- Japan

- /

- Healthtech

- /

- TSE:4480

3 Japanese Exchange Stocks Estimated To Be Up To 49.9% Undervalued

Reviewed by Simply Wall St

Japan's stock markets have seen significant gains recently, with the Nikkei 225 Index rising by 5.6% and the broader TOPIX Index up 3.7%, buoyed by dovish commentary from the Bank of Japan and optimism surrounding China's new stimulus measures. This favorable environment presents an opportune moment to explore undervalued stocks that could benefit from these market conditions. Identifying undervalued stocks involves looking for companies with strong fundamentals that are trading below their intrinsic value, especially in a market showing signs of recovery and external economic support.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| IMAGICA GROUP (TSE:6879) | ¥510.00 | ¥1016.67 | 49.8% |

| Densan System Holdings (TSE:4072) | ¥2710.00 | ¥5306.22 | 48.9% |

| Stella Chemifa (TSE:4109) | ¥4110.00 | ¥8070.29 | 49.1% |

| Pilot (TSE:7846) | ¥4457.00 | ¥8857.09 | 49.7% |

| Taiyo Yuden (TSE:6976) | ¥3081.00 | ¥6043.29 | 49% |

| Hibino (TSE:2469) | ¥3520.00 | ¥6951.27 | 49.4% |

| Appier Group (TSE:4180) | ¥1789.00 | ¥3491.74 | 48.8% |

| Plus Alpha ConsultingLtd (TSE:4071) | ¥2211.00 | ¥4417.72 | 50% |

| Medley (TSE:4480) | ¥3950.00 | ¥7881.09 | 49.9% |

| SBI Sumishin Net Bank (TSE:7163) | ¥2756.00 | ¥5420.95 | 49.2% |

Here's a peek at a few of the choices from the screener.

Medley (TSE:4480)

Overview: Medley, Inc. operates platforms for recruitment and medical businesses in Japan and the United States, with a market cap of ¥128.32 billion.

Operations: Revenue segments include New Services at ¥573 million, Medical Platform Business at ¥6.09 billion, and Human Resource Platform Business at ¥17.87 billion.

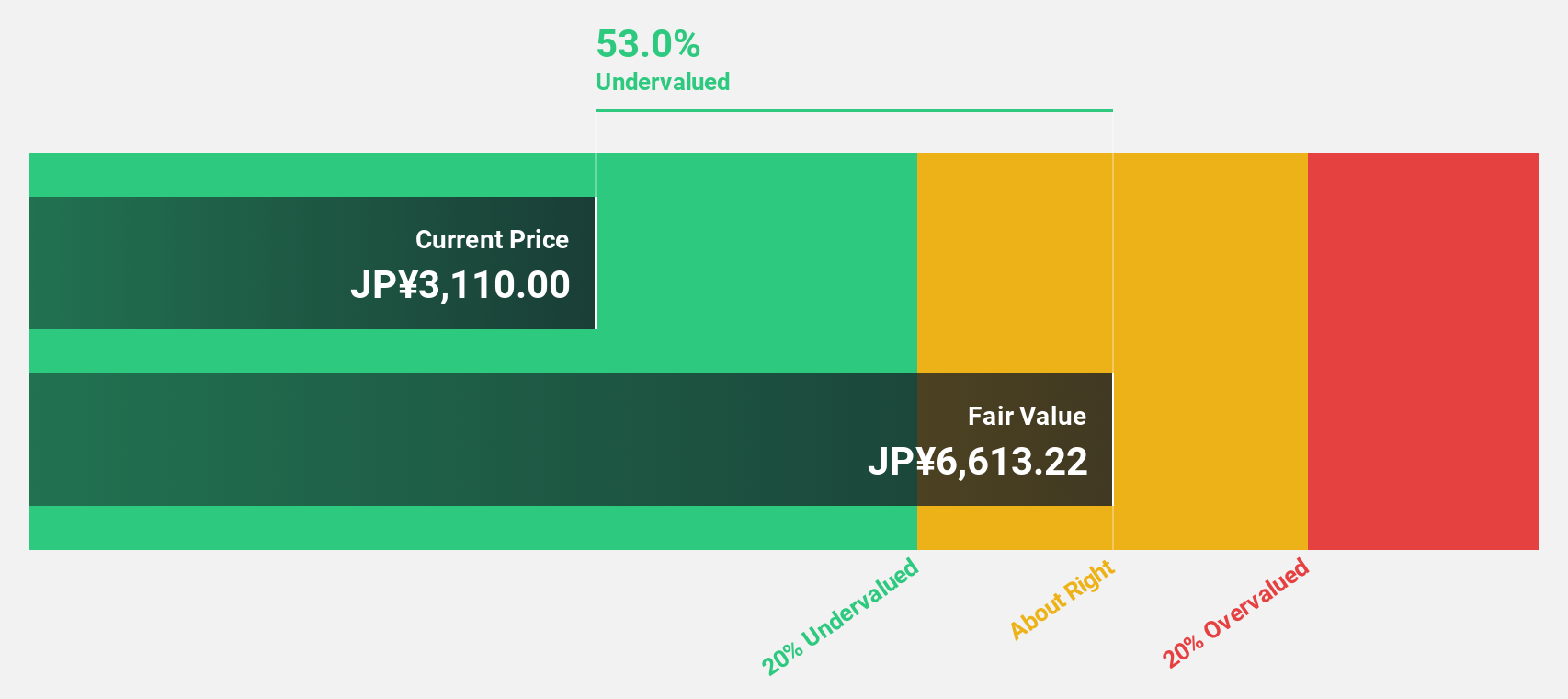

Estimated Discount To Fair Value: 49.9%

Medley, Inc. (¥3950) is currently trading at 49.9% below its estimated fair value of ¥7881.09, indicating significant undervaluation based on discounted cash flow analysis. The company’s earnings are forecast to grow at 30.36% per year, outpacing the Japanese market's growth rate of 8.7%. Despite a highly volatile share price recently, Medley’s revenue is expected to grow by 25% annually, driven by expansions like Jobley's rollout across the U.S., enhancing its long-term prospects.

- In light of our recent growth report, it seems possible that Medley's financial performance will exceed current levels.

- Dive into the specifics of Medley here with our thorough financial health report.

Union Tool (TSE:6278)

Overview: Union Tool Co. produces and sells cutting tools, linear motion products, and metal machining equipment in Japan and internationally, with a market cap of ¥109.01 billion.

Operations: The company's revenue segments are ¥19.84 billion from Japan, ¥15.05 billion from Asia, ¥2.17 billion from Europe, and ¥1.84 billion from North America.

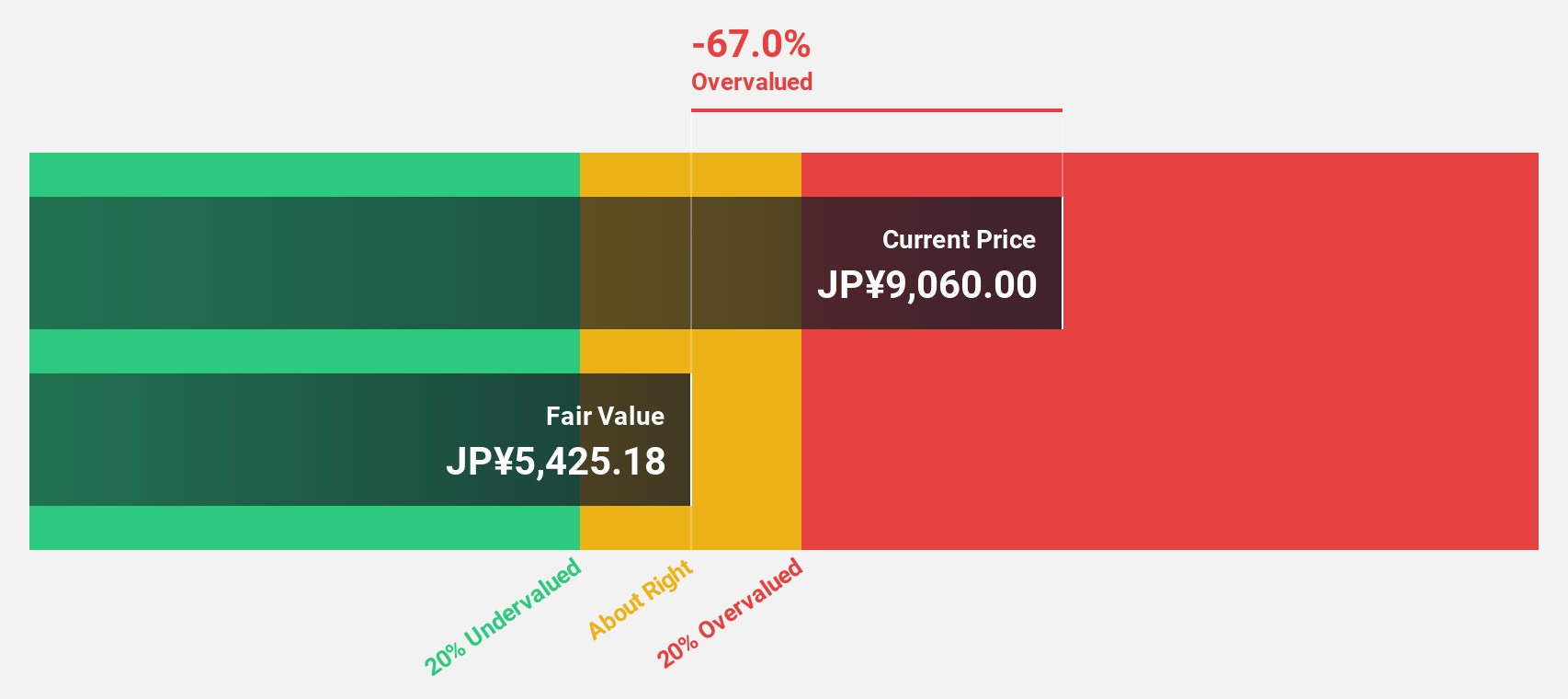

Estimated Discount To Fair Value: 20.4%

Union Tool Co. (¥6310) is trading 20.4% below its estimated fair value of ¥7929, presenting an undervaluation based on discounted cash flow analysis. The company’s earnings are projected to grow by 21.45% annually, outpacing the Japanese market's growth rate of 8.7%. Despite recent share price volatility, Union Tool forecasts net sales of ¥30 billion and an operating profit of ¥6.4 billion for FY2024, reinforcing its strong cash flow potential amidst a challenging market environment.

- Upon reviewing our latest growth report, Union Tool's projected financial performance appears quite optimistic.

- Take a closer look at Union Tool's balance sheet health here in our report.

Kokusai Electric (TSE:6525)

Overview: Kokusai Electric Corporation develops, manufactures, sells, repairs, and maintains semiconductor manufacturing equipment globally with a market cap of ¥770.63 billion.

Operations: The Semiconductor Manufacturing Equipment Business segment of Kokusai Electric Corporation generated ¥213.35 billion in revenue.

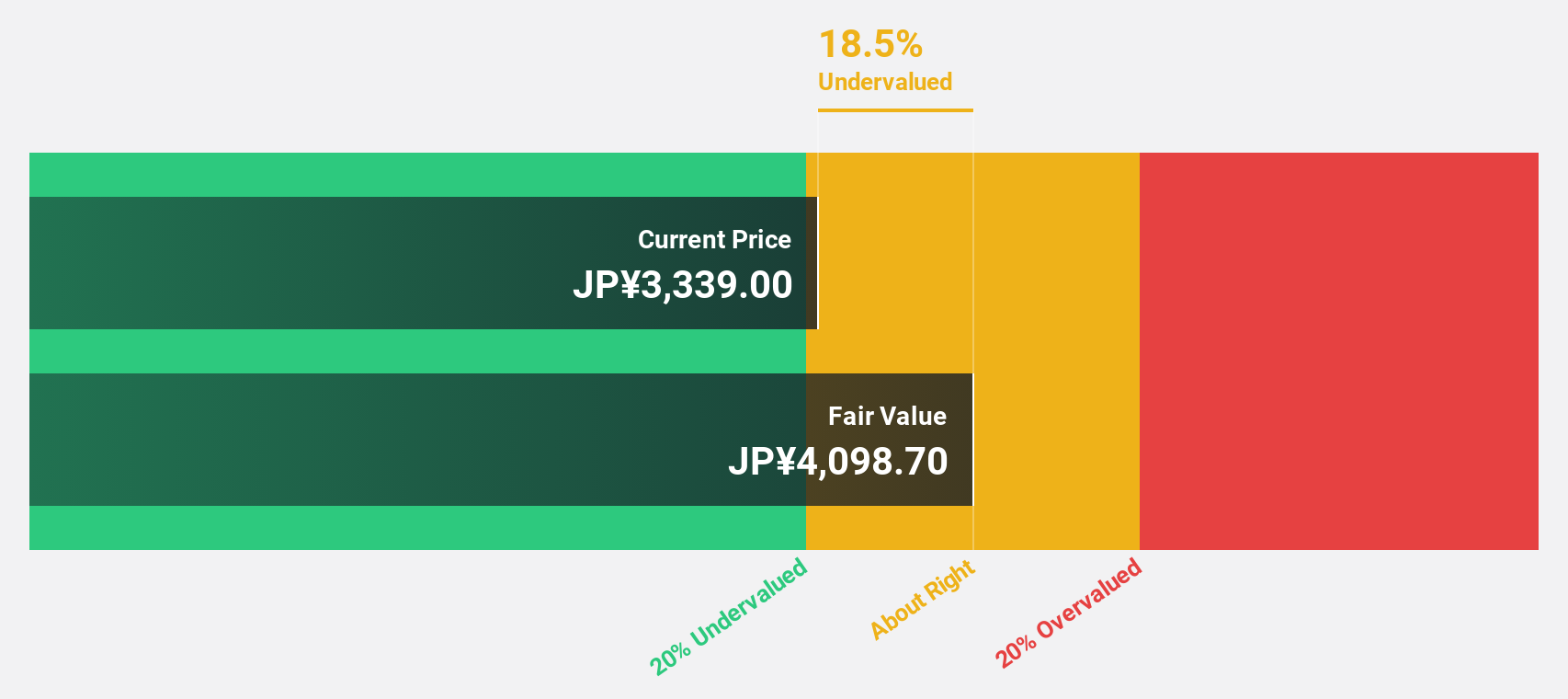

Estimated Discount To Fair Value: 37.3%

Kokusai Electric (¥3265) is trading 37.3% below its estimated fair value of ¥5210.05, indicating significant undervaluation based on discounted cash flow analysis. The company forecasts revenue growth of 11.3% annually, outpacing the Japanese market's 4.2%. Recent actions include a share buyback program and inclusion in the S&P Japan 500 index, enhancing shareholder value and stability despite recent share price volatility. Earnings are projected to grow at 17.1% per year, exceeding market expectations.

- Our comprehensive growth report raises the possibility that Kokusai Electric is poised for substantial financial growth.

- Get an in-depth perspective on Kokusai Electric's balance sheet by reading our health report here.

Turning Ideas Into Actions

- Explore the 80 names from our Undervalued Japanese Stocks Based On Cash Flows screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4480

Medley

Operates platforms for recruitment and medical businesses in Japan and the United States.

Exceptional growth potential with excellent balance sheet.