- Japan

- /

- Infrastructure

- /

- TSE:9066

3 Japanese Dividend Stocks Yielding 3% To 4.5%

Reviewed by Simply Wall St

Amid recent market fluctuations, Japan's stock markets have experienced notable declines, with the Nikkei 225 Index down 5.8% and the broader TOPIX Index registering a 4.2% loss. Despite these challenges, dividend stocks in Japan continue to attract investors seeking stable income streams and potential capital appreciation. When evaluating dividend stocks, it is essential to consider factors such as consistent payout history, financial health of the company, and resilience amidst economic uncertainties. In this article, we will explore three Japanese dividend stocks yielding between 3% to 4.5%, offering a balance of income and stability in today's volatile market environment.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.26% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.20% | ★★★★★★ |

| Globeride (TSE:7990) | 4.32% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.88% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.91% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.01% | ★★★★★★ |

| Innotech (TSE:9880) | 4.76% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.28% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.65% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.31% | ★★★★★★ |

Click here to see the full list of 466 stocks from our Top Japanese Dividend Stocks screener.

We'll examine a selection from our screener results.

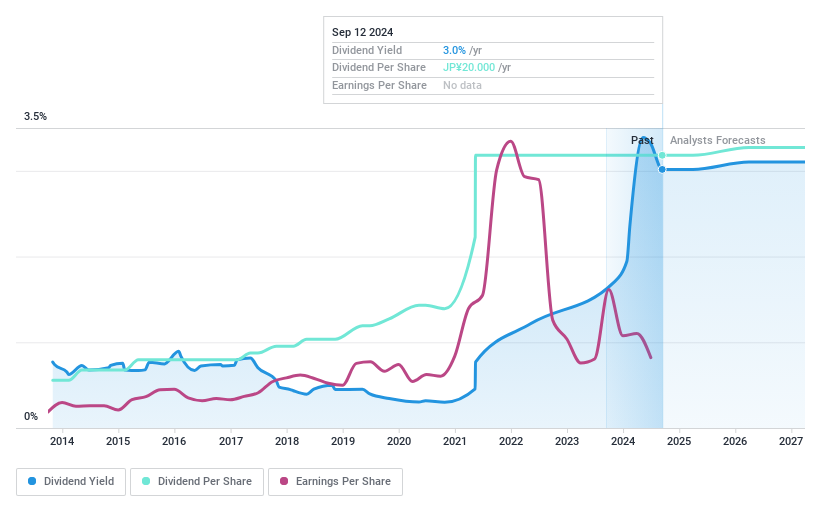

JCR Pharmaceuticals (TSE:4552)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: JCR Pharmaceuticals Co., Ltd. and its subsidiaries are involved in the research, development, manufacture, import and export, and sale of pharmaceutical products, regenerative medicines, and drug substances in Japan with a market cap of ¥83.01 billion.

Operations: JCR Pharmaceuticals Co., Ltd. generates revenue primarily through its Pharmaceuticals Business segment, which reported ¥40.21 billion in revenue.

Dividend Yield: 3%

JCR Pharmaceuticals pays a reliable dividend of ¥3.01 per share, with a payout ratio of 60.9%, indicating dividends are well-covered by earnings and cash flows (34.6%). Though its 3.01% yield is lower than the top 25% in Japan, JCR's dividends have been stable and growing over the past decade. Recent regulatory approvals for JR-441 and JR-446 highlight potential future revenue streams, balancing out the discontinuation of TEMCELL®HS Inj.'s expanded indication development.

- Take a closer look at JCR Pharmaceuticals' potential here in our dividend report.

- Insights from our recent valuation report point to the potential overvaluation of JCR Pharmaceuticals shares in the market.

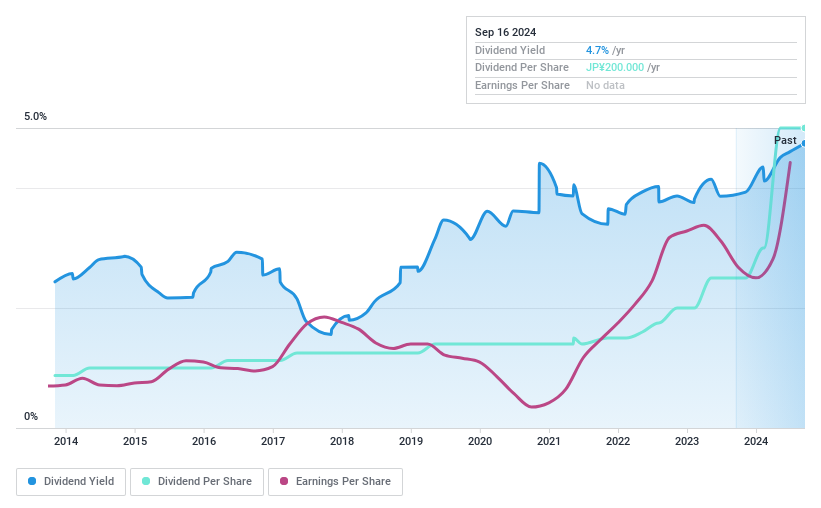

Nissin (TSE:9066)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Nissin Corporation offers logistics services across Japan, Europe, the Americas, China, Russia, and other parts of Asia with a market cap of ¥63.15 billion.

Operations: Nissin Corporation's revenue segments include logistics services in Japan, Europe, the Americas, China, Russia, and various other regions in Asia.

Dividend Yield: 4.6%

Nissin Corporation's dividend payments are well-covered by earnings (payout ratio: 15.5%) and cash flows (cash payout ratio: 55.7%), ensuring sustainability. Trading at 44.3% below its estimated fair value, it offers a high and reliable dividend yield of 4.56%, placing it in the top tier of JP market payers. Despite large one-off items impacting financial results, Nissin has shown strong earnings growth of 33.6% over the past year and has maintained stable, growing dividends for the past decade.

- Click here and access our complete dividend analysis report to understand the dynamics of Nissin.

- The analysis detailed in our Nissin valuation report hints at an deflated share price compared to its estimated value.

Sumitomo Warehouse (TSE:9303)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Sumitomo Warehouse Co., Ltd. provides integrated logistics services both in Japan and internationally, with a market cap of ¥213.99 billion.

Operations: Sumitomo Warehouse Co., Ltd. generates revenue primarily from its Logistics Business, which accounts for ¥173.54 billion, and its Real Estate Business, contributing ¥11.40 billion.

Dividend Yield: 3.7%

Sumitomo Warehouse's dividends are covered by earnings (payout ratio: 65%) and cash flows (cash payout ratio: 46.9%), ensuring sustainability. However, the dividend track record has been unstable with volatility over the past decade. Recent buybacks completed in September 2024, totaling ¥1.96 billion for 750,000 shares, indicate a commitment to shareholder returns but do not necessarily guarantee future dividend stability or growth. The current yield of 3.69% is slightly below Japan's top quartile payers.

- Navigate through the intricacies of Sumitomo Warehouse with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Sumitomo Warehouse is trading beyond its estimated value.

Seize The Opportunity

- Investigate our full lineup of 466 Top Japanese Dividend Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nissin might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9066

Nissin

Provides logistics services in Japan, Europe, the Americas, China, Russia, rest of Asia, and internationally.

Flawless balance sheet 6 star dividend payer.