- Japan

- /

- Entertainment

- /

- TSE:9697

Capcom (TSE:9697) Valuation Check as New Sci‑Fi IP PRAGMATA Targets 2026 Multi‑Platform Launch

Reviewed by Simply Wall St

Capcom (TSE:9697) just put fresh fuel under its long term growth story by unveiling PRAGMATA, a new sci fi IP slated for April 2026, with a PC demo launching now.

See our latest analysis for Capcom.

Despite the buzz around PRAGMATA, Capcom’s recent share price return has cooled, with a 30 day share price return of minus 11.46 percent and a 90 day share price return of minus 14.19 percent. However, its five year total shareholder return of 125.32 percent still points to strong long term momentum.

If you like Capcom’s blend of franchises and new IP but want to see what else the market is offering, now could be a good time to explore high growth tech and AI stocks.

With earnings still growing, the share price pulling back and the stock trading at a sizable discount to analyst targets, is Capcom now an overlooked growth story, or are markets already pricing in its next leg higher?

Most Popular Narrative: 24.6% Undervalued

Capcom's most followed narrative sees its fair value well above the last close of ¥3,483, framing the recent pullback as a potential mispricing.

The analysts have a consensus price target of ¥4624.0 for Capcom based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥5400.0, and the most bearish reporting a price target of just ¥3800.0.

Want to see what kind of revenue runway and margin lift justify this punchy outlook, and why the future earnings multiple needs to stretch higher? Dive in.

Result: Fair Value of ¥4,620.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat scenario could unravel if core franchises show fatigue or if ballooning development and talent costs squeeze the margin gains analysts are banking on.

Find out about the key risks to this Capcom narrative.

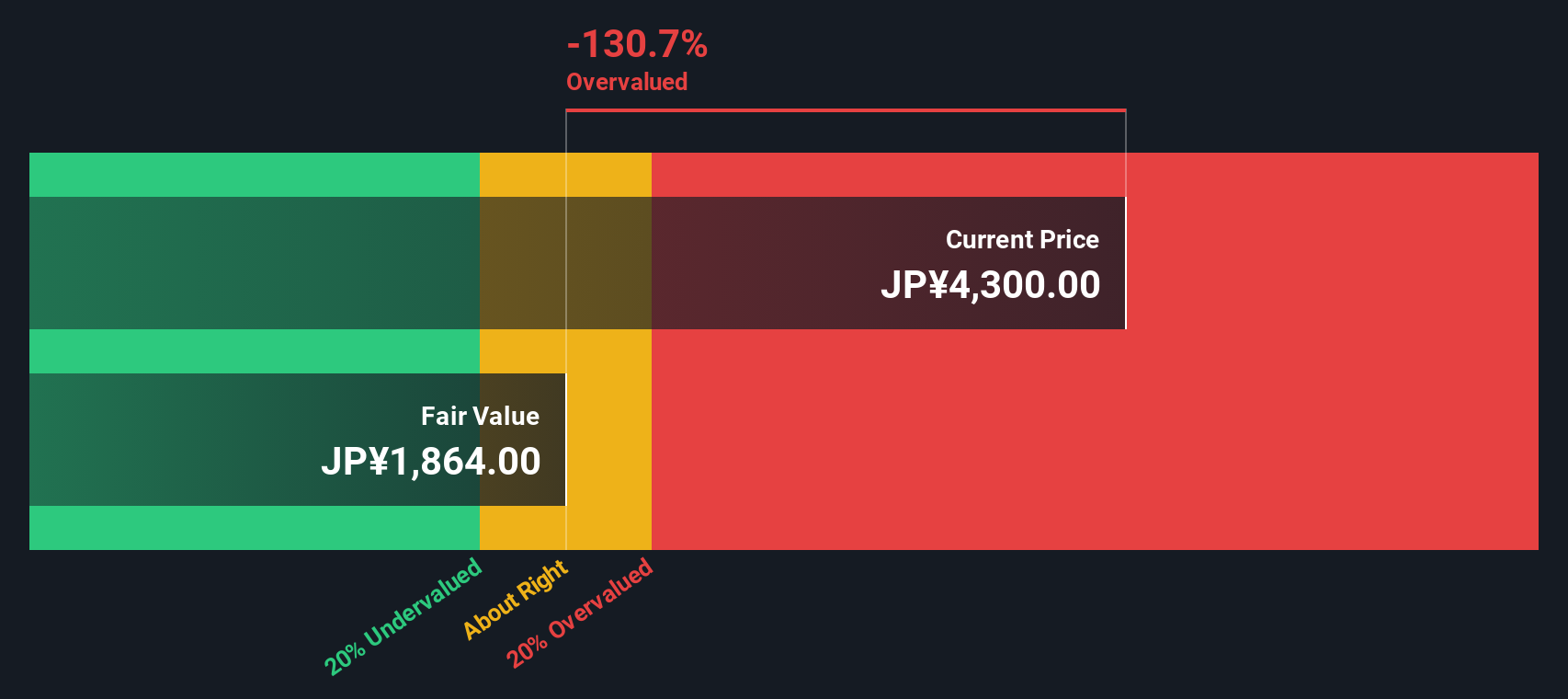

Another View: DCF Flags Overvaluation

Our DCF model paints a cooler picture, putting fair value closer to ¥1,900 versus today’s ¥3,483. This suggests Capcom could be materially overvalued on cash flow assumptions even as analysts see upside on earnings multiples. Which story feels closer to reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Capcom for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Capcom Narrative

If you want to stress test these assumptions or dig into the numbers yourself, you can build a personalized view in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Capcom.

Looking for more investment ideas?

Capcom might fit your strategy, but you will kick yourself later if you ignore other opportunities the Simply Wall St Screener uncovers across sectors and styles.

- Capture potential multi-baggers early by scanning these 3633 penny stocks with strong financials with robust balance sheets and room to scale.

- Ride the structural shift toward automation and smart platforms by targeting these 24 AI penny stocks reshaping everything from cloud infrastructure to consumer apps.

- Lock in income and stability by focusing on these 12 dividend stocks with yields > 3% that can keep paying you even when markets wobble.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9697

Capcom

Plans, develops, manufactures, sells, and distributes home video games, online games, mobile games, and arcade games in Japan and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion