Global Market: 3 Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

In recent weeks, global markets have been marked by volatility, with U.S. stocks experiencing losses amid inflation concerns and trade policy uncertainties. As investors navigate these challenging conditions, opportunities may arise in the form of undervalued stocks that could offer potential value based on their current trading prices relative to intrinsic worth.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Romsdal Sparebank (OB:ROMSB) | NOK130.30 | NOK260.00 | 49.9% |

| Somec (BIT:SOM) | €10.35 | €20.55 | 49.6% |

| Alarum Technologies (TASE:ALAR) | ₪2.483 | ₪4.89 | 49.3% |

| Wienerberger (WBAG:WIE) | €35.12 | €69.28 | 49.3% |

| Net Insight (OM:NETI B) | SEK4.825 | SEK9.58 | 49.6% |

| APAC Realty (SGX:CLN) | SGD0.43 | SGD0.85 | 49.5% |

| Takara Bio (TSE:4974) | ¥854.00 | ¥1687.32 | 49.4% |

| dormakaba Holding (SWX:DOKA) | CHF685.00 | CHF1356.53 | 49.5% |

| Nanofilm Technologies International (SGX:MZH) | SGD0.67 | SGD1.33 | 49.6% |

| Entech (ENXTPA:ALESE) | €8.16 | €16.30 | 50% |

We're going to check out a few of the best picks from our screener tool.

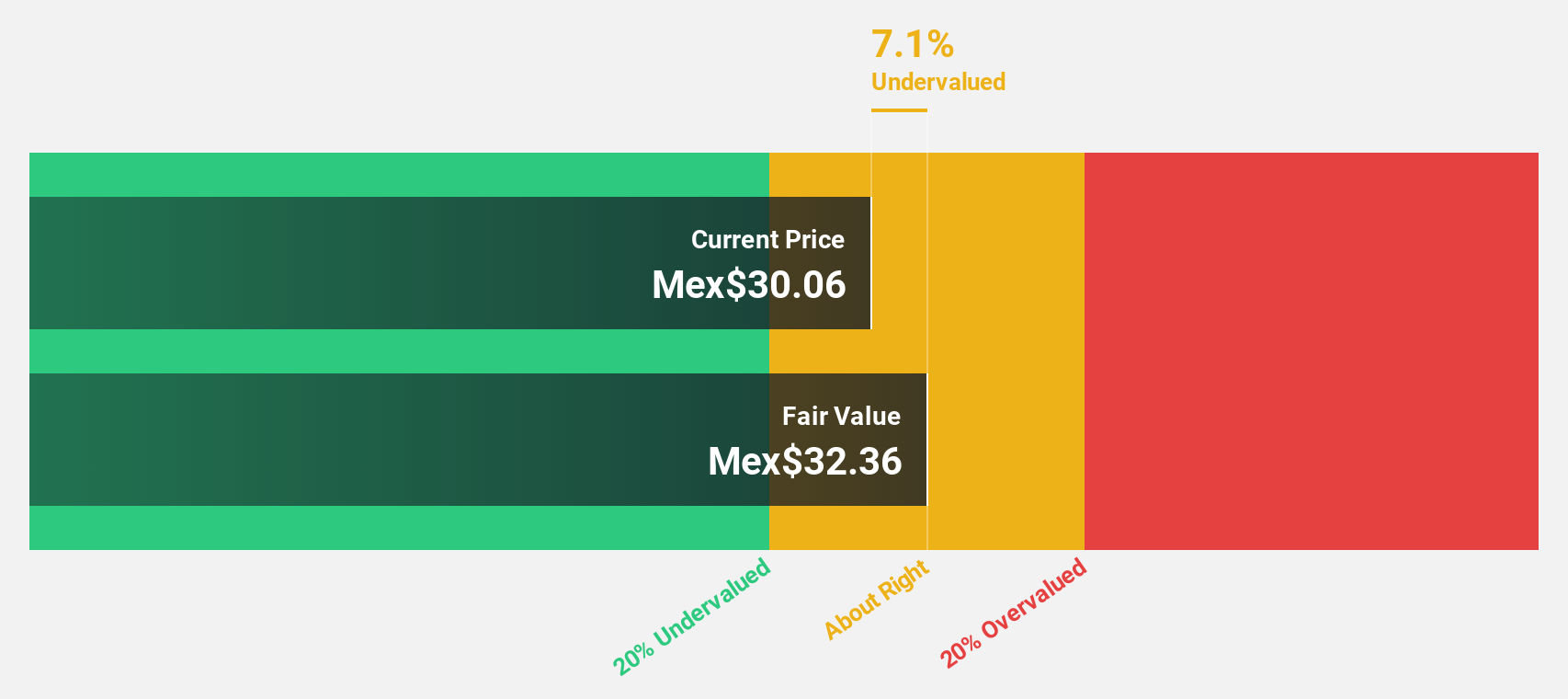

GMéxico Transportes. de (BMV:GMXT *)

Overview: GMéxico Transportes, S.A.B. de C.V. offers logistics and ground transportation solutions in Mexico, with a market cap of MX$142.33 billion.

Operations: The company's revenue segments include Cement (MX$3.03 billion), Energy (MX$4.85 billion), Metals (MX$3.03 billion), Minerals (MX$5.46 billion), Quimicos (MX$4.85 billion), Automotive (MX$6.06 billion), Inter-Modal (MX$9.10 billion), Agricultural (MX$17.59 billion), and Industriales (MX$4.85 billion).

Estimated Discount To Fair Value: 29.8%

GMéxico Transportes is trading at 29.8% below its estimated fair value of MX$46.41, with the current price at MX$32.57, indicating potential undervaluation based on cash flows. Recent Q4 2024 earnings showed sales of MX$15.32 billion and net income of MX$2.14 billion, reflecting growth from the previous year. Despite a dividend yield of 6.14% that's not well covered by earnings, significant annual profit growth is forecasted at 21.83%, outpacing market averages.

- Our growth report here indicates GMéxico Transportes. de may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of GMéxico Transportes. de.

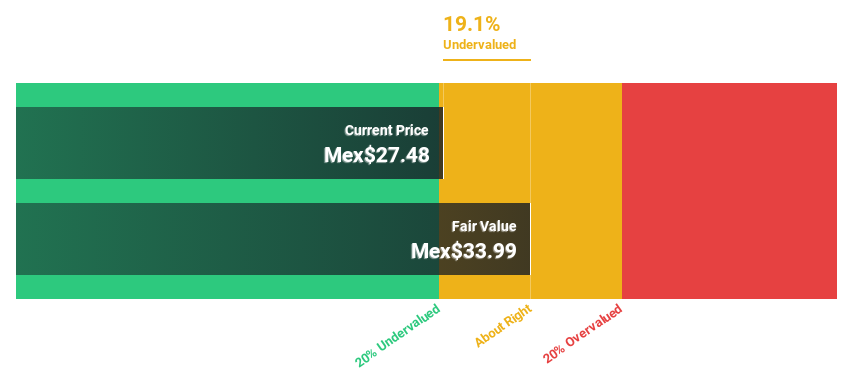

Genomma Lab Internacional. de (BMV:LAB B)

Overview: Genomma Lab Internacional, S.A.B. de C.V. operates in the pharmaceutical and personal care sectors, offering products primarily in Mexico and internationally, with a market cap of MX$24.32 billion.

Operations: The company generates revenue of MX$18.61 billion from its pharmaceutical and personal care products industry segment.

Estimated Discount To Fair Value: 12.1%

Genomma Lab Internacional is trading at MX$24.87, slightly below its estimated fair value of MX$28.3, suggesting some undervaluation based on cash flows. Recent earnings showed a significant turnaround with net income for Q4 2024 reaching MX$473.49 million from a loss the previous year, and annual sales growing to MX$18.61 billion. Though revenue growth is moderate at 7.9% annually, it surpasses the market average of 6.8%.

- According our earnings growth report, there's an indication that Genomma Lab Internacional. de might be ready to expand.

- Dive into the specifics of Genomma Lab Internacional. de here with our thorough financial health report.

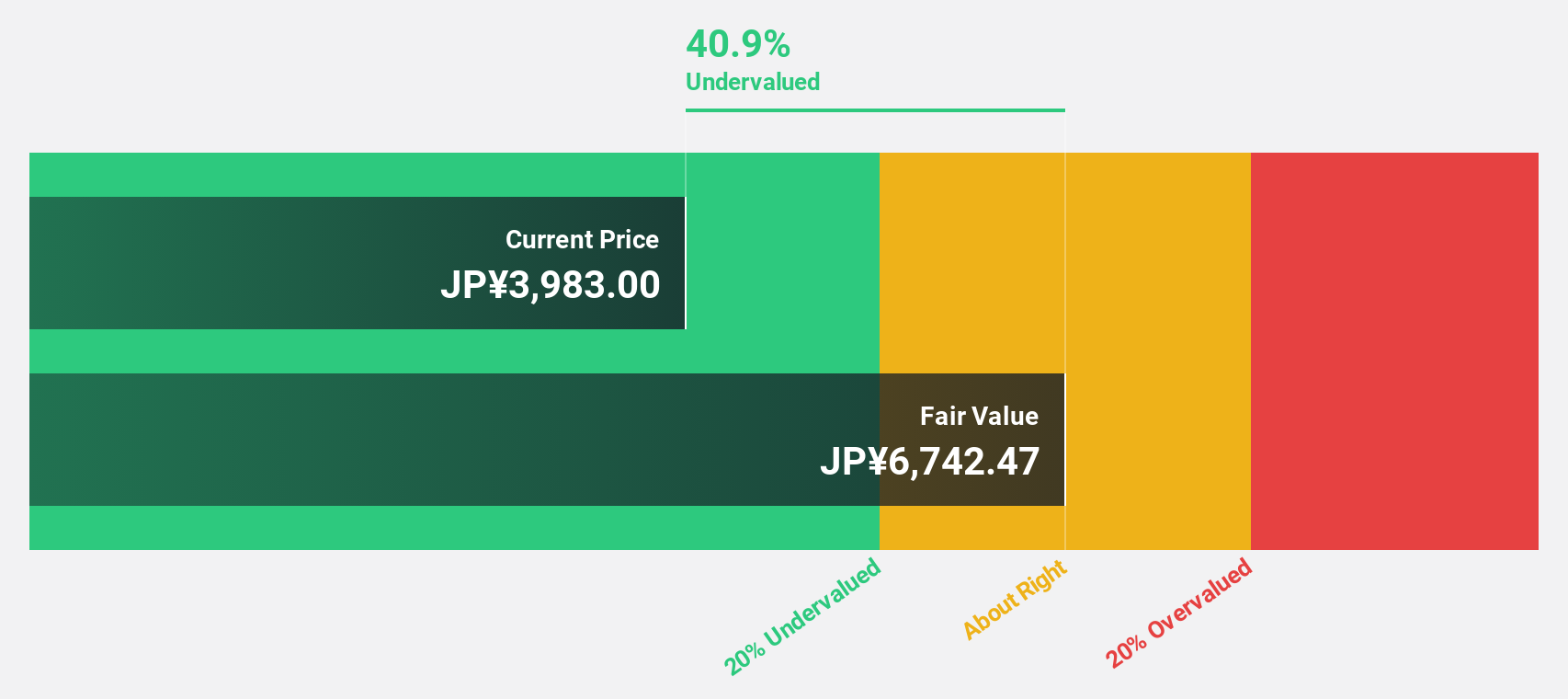

Kadokawa (TSE:9468)

Overview: Kadokawa Corporation is a Japanese entertainment company with a market cap of ¥510.18 billion, engaging in various media and content production activities.

Operations: Kadokawa Corporation's revenue is primarily derived from Publishing and IP Creation at ¥149.50 billion, followed by Animation and Live-Action Footage at ¥50.10 billion, Game at ¥32.55 billion, Web Service at ¥18.43 billion, and Education/Edtech at ¥14.91 billion.

Estimated Discount To Fair Value: 27.1%

Kadokawa is trading at ¥3,632, significantly below its estimated fair value of ¥4,985.51, presenting an undervaluation based on cash flows. The company's earnings grew by 82% last year and are forecast to increase by 25.5% annually over the next three years, outpacing the JP market's growth rate of 8%. Despite a highly volatile share price recently and a low future return on equity forecast of 9.8%, revenue is expected to grow faster than the market average.

- Upon reviewing our latest growth report, Kadokawa's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Kadokawa with our comprehensive financial health report here.

Summing It All Up

- Get an in-depth perspective on all 504 Undervalued Global Stocks Based On Cash Flows by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Kadokawa, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kadokawa might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9468

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives