- Japan

- /

- Entertainment

- /

- TSE:9697

Capcom (TSE:9697): Evaluating the Gaming Giant’s True Value After a Strong Run

Reviewed by Simply Wall St

Capcom (TSE:9697) has drawn investor attention this week after a steady climb so far this year, even without a headline-grabbing announcement or major event to set things in motion. Sometimes, it’s precisely this kind of quiet momentum that gets investors wondering if something bigger is happening beneath the surface, or if the market is simply catching up to the fundamentals. With Capcom’s name frequently coming up in discussions about growth potential in the gaming industry, any move in its share price is bound to spark questions about what is really driving returns.

Over the past year, Capcom shares have returned 22%, outpacing many industry peers and hinting at sustained investor enthusiasm. The stock has delivered nearly a 20% gain year-to-date, despite a recent dip in the past 3 months suggesting momentum may be cooling. Recent earnings showed solid growth in both revenue and profit, keeping Capcom in the conversation for long-term investors. Naturally, this track record leads to a closer look at valuation and what is already priced in by the market.

After this steady rise and mixed short-term signals, should investors see Capcom as undervalued, or is the current price already reflecting all future growth?

Most Popular Narrative: 13.1% Undervalued

According to the prevailing narrative, Capcom shares have upside potential, with their fair value estimated at a level notably above today’s market price.

Capcom's strategy to accelerate global expansion, particularly in emerging markets and through increased support for PC platforms, directly positions the company to capitalize on the ongoing growth in the worldwide gaming population, driving long-term revenue and potential international earnings growth.

What is fueling this bullish outlook? The narrative revolves around ambitious growth plans and a leap in future profitability that could re-rate Capcom’s value compared to the broader market. Intrigued by what underpins this projection? The assumptions behind this fair value rest on bold expectations for rising sales, profits, and operating margins. These are numbers you might not anticipate for a company already on a winning streak. Want to uncover what analysts think justifies such a premium? Dive deeper to reveal the surprising calculations powering this target valuation.

Result: Fair Value of ¥4,624 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, overreliance on blockbuster franchises and rising development costs could challenge Capcom’s growth outlook if future releases underperform or if margins come under pressure.

Find out about the key risks to this Capcom narrative.Another View: What Do Market Comparisons Say?

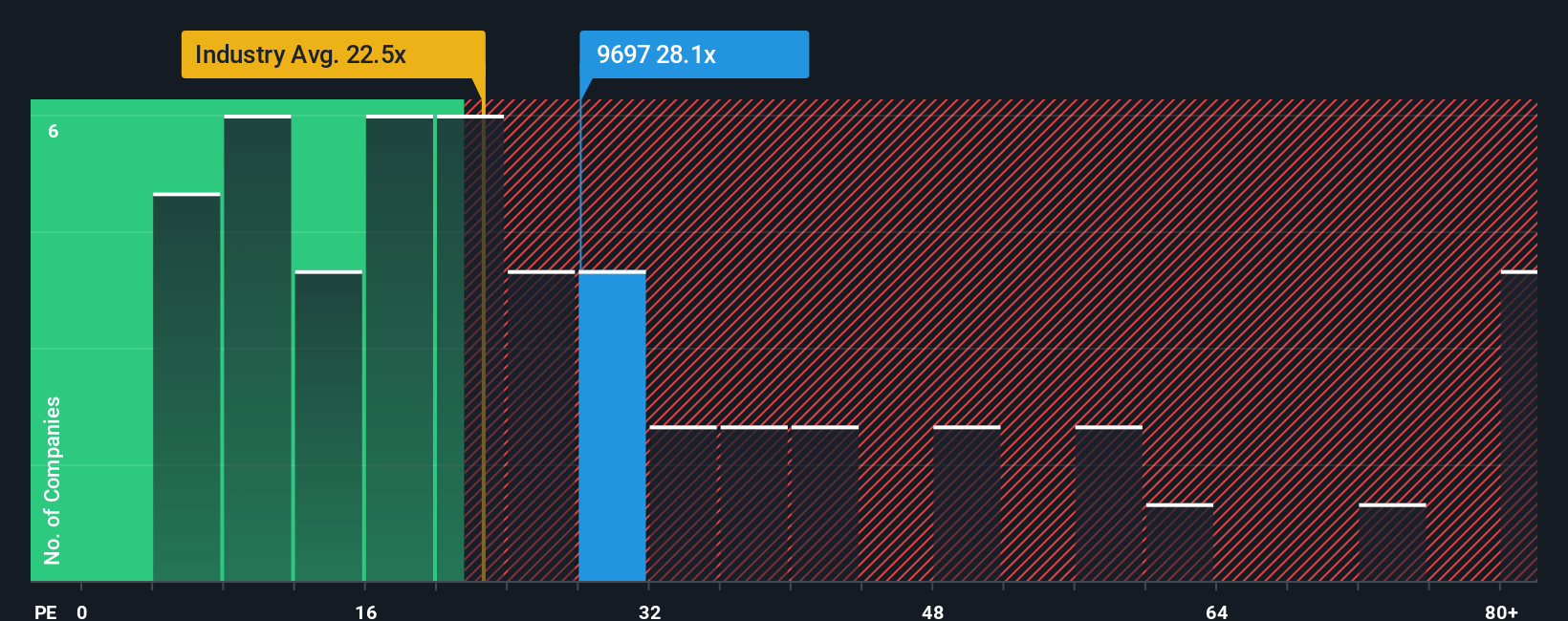

Looking at Capcom through the lens of market benchmarks paints a slightly different picture. The current share price appears high when compared to the broader industry, which raises questions about how much upside remains. Could investors be overestimating future potential?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Capcom Narrative

If you see things differently, or want to build your own perspective based on the data, you can create your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Capcom.

Looking for Your Next Big Investment Move?

Don’t let strong opportunities slip away. Harness Simply Wall Street’s powerful tools to track down stocks with strong growth potential, untapped value, or consistent income. Act now to put yourself ahead of the market with fresh ideas that align with your strategy.

- Supercharge your portfolio with small-cap gems showing real financial muscle by starting with penny stocks with strong financials.

- Ride the future of computing by tapping into revolutionary breakthroughs featured in quantum computing stocks.

- Capture reliable cash flow and build long-term wealth by targeting companies with robust payouts through dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSE:9697

Capcom

Plans, develops, manufactures, sells, and distributes home video games, online games, mobile games, and arcade games in Japan and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives