Kadokawa's Global Chinese Animation Release Might Change the Case for Investing in Kadokawa (TSE:9468)

Reviewed by Sasha Jovanovic

- On October 13, 2025, iQIYI announced a collaboration with Kadokawa Corporation to distribute original Chinese animated series, including "The Fated Magical Princess" and "The Forbidden City: Cat Imperial Study," to key global markets.

- This marks Kadokawa's first simultaneous international release of a premium Chinese animation produced by a Chinese streaming platform, highlighting its expanding content strategy.

- We'll explore how Kadokawa's move to launch Chinese animation internationally could shape its investment narrative and future content reach.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Kadokawa's Investment Narrative?

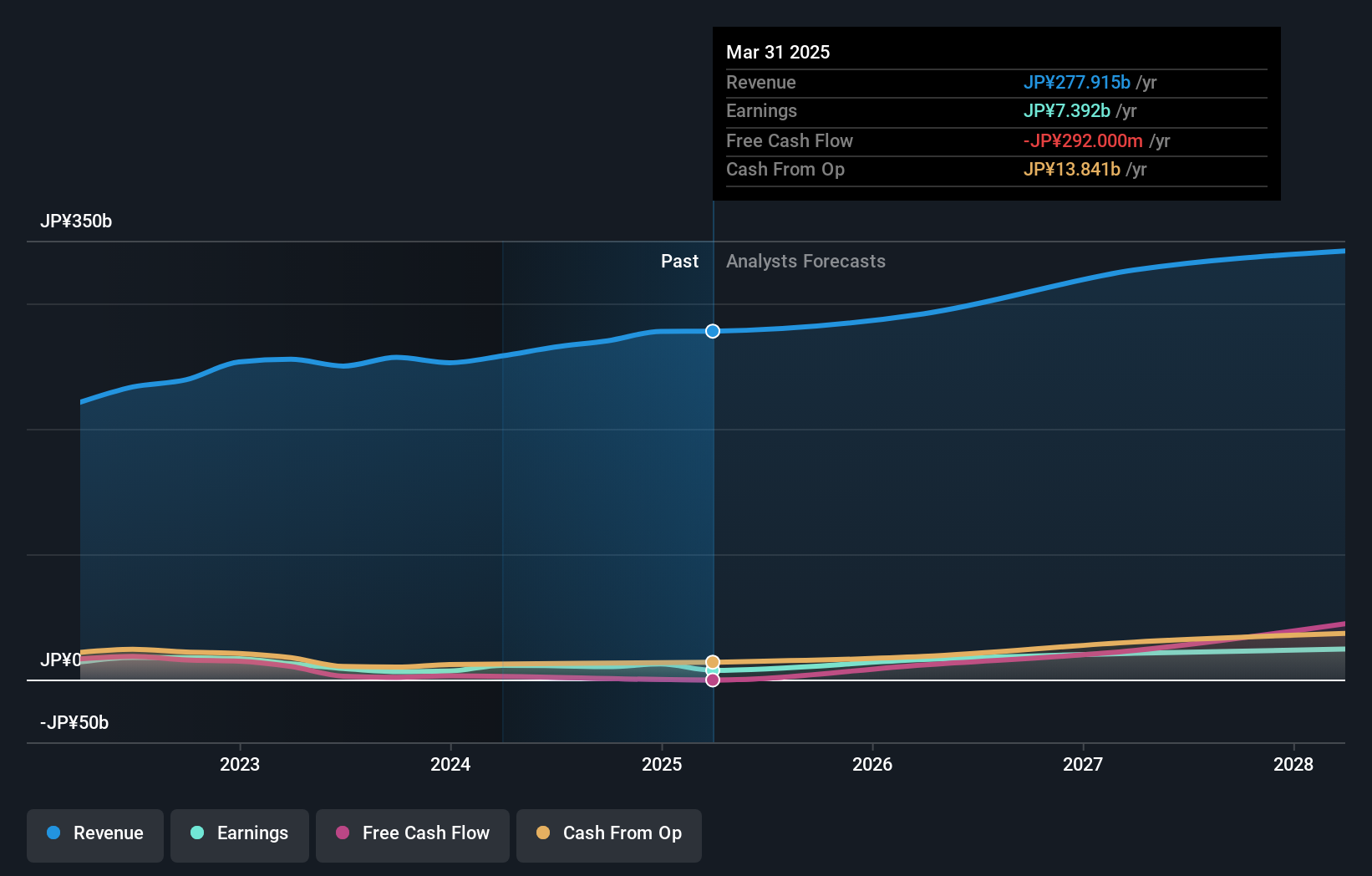

For shareholders in Kadokawa, the core belief is in the company’s ability to build on its global content platform and alliances. The recent partnership with iQIYI marks a meaningful step, positioning Kadokawa to capitalize on surging demand for Asian content beyond Japan’s domestic market and could strengthen its long-term growth narrative if these series gain global traction. This move may also serve as a near-term catalyst for interest in the stock, given investor focus on expanding intellectual property (IP) reach and diversified content. However, any potential financial upside will depend on actual audience reception and the monetization of these new titles, which is difficult to forecast at this early stage. Risks around stretched valuation multiples remain, especially as recent share price moves suggest the market may already be pricing in strong growth expectations. But it’s clear Kadokawa’s approach to global expansion is evolving and could influence both catalysts and risk factors ahead.

But, the question of whether current profit margins can support this expansion effort remains unresolved. Despite retreating, Kadokawa's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 2 other fair value estimates on Kadokawa - why the stock might be worth over 2x more than the current price!

Build Your Own Kadokawa Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kadokawa research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Kadokawa research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kadokawa's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kadokawa might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9468

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives