- Japan

- /

- Entertainment

- /

- TSE:7974

How Investors Are Reacting To Nintendo (TSE:7974) Ramping Up Switch 2 Production Targets

Reviewed by Sasha Jovanovic

- In recent news, Nintendo has requested its suppliers to ramp up Switch 2 production to as many as 25 million units by March 2026, well above its earlier sales forecasts and covering anticipated high demand through the holiday season and into the following year.

- This manufacturing push suggests strong confidence from Nintendo’s management in the momentum and appeal of its next-generation gaming console.

- We’ll consider how Nintendo’s aggressive Switch 2 production plan underpins its investment narrative and signals expectations for sustained hardware demand.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Nintendo's Investment Narrative?

Shareholders in Nintendo have historically needed to believe in an enduring ability to launch hit hardware and software, successfully capitalizing on both dedicated fan loyalty and larger entertainment trends. The recent news that Nintendo is asking suppliers to ramp up Switch 2 production to as many as 25 million units by March 2026 could change the playing field for the current investment story. Previously, analysis pointed to healthy but not significant profit growth, high-quality earnings, premium valuation, and robust but moderating momentum, with catalysts tied to new product launches, film releases, and dividend growth. There were caution flags: stretched profit margins, high price-to-earnings multiples, and profit growth forecasts not seen as dramatic. The planned Switch 2 production surge, if met by sustained demand, now raises the stakes for near-term catalysts, making first-year sales performance and inventory risk more central than before. This shift in focus could also influence perceptions of fair value and near-term volatility.

Yet even with all this optimism, inventory risk could quickly come to the fore for shareholders.

Exploring Other Perspectives

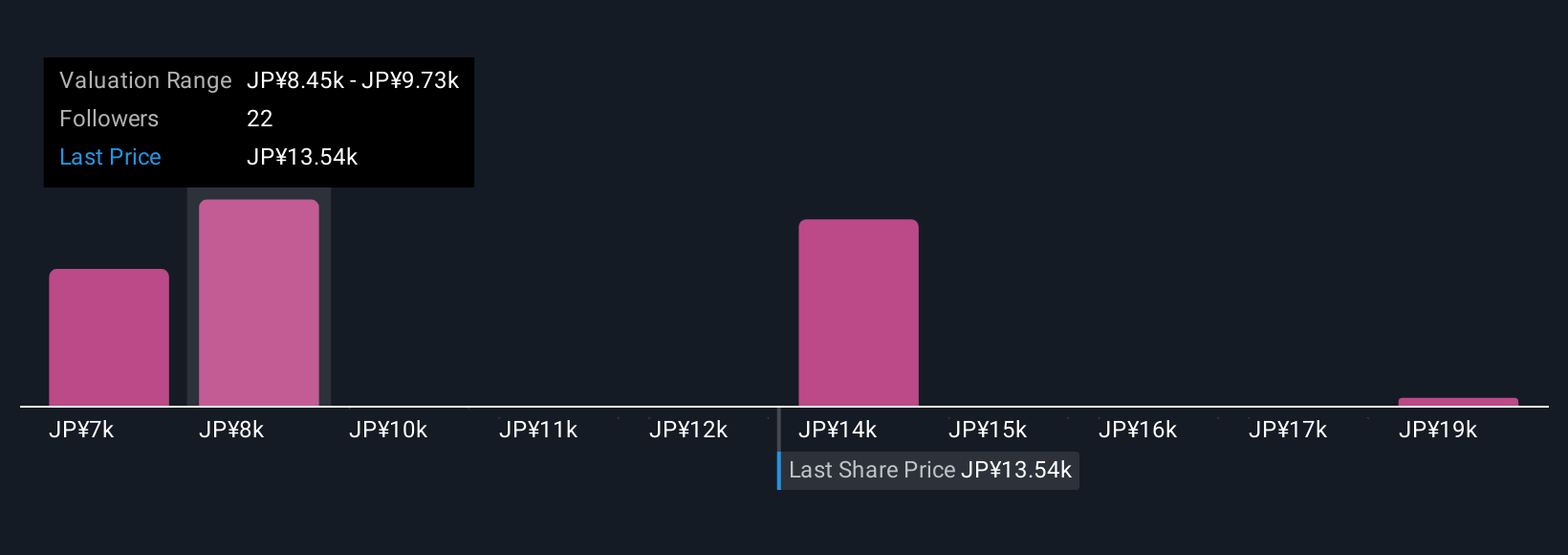

Explore 8 other fair value estimates on Nintendo - why the stock might be worth as much as 61% more than the current price!

Build Your Own Nintendo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nintendo research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Nintendo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nintendo's overall financial health at a glance.

No Opportunity In Nintendo?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nintendo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7974

Nintendo

Develops, manufactures, and sells home entertainment products in Japan, the Americas, Europe, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives