- Japan

- /

- Real Estate

- /

- TSE:3299

3 Japanese Dividend Stocks Yielding Up To 4.7%

Reviewed by Simply Wall St

Japan’s stock markets have recently experienced a significant uptick, with the Nikkei 225 Index rising 5.6% and the broader TOPIX Index up 3.7%. This positive momentum has been fueled by dovish commentary from the Bank of Japan and optimism surrounding China's new stimulus measures. In this environment, dividend stocks can offer a stable income stream while potentially benefiting from market gains. Here are three Japanese dividend stocks yielding up to 4.7% that could be worth considering for their income potential and stability amidst current economic conditions.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.17% | ★★★★★★ |

| Globeride (TSE:7990) | 4.32% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.81% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.98% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.83% | ★★★★★★ |

| Innotech (TSE:9880) | 4.94% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.31% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.57% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.45% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.50% | ★★★★★★ |

Click here to see the full list of 439 stocks from our Top Japanese Dividend Stocks screener.

We'll examine a selection from our screener results.

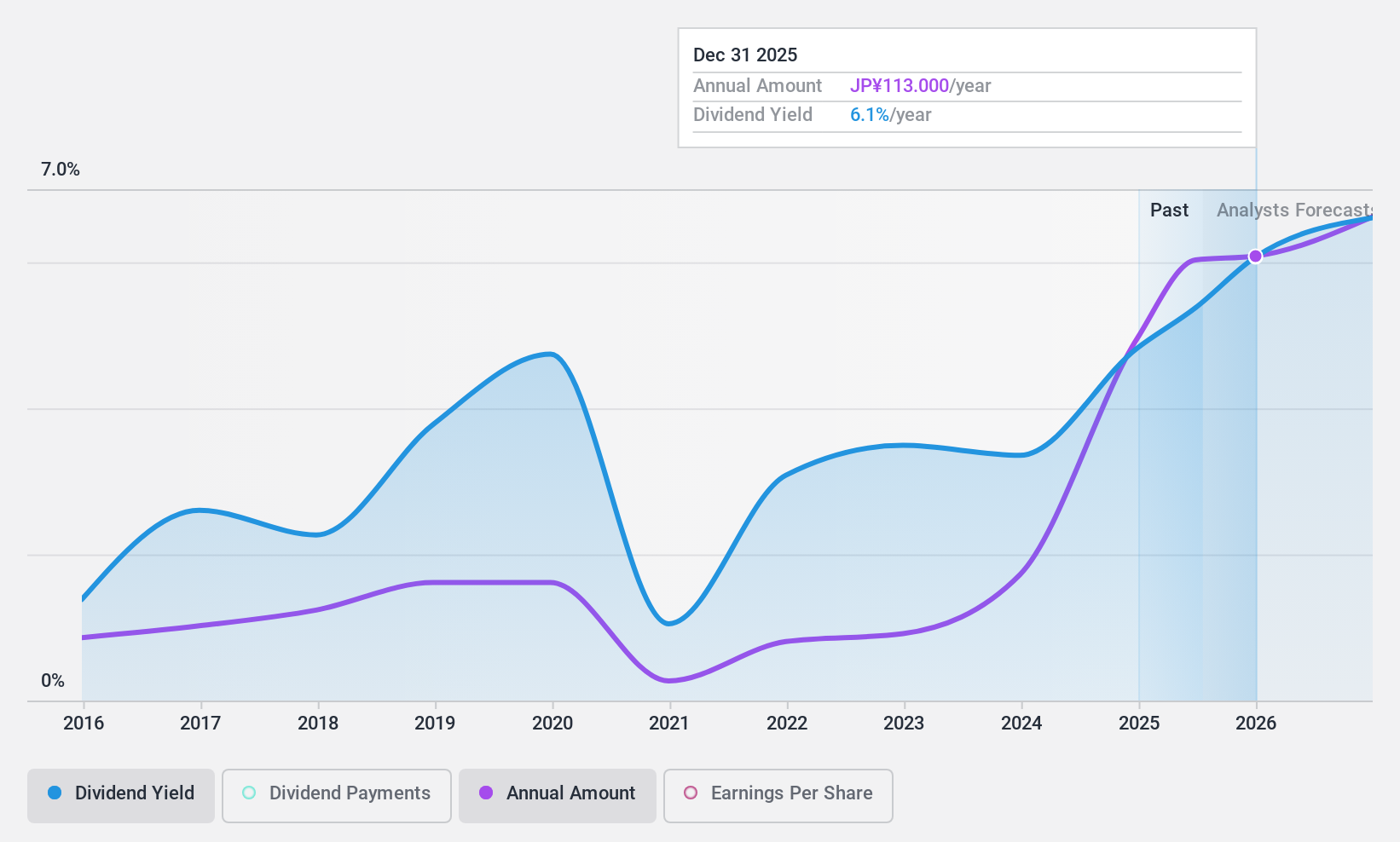

MUGEN ESTATELtd (TSE:3299)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MUGEN ESTATE Co., Ltd. purchases and resells used real estate properties in Japan and has a market cap of ¥39.79 billion.

Operations: MUGEN ESTATE Ltd. generates revenue primarily from its Real Estate Sales Business, which contributed ¥54.55 billion, and its Leasing and Other Business, which added ¥2.38 billion.

Dividend Yield: 4%

MUGEN ESTATE Ltd. offers a 4.01% dividend yield, placing it in the top 25% of JP market dividend payers. However, its dividends have been unreliable and volatile over the past decade. The company's high cash payout ratio (306.2%) indicates dividends are not well covered by free cash flow, though they are covered by earnings with a low payout ratio (31%). Recent expansions include opening a new sales office in Sendai to bolster its purchase and resale business.

- Get an in-depth perspective on MUGEN ESTATELtd's performance by reading our dividend report here.

- Our expertly prepared valuation report MUGEN ESTATELtd implies its share price may be too high.

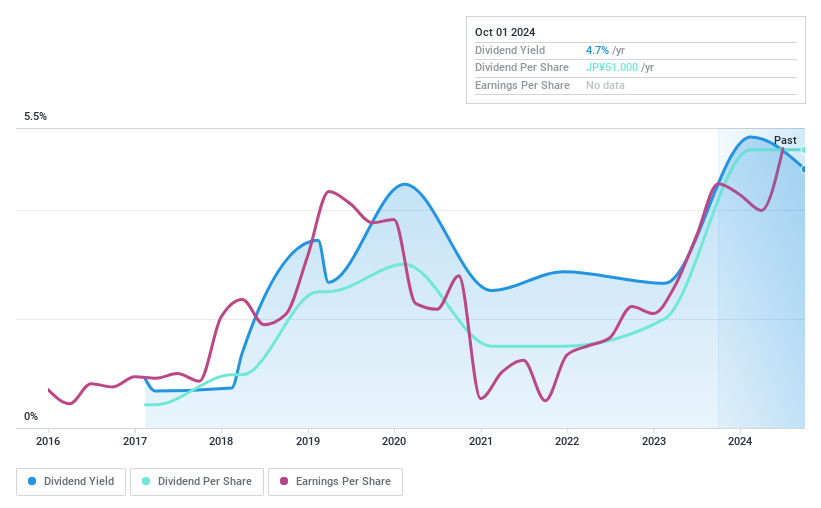

B-Lot (TSE:3452)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: B-Lot Company Limited operates in the real estate and financial consulting sectors in Japan, with a market cap of approximately ¥20.82 billion.

Operations: B-Lot Company Limited's revenue is primarily derived from its Real Estate Investment Development Business at ¥19.47 billion, followed by the Real Estate Management Business at ¥4.31 billion and the Real Estate Consulting Business at ¥2.18 billion.

Dividend Yield: 4.7%

B-Lot Company Limited offers a dividend yield of 4.74%, positioning it in the top 25% of JP market dividend payers. The company's dividends are well covered by earnings (payout ratio: 24.9%) and cash flows (cash payout ratio: 64.5%). However, its dividend track record is unstable with payments being volatile over the past eight years. Despite recent earnings growth of 44% and a favorable P/E ratio (5.3x), debt remains poorly covered by operating cash flow.

- Click to explore a detailed breakdown of our findings in B-Lot's dividend report.

- Insights from our recent valuation report point to the potential overvaluation of B-Lot shares in the market.

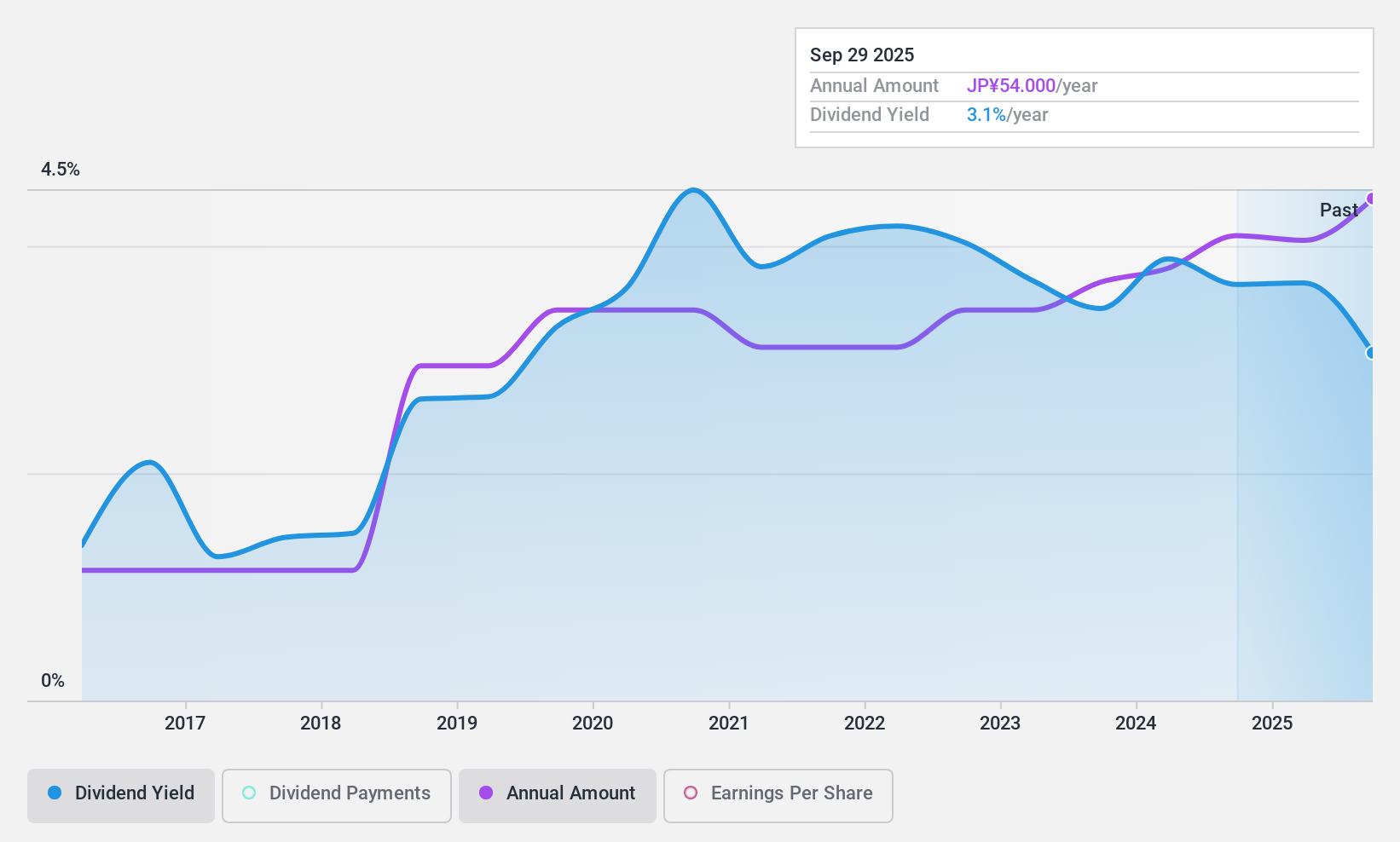

ShinMaywa Industries (TSE:7224)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ShinMaywa Industries, Ltd. and its subsidiaries manufacture and sell transportation equipment globally, with a market cap of ¥93.94 billion.

Operations: ShinMaywa Industries, Ltd.'s revenue segments include Fluid (¥26.62 billion), Aircraft (¥32.04 billion), Parking System (¥43.37 billion), Special Purpose Vehicle (¥102.56 billion), and Industrial Machinery / Environmental System (¥42.71 billion).

Dividend Yield: 3.5%

ShinMaywa Industries' dividend payments are well supported by both earnings (payout ratio: 38.1%) and cash flows (cash payout ratio: 24.1%). The stock trades at a significant discount to its estimated fair value, making it potentially attractive for value investors. However, the dividend yield of 3.51% is slightly below the top quartile in Japan, and the company's dividend history has been volatile over the past decade despite recent increases.

- Navigate through the intricacies of ShinMaywa Industries with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that ShinMaywa Industries is trading behind its estimated value.

Seize The Opportunity

- Access the full spectrum of 439 Top Japanese Dividend Stocks by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3299

MUGEN ESTATELtd

MUGEN ESTATE Co.,Ltd. purchases and resells used real estate properties in Japan.

Solid track record with adequate balance sheet and pays a dividend.