Undiscovered Gems Koatsu Gas Kogyo And 2 Other Small Caps With Strong Potential

Reviewed by Simply Wall St

In recent weeks, Japan's stock markets have experienced notable declines, with the Nikkei 225 Index falling 5.8% and the broader TOPIX Index down by 4.2%. This downturn has been influenced by a U.S.-led sell-off in semiconductor stocks and a stronger yen, which poses challenges for Japan’s export-oriented companies. Despite these headwinds, certain small-cap stocks in Japan present compelling opportunities due to their robust fundamentals and growth potential. In this article, we will explore three such undiscovered gems: Koatsu Gas Kogyo and two other promising small-cap companies.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Togami Electric Mfg | 1.55% | 3.53% | 7.20% | ★★★★★★ |

| AOKI Holdings | 28.27% | 0.91% | 37.15% | ★★★★★★ |

| Toukei Computer | NA | 5.46% | 12.14% | ★★★★★★ |

| Yashima Denki | 2.93% | -2.38% | 13.99% | ★★★★★★ |

| Icom | NA | 4.68% | 14.92% | ★★★★★★ |

| Nikko | 31.99% | 4.24% | -8.75% | ★★★★★☆ |

| MIRARTH HOLDINGSInc | 266.33% | 3.00% | -2.40% | ★★★★☆☆ |

| YagiLtd | 32.86% | -9.57% | -0.12% | ★★★★☆☆ |

| GakkyushaLtd | 23.64% | 5.03% | 18.56% | ★★★★☆☆ |

| Toyo Kanetsu K.K | 47.92% | 2.34% | 15.44% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Koatsu Gas Kogyo (TSE:4097)

Simply Wall St Value Rating: ★★★★★☆

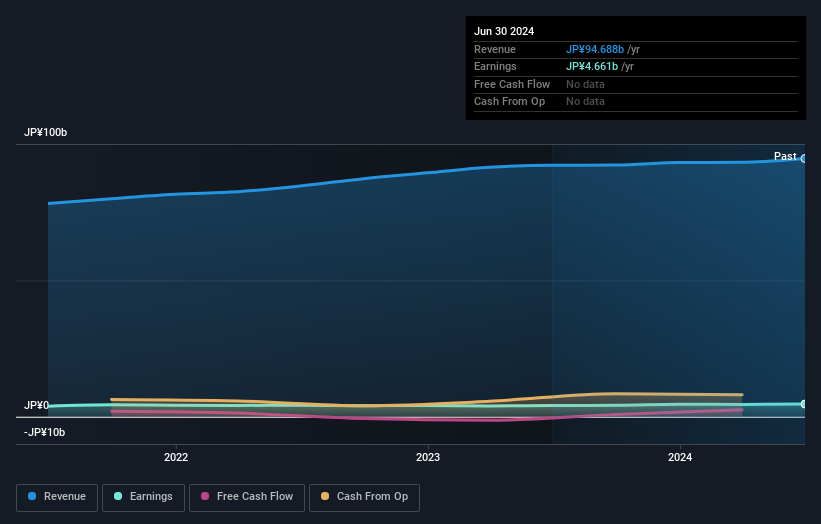

Overview: Koatsu Gas Kogyo Co., Ltd., along with its subsidiaries, operates in the gas, chemical products, and IT solutions sectors in Japan and has a market cap of ¥48.63 billion.

Operations: Koatsu Gas Kogyo generates revenue primarily from its gas, chemical products, and IT solutions sectors. The company has a market cap of ¥48.63 billion.

Koatsu Gas Kogyo, a small cap in Japan's chemicals sector, has been trading at 2.2% below its estimated fair value. Over the past year, earnings have grown by 13%, outpacing the industry average. The company's debt to equity ratio increased from 7.8% to 15% over five years, yet it remains profitable with sufficient cash runway and free cash flow positive status. Additionally, Koatsu's high-quality earnings and interest coverage indicate strong financial health going forward.

- Unlock comprehensive insights into our analysis of Koatsu Gas Kogyo stock in this health report.

Understand Koatsu Gas Kogyo's track record by examining our Past report.

ITFOR (TSE:4743)

Simply Wall St Value Rating: ★★★★★★

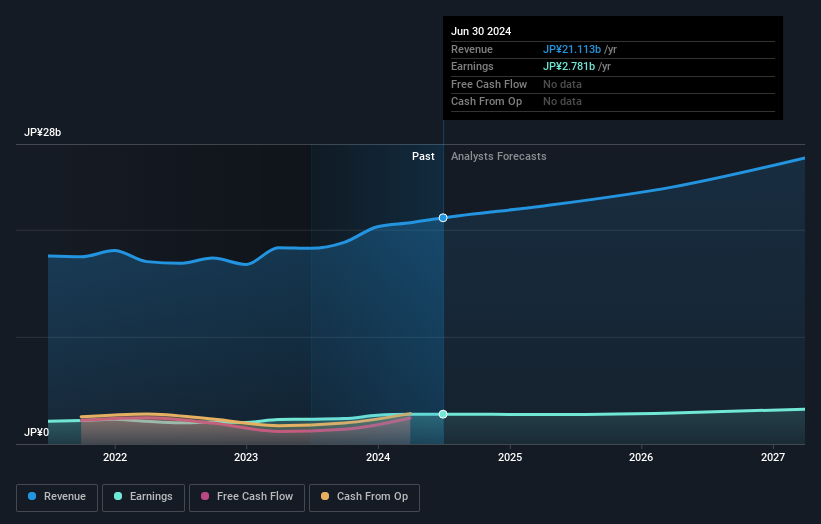

Overview: ITFOR Inc. provides support services for the implementation of information technology in Japan and has a market cap of ¥35.66 billion.

Operations: ITFOR Inc. generates revenue primarily from Recurring Business (¥8.71 billion) and System Development and Sales (¥12.41 billion).

ITFOR, a promising player in Japan's IT sector, has seen its earnings grow by 20.5% over the past year, outpacing the industry average of 10.1%. Trading at 26.6% below estimated fair value and debt-free for five years, it offers good relative value compared to peers. Recent guidance projects net sales of ¥22 billion and operating income of ¥3.8 billion for FY2025, with dividends set at ¥25 per share for both Q2 and the full year.

- Take a closer look at ITFOR's potential here in our health report.

Examine ITFOR's past performance report to understand how it has performed in the past.

YAKUODO HOLDINGS (TSE:7679)

Simply Wall St Value Rating: ★★★★★★

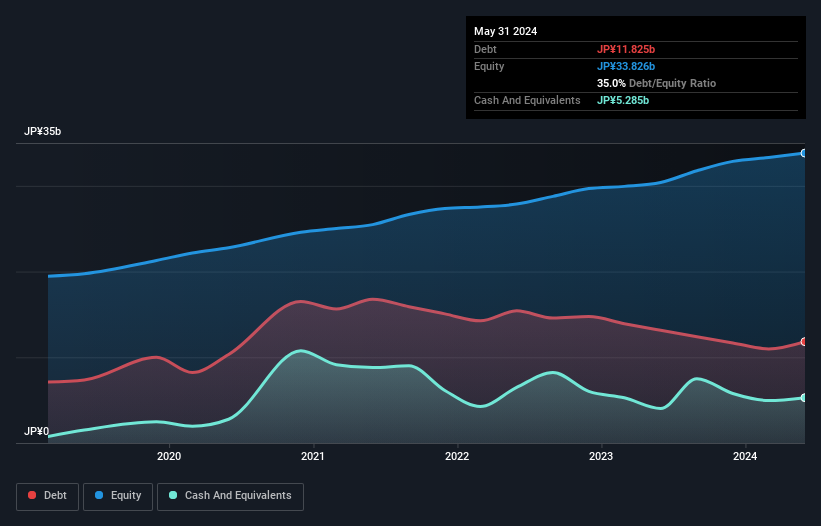

Overview: YAKUODO HOLDINGS Co., Ltd., with a market cap of ¥49.46 billion, operates a drugstore business in Japan through its subsidiaries.

Operations: YAKUODO HOLDINGS generates revenue primarily from its drugstore business in Japan. The company has a market cap of ¥49.46 billion and focuses on retail sales through its subsidiaries.

YAKUODO HOLDINGS, a promising player in Japan's market, has demonstrated consistent growth with earnings increasing by 3.1% annually over the past five years. The company's debt to equity ratio improved from 37.2% to 35%, indicating prudent financial management. Its price-to-earnings ratio stands at 12.8x, below the JP market average of 13.3x, suggesting potential value for investors. Additionally, YAKUODO's interest payments are well covered by EBIT at an impressive 138.5x coverage ratio.

- Dive into the specifics of YAKUODO HOLDINGS here with our thorough health report.

Review our historical performance report to gain insights into YAKUODO HOLDINGS''s past performance.

Make It Happen

- Get an in-depth perspective on all 752 Japanese Undiscovered Gems With Strong Fundamentals by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Koatsu Gas Kogyo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4097

Koatsu Gas Kogyo

Engages in the gas, chemical products, and IT solutions business in Japan.

Solid track record with excellent balance sheet and pays a dividend.