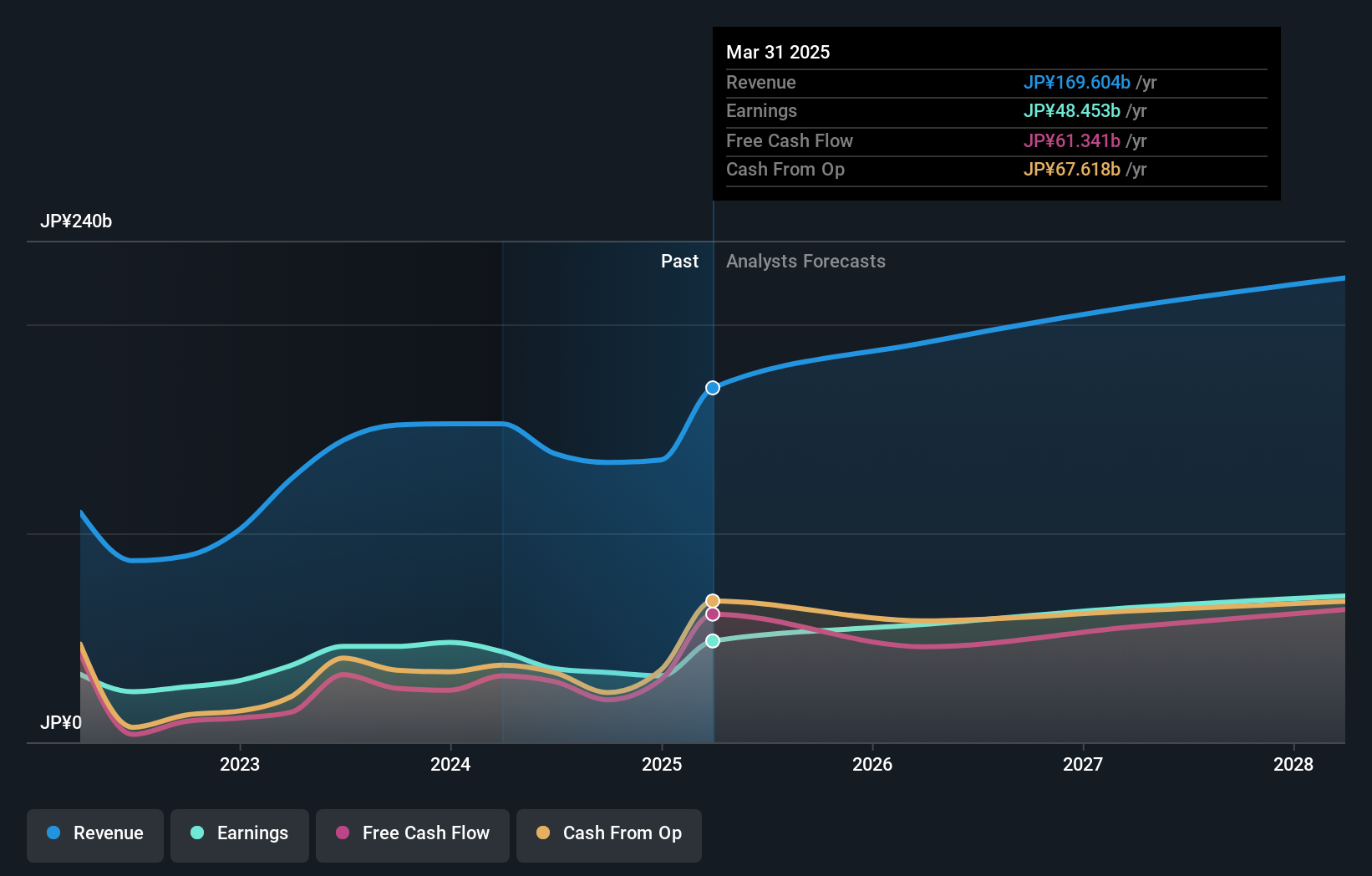

Capcom (TSE:9697)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Capcom Co., Ltd. is a global entertainment company involved in the planning, development, manufacturing, sales, and distribution of home video games, online games, mobile games, and arcade games with a market capitalization of ¥1.99 trillion.

Operations: The company generates revenue primarily through its Digital Content segment, which accounts for ¥125.13 billion, followed by Amusement Facilities at ¥22.75 billion and Amusement Equipment at ¥15.61 billion.

Capcom's strategic emphasis on innovation is evident with a robust 10.7% annual earnings growth and an 8.2% increase in revenue, outpacing the broader Japanese market's growth rates of 7.3% and 3.7%, respectively. The company's commitment to R&D has fostered significant advancements in gaming technology, as seen with the development of Resident Evil Requiem using their proprietary RE ENGINE, enhancing graphical fidelity for a more immersive experience. This focus not only drives current product excellence but also positions Capcom favorably for future tech-driven expansions in the global gaming landscape.

- Click here and access our complete health analysis report to understand the dynamics of Capcom.

Evaluate Capcom's historical performance by accessing our past performance report.

Make It Happen

- Gain an insight into the universe of 498 Asian High Growth Tech and AI Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688686

OPT Machine Vision Tech

Develops and supplies components and software for factory automation worldwide.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives