- Japan

- /

- Entertainment

- /

- TSE:9697

Exploring Sansan And 2 High Growth Tech Stocks In Japan

Reviewed by Simply Wall St

Japan’s stock markets have faced recent declines, with the Nikkei 225 Index down 5.8% and the broader TOPIX Index registering a 4.2% loss, driven by semiconductor stocks tracking a U.S.-led sell-off and yen strength posing a headwind for export-oriented companies. Despite these challenges, high-growth tech stocks in Japan continue to attract attention due to their potential for innovation and market expansion. In this article, we explore Sansan and two other high-growth tech stocks in Japan that stand out for their resilience and growth prospects amid shifting economic conditions.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 50.99% | 61.55% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Material Group | 17.82% | 28.74% | ★★★★★☆ |

| f-code | 22.70% | 22.62% | ★★★★★☆ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| GMO AD Partners | 69.79% | 97.87% | ★★★★★☆ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| ExaWizards | 22.69% | 62.99% | ★★★★★★ |

| Money Forward | 20.68% | 68.12% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

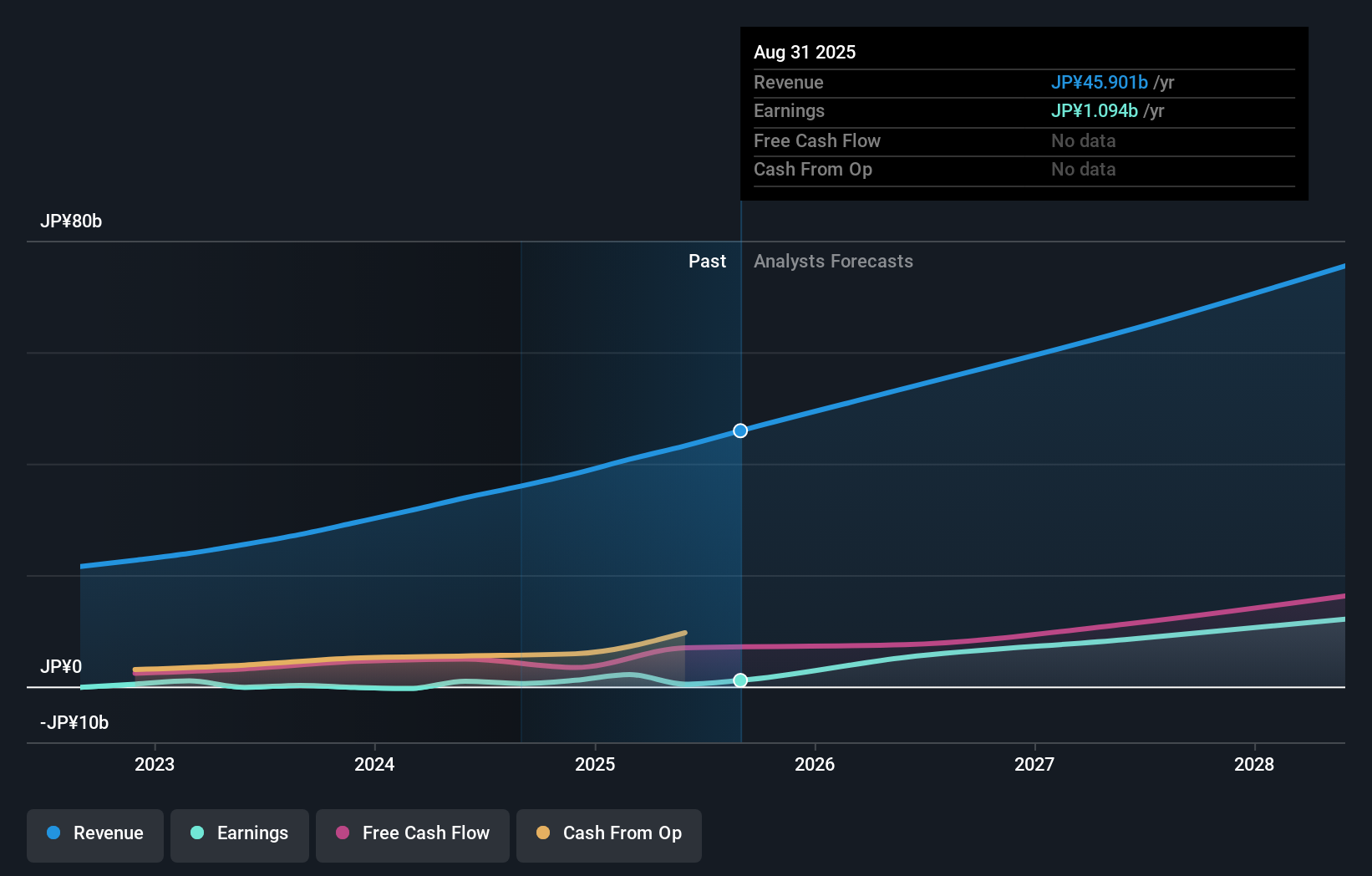

Sansan (TSE:4443)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sansan, Inc. engages in the planning, development, and selling of cloud-based solutions in Japan with a market cap of ¥288.72 billion.

Operations: Sansan, Inc. focuses on developing and selling cloud-based solutions in Japan. The company generates revenue primarily through its subscription services for business card management and contact management platforms.

Sansan's focus on innovation is evident from its substantial R&D expenses, which accounted for ¥1.2 billion in the last fiscal year, representing 16.2% of its revenue. This investment supports their transition to SaaS models, ensuring recurring subscription revenues. Expected earnings growth at 35.6% annually over the next three years positions Sansan favorably against the JP market's 8.6%. Recently, the company repurchased 141,700 shares for ¥299.95 million to enhance shareholder value and completed this tranche by August 21, 2024.

- Get an in-depth perspective on Sansan's performance by reading our health report here.

Understand Sansan's track record by examining our Past report.

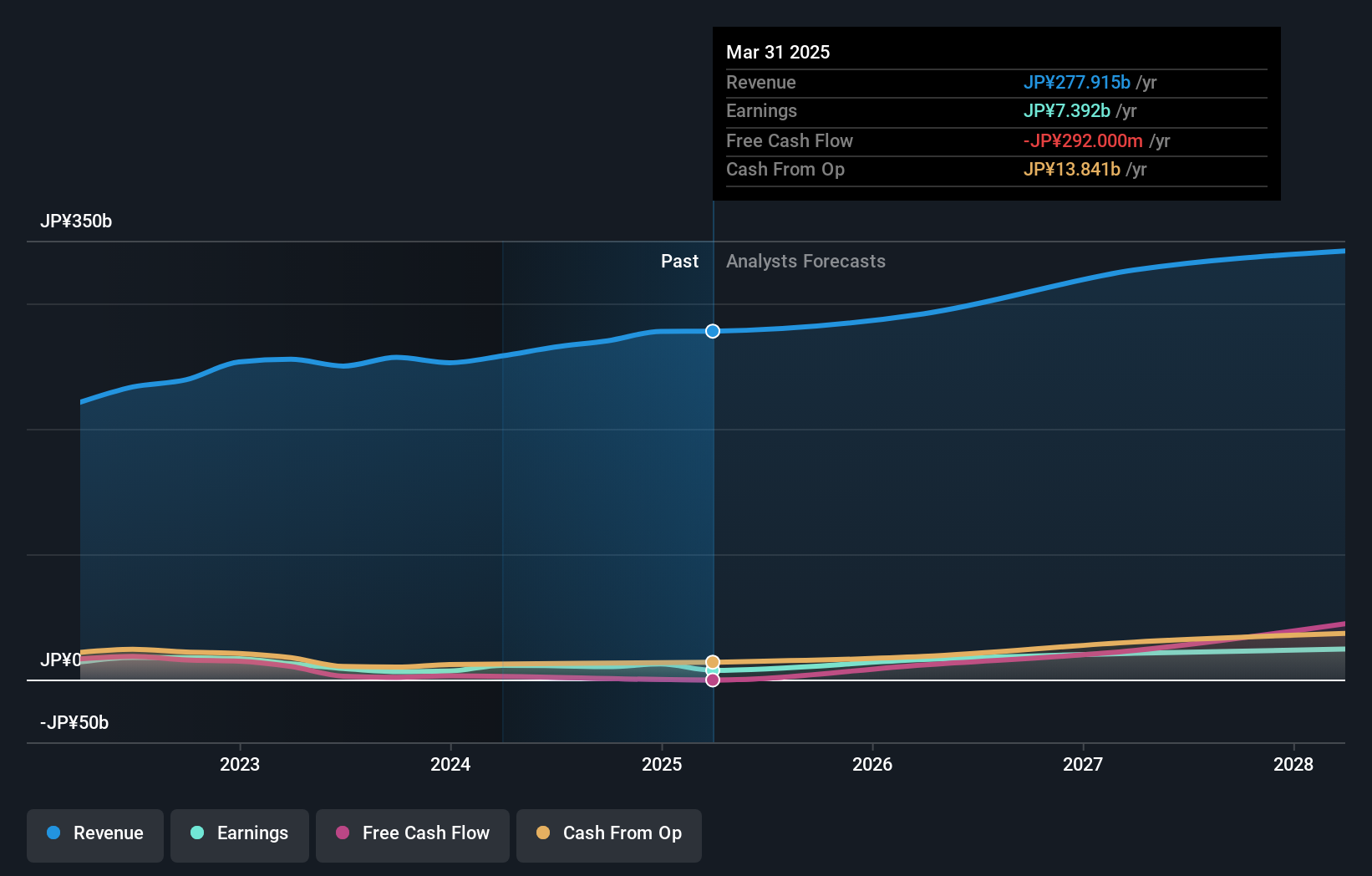

Kadokawa (TSE:9468)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kadokawa Corporation operates as an entertainment company in Japan, with a market cap of ¥406.08 billion.

Operations: Kadokawa Corporation generates revenue primarily from its Publication segment (¥143.28 billion), followed by Animation/Film (¥46.36 billion) and Game segments (¥28.63 billion). The company also has significant contributions from Web Service (¥20.44 billion) and Education/Edtech divisions (¥13.83 billion).

Kadokawa's revenue is projected to grow at 6.5% annually, outpacing the broader Japanese market's 4.2%. With earnings growth expected to soar by 21.7% per year, Kadokawa significantly exceeds the media industry's average of 1.6%. Their R&D expenditure highlights a commitment to innovation, with ¥2 billion spent last year alone, representing a notable investment in future capabilities. This strategic focus on R&D and robust earnings trajectory positions Kadokawa favorably within Japan’s tech landscape.

- Delve into the full analysis health report here for a deeper understanding of Kadokawa.

Gain insights into Kadokawa's past trends and performance with our Past report.

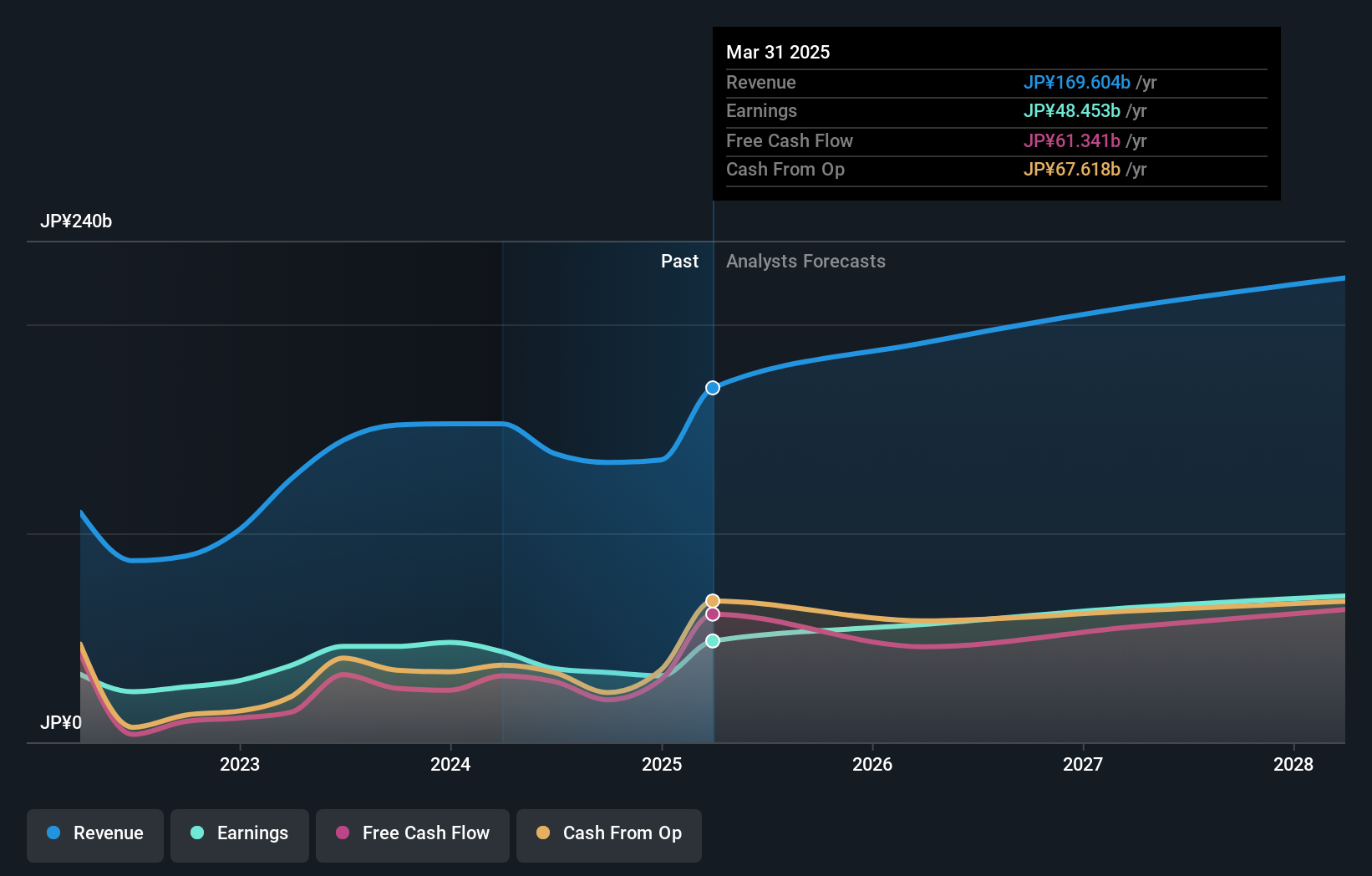

Capcom (TSE:9697)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Capcom Co., Ltd. engages in the planning, development, manufacturing, sales, and distribution of home video games, online games, mobile games, and arcade games both in Japan and internationally with a market cap of ¥1.36 trillion.

Operations: Capcom generates revenue primarily from Digital Content, which accounts for ¥103.38 billion, followed by Amusement Facilities at ¥20.09 billion and Amusement Equipment at ¥10.34 billion. The company operates across various gaming platforms including home video games, online games, mobile games, and arcade games in both domestic and international markets.

Capcom's revenue is forecasted to grow at 9.5% annually, outpacing the broader Japanese market's 4.2%. Despite a recent -23.3% earnings contraction, future projections are optimistic with expected annual profit growth of 14.5%. The company invested ¥2 billion in R&D last year, underlining its commitment to innovation and long-term growth potential. Additionally, Capcom repurchased shares in the past year, indicating confidence in its financial stability and future prospects within Japan’s tech landscape.

Taking Advantage

- Delve into our full catalog of 126 Japanese High Growth Tech and AI Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9697

Capcom

Plans, develops, manufactures, sells, and distributes home video games, online games, mobile games, and arcade games in Japan and internationally.

Flawless balance sheet with reasonable growth potential and pays a dividend.