- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6645

Exploring Three High Growth Tech Stocks In Japan

Reviewed by Simply Wall St

Japan's stock markets have recently seen significant gains, with the Nikkei 225 Index rising 5.6% and the broader TOPIX Index up 3.7%, driven by optimism surrounding China's new stimulus measures and dovish commentary from the Bank of Japan. This positive market sentiment creates an opportune environment to explore high growth tech stocks in Japan, where strong fundamentals and innovative capabilities can make a compelling case for potential investors looking to capitalize on these favorable conditions.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 50.99% | 61.55% | ★★★★★★ |

| Cyber Security Cloud | 20.71% | 25.73% | ★★★★★☆ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| GMO AD Partners | 69.79% | 97.87% | ★★★★★☆ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| ExaWizards | 21.96% | 75.16% | ★★★★★★ |

| Money Forward | 20.68% | 68.12% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

OMRON (TSE:6645)

Simply Wall St Growth Rating: ★★★★☆☆

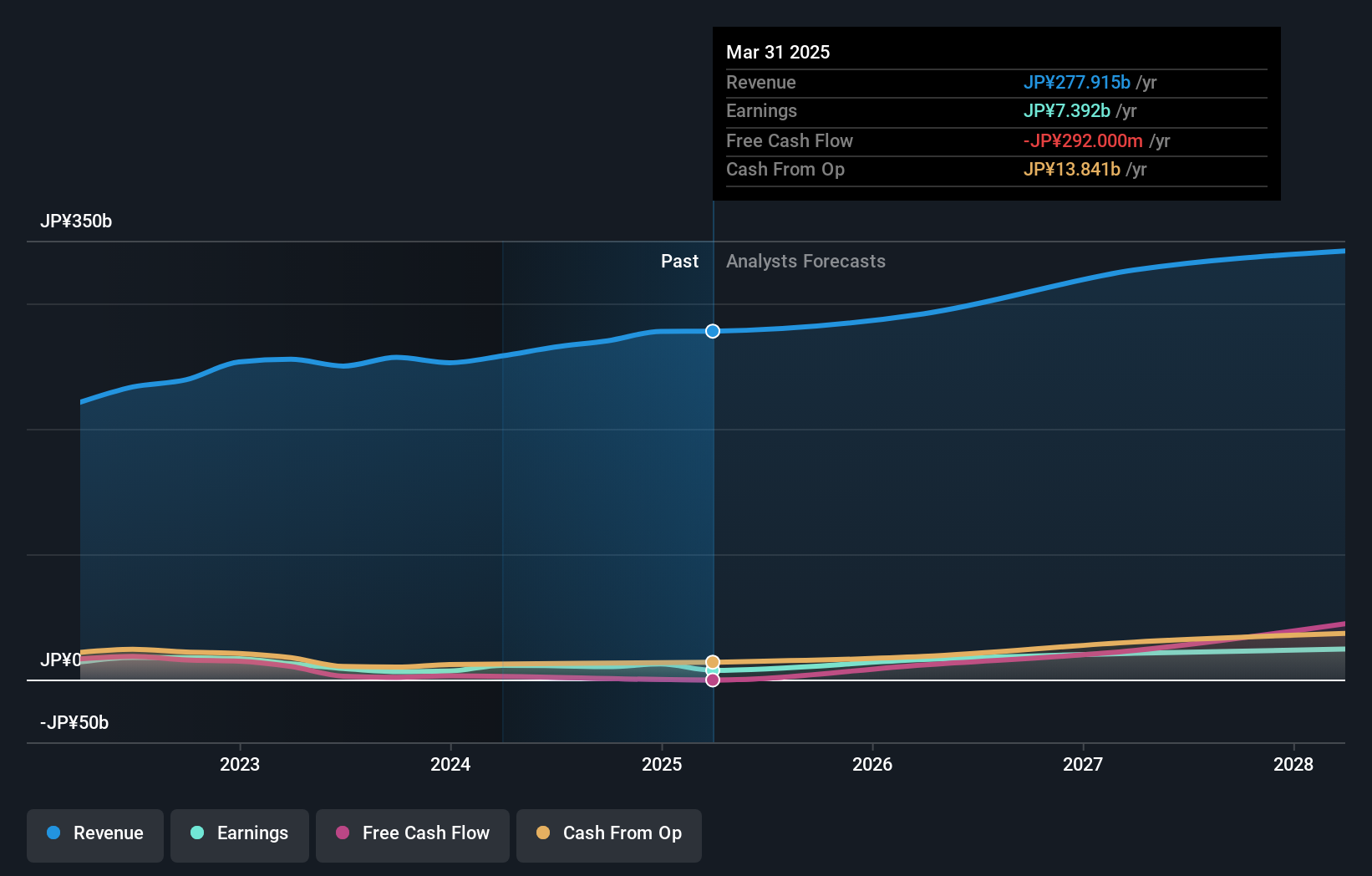

Overview: OMRON Corporation operates globally in industrial automation, device and module solutions, social systems, and healthcare businesses with a market cap of ¥1.31 trillion.

Operations: OMRON Corporation generates revenue primarily from its Industrial Automation Business (¥373.70 billion), Healthcare Business (¥150.40 billion), Social Systems, Solutions and Service Business (¥156.85 billion), and Devices & Module Solutions Business (¥143.69 billion). The company operates globally across these segments, contributing to a diverse revenue model.

OMRON's strategic focus on innovation is evident from its R&D expenses, which are crucial for maintaining competitiveness in Japan's tech sector. With earnings expected to surge by 46.2% annually, the company is positioning itself for robust growth despite current unprofitability. Additionally, a modest revenue increase of 5.6% per year outpaces the Japanese market average of 4.2%, reflecting OMRON's potential to capture more market share in upcoming years. This growth trajectory is supported by recent developments such as their Q1 2025 earnings call and a consistent dividend payout, highlighting their commitment to shareholder returns amidst expansion efforts.

- Click here and access our complete health analysis report to understand the dynamics of OMRON.

Examine OMRON's past performance report to understand how it has performed in the past.

Taiyo Yuden (TSE:6976)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Taiyo Yuden Co., Ltd. develops, manufactures, and sells electronic components in Japan, China, Hong Kong, and internationally with a market cap of ¥383.98 billion.

Operations: The company primarily generates revenue from its Electronic Components Business, which accounted for ¥331.17 billion. The net profit margin is a key indicator to consider when evaluating the company's financial health.

Taiyo Yuden has demonstrated a commitment to innovation with R&D expenses rising to 6.7% of revenue, reflecting its strategic focus to stay competitive in the high-tech Japanese market. Despite a forecasted revenue growth of 6.7% per year, which slightly outpaces the market average of 4.2%, earnings are expected to surge by an impressive 25.7% annually. This growth is underpinned by recent initiatives including a significant cash dividend announced for late September and ongoing investments in technology development, positioning Taiyo Yuden well amidst evolving industry demands and client needs like those from major tech firms.

Kadokawa (TSE:9468)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kadokawa Corporation operates as an entertainment company in Japan, with a market cap of ¥434.99 billion.

Operations: The company generates revenue primarily from its Publication segment (¥143.28 billion) and Animation/Film segment (¥46.36 billion), with additional contributions from Game, Web Service, and Education/Edtech segments. The net profit margin is notable for its trend over recent periods.

Kadokawa has carved a niche in Japan's tech landscape, with an impressive 21.5% projected annual earnings growth over the next three years, outstripping the broader market's 8.7%. This growth trajectory is bolstered by strategic R&D investments, which now account for 6.7% of its revenue, underscoring a commitment to innovation despite a competitive environment. Moreover, recent initiatives have expanded its digital content offerings, capturing more of the burgeoning online entertainment market—a move that not only diversifies its revenue streams but also aligns with shifting consumer behaviors towards digital consumption.

- Take a closer look at Kadokawa's potential here in our health report.

Assess Kadokawa's past performance with our detailed historical performance reports.

Where To Now?

- Embark on your investment journey to our 122 Japanese High Growth Tech and AI Stocks selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6645

OMRON

Engages in industrial automation, device and module solutions, social systems, and healthcare businesses worldwide.

Excellent balance sheet with reasonable growth potential.