As global markets navigate the complexities of tariff uncertainties and mixed economic indicators, the tech sector remains a focal point for investors seeking growth opportunities. In this environment, identifying high-growth tech stocks involves looking at companies that demonstrate resilience and innovation amidst fluctuating market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1207 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Sinch (OM:SINCH)

Simply Wall St Growth Rating: ★★★★☆☆

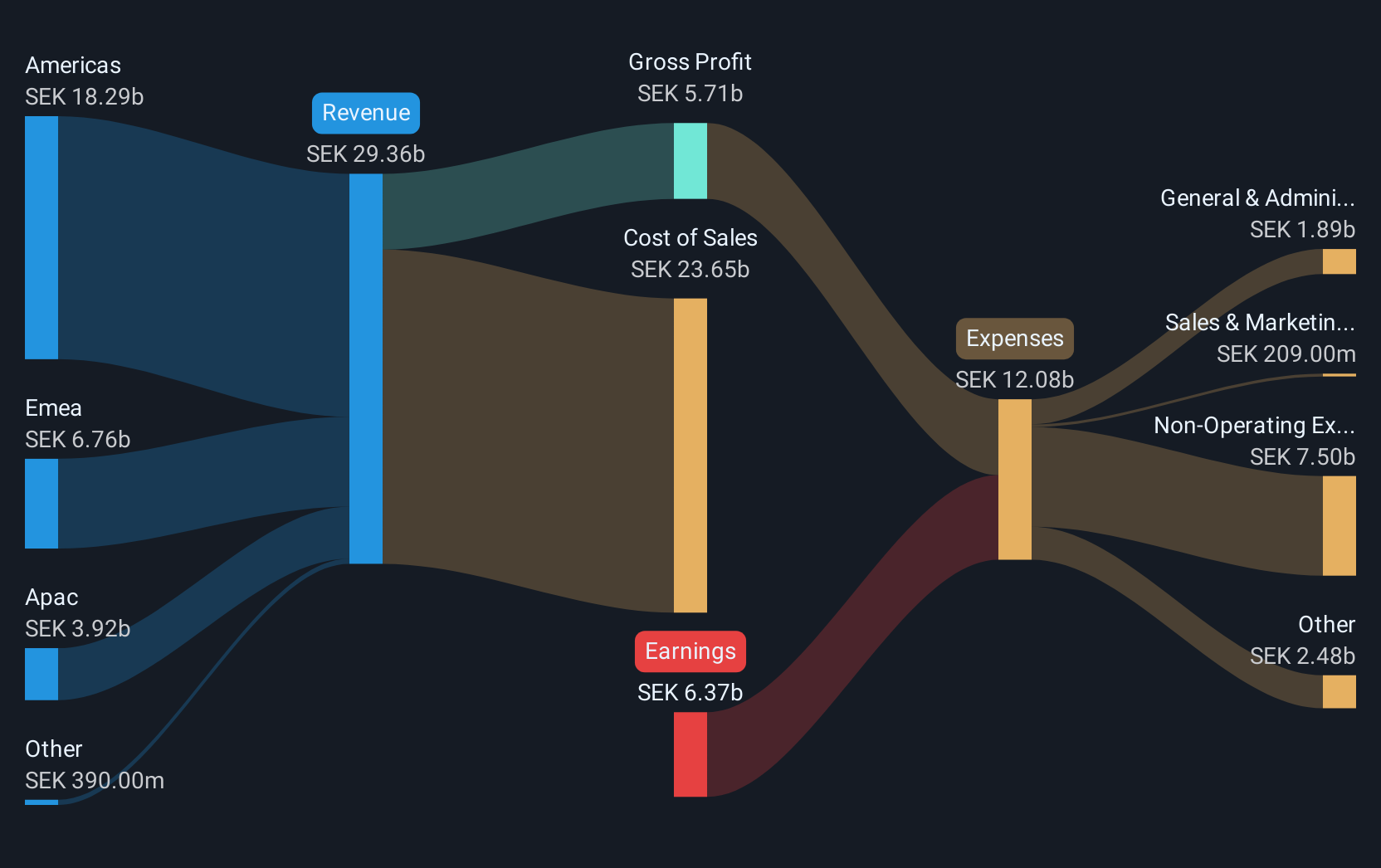

Overview: Sinch AB (publ) offers cloud communications services and solutions to enterprises and mobile operators across various countries, including Sweden, France, the United Kingdom, Germany, Brazil, India, Singapore, and the United States with a market cap of SEK24.48 billion.

Operations: The company specializes in providing cloud communications services and solutions to enterprises and mobile operators globally. Its revenue is primarily derived from delivering messaging, voice, and video communication services.

Sinch, a player in the tech communication sector, is navigating through challenging financial waters with its recent quarterly report showing a shift from a net income of SEK 144 million to a net loss of SEK 324 million. Despite this setback, the company's strategic partnership with Aduna underscores its commitment to enhancing digital services globally through innovative network API solutions. This collaboration is poised to broaden Sinch’s influence in the tech ecosystem, potentially catalyzing future revenue streams and solidifying its role in advancing global communication technologies. With an expected annual revenue growth rate of 3.5%, Sinch aims to outpace the Swedish market's growth and is projected to turn profitable within three years, suggesting resilience and adaptability in its strategy amidst current financial volatilities.

- Click here and access our complete health analysis report to understand the dynamics of Sinch.

Assess Sinch's past performance with our detailed historical performance reports.

AAC Technologies Holdings (SEHK:2018)

Simply Wall St Growth Rating: ★★★★☆☆

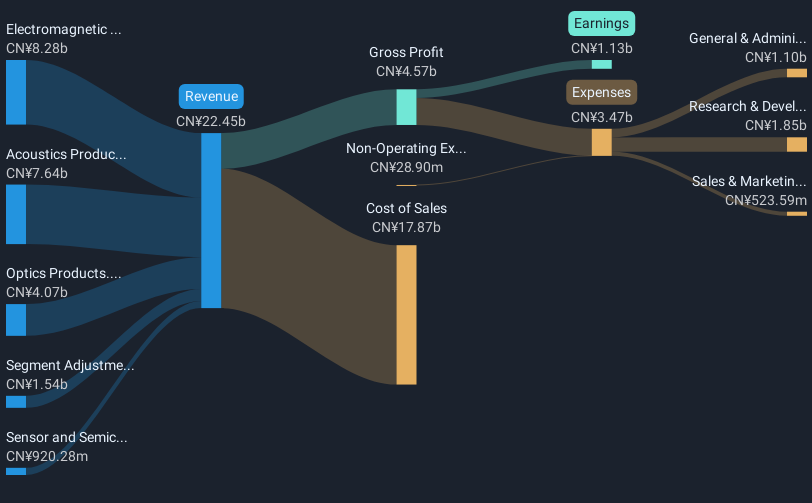

Overview: AAC Technologies Holdings Inc. is an investment holding company that offers solutions for smart devices across various regions including Mainland China, Hong Kong SAR, Taiwan, other Asian countries, the United States, and Europe, with a market capitalization of HK$55.50 billion.

Operations: AAC Technologies generates revenue primarily from Acoustics Products (CN¥7.64 billion) and Electromagnetic Drives and Precision Mechanics (CN¥8.28 billion), with significant contributions from Optics Products and Sensor & Semiconductor Products. The company operates across multiple regions, focusing on smart device solutions.

AAC Technologies, a leader in sensory interaction technologies, continues to innovate across multiple tech domains. With recent product launches at CES 2025, AAC has set new standards in smart automotive and acoustics, showcasing solutions like the Ultimate Speaker for smartphones and RichTap AI Vibration Solutions. These advancements underscore AAC's commitment to enhancing user experiences through superior technology integration. The company's R&D focus is evident as it consistently develops industry-leading products such as WLG glass lenses and hybrid glass-plastic lens products which are pivotal in optics technology. Financially, AAC demonstrates robust growth with an annual revenue increase projected at 12.1% and earnings growth outpacing the Hong Kong market with a notable 81.3% rise over the past year. Moreover, its strategic share repurchase program initiated on December 17, 2024, emphasizes its confidence in sustaining long-term value creation for shareholders.

Kadokawa (TSE:9468)

Simply Wall St Growth Rating: ★★★★☆☆

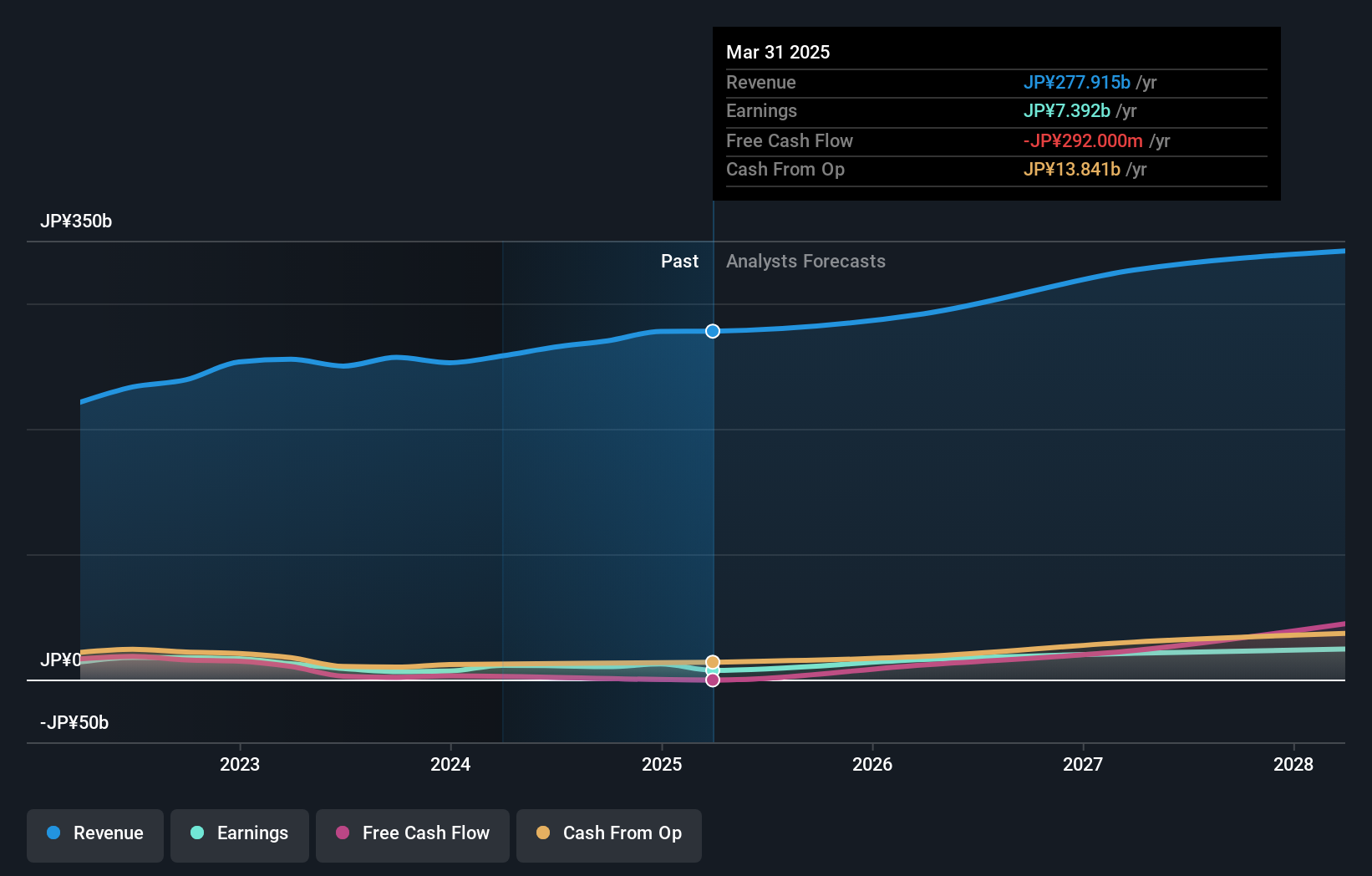

Overview: Kadokawa Corporation is an entertainment company in Japan with a market capitalization of ¥533.03 billion.

Operations: Kadokawa Corporation generates revenue primarily through its publishing, film, and digital content businesses. The company focuses on producing and distributing books, magazines, movies, anime, and video games.

Kadokawa Corporation, a multifaceted media company, has demonstrated robust growth with its earnings surging by 82% over the past year, significantly outpacing the Media industry's growth of 4.9%. This performance is anchored in its strategic expansion into digital publishing, particularly e-books which have seen a 15.3% annual increase in net sales over five years. The recent strategic alliance with Kakao piccoma to enhance manga content distribution underscores Kadokawa’s commitment to leveraging technology for IP maximization and global reach. Further bolstered by a private placement raising nearly ¥50 billion with Sony’s participation, Kadokawa is poised for continued innovation and market penetration as it aims for JPY 340 billion in sales by 2028.

- Delve into the full analysis health report here for a deeper understanding of Kadokawa.

Gain insights into Kadokawa's historical performance by reviewing our past performance report.

Turning Ideas Into Actions

- Get an in-depth perspective on all 1207 High Growth Tech and AI Stocks by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SINCH

Sinch

Provides cloud communications services and solutions for enterprises and mobile operators in Sweden, France, the United Kingdom, Germany, Brazil, India, Singapore, other European countries, the United States, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives