- Japan

- /

- Entertainment

- /

- TSE:7974

Will Nintendo’s (TSE:7974) Expanding Film Universe Deepen Its Entertainment Moat?

Reviewed by Simply Wall St

- Illumination and Nintendo announced in the past week that the next Super Mario Bros. animated film will be titled "The Super Mario Galaxy Movie," with a global release planned for April 2026 and a returning cast of well-known voice actors.

- The Nintendo Direct broadcast also included the surprise launch of new action rogue-like Storm Lancers, highlighting the company’s momentum in expanding its entertainment properties and delivering fresh content for its gaming audience.

- We’ll explore how Nintendo’s collaboration on a new Super Mario film supports its long-term multi-platform entertainment strategy.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Nintendo's Investment Narrative?

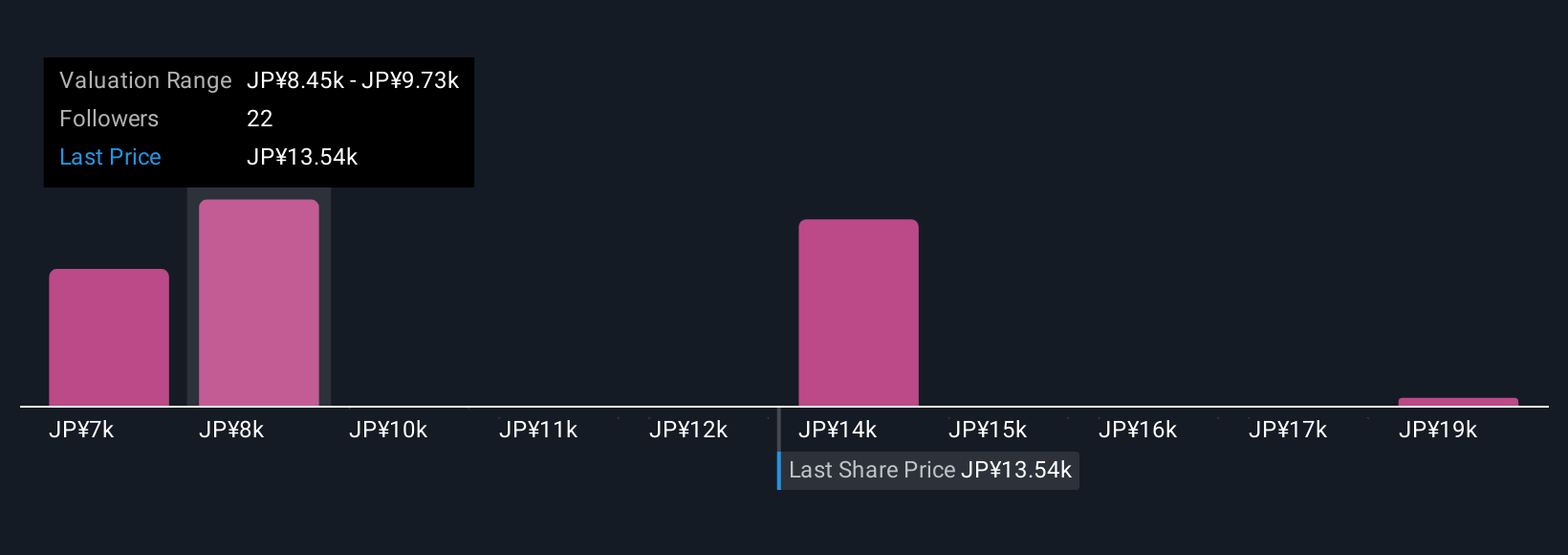

Owning Nintendo today means believing in the company’s ability to leverage its timeless franchises across platforms, from gaming hardware and new software launches to blockbuster animated features. The just-announced Super Mario Galaxy Movie, coming in 2026, is an example of Nintendo pressing its advantage as a global entertainment brand, but its actual impact on near-term revenue or profit drivers is likely muted until closer to launch. More directly, the surprise release of Storm Lancers on Switch continues Nintendo’s push for engaging new content, helping support platform momentum after the recent Switch 2 launch. However, despite recent price strength, current valuations appear stretched versus peers and consensus analyst price targets, so even big collaborative announcements may not fundamentally alter the near-term risk profile. The key catalysts remain the performance of Switch 2, continued software pipeline delivery, and consumer engagement with new releases. On the other hand, valuation risk remains high for those chasing recent share price gains.

Nintendo's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 8 other fair value estimates on Nintendo - why the stock might be worth 50% less than the current price!

Build Your Own Nintendo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nintendo research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Nintendo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nintendo's overall financial health at a glance.

No Opportunity In Nintendo?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nintendo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7974

Nintendo

Develops, manufactures, and sells home entertainment products in Japan, the Americas, Europe, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives