- China

- /

- Electronic Equipment and Components

- /

- SZSE:301106

Undiscovered Gems with Potential To Explore This November 2024

Reviewed by Simply Wall St

In the wake of a significant rally in U.S. stocks driven by expectations of economic growth and tax reforms, small-cap indices like the Russell 2000 have shown notable gains, although they remain slightly below past record highs. As investors navigate this dynamic landscape marked by potential regulatory changes and interest rate adjustments, identifying promising small-cap stocks can be crucial for capitalizing on emerging opportunities. A good stock in such an environment often exhibits strong fundamentals, resilience to economic fluctuations, and potential for growth amidst evolving market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| PSC | 17.90% | 2.07% | 13.38% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Mandiri Herindo Adiperkasa | NA | 20.72% | 11.08% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Bank Ganesha | NA | 25.03% | 70.72% | ★★★★★★ |

| Citra Tubindo | NA | 9.17% | 14.32% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Jiangsu Smartwin Electronics TechnologyLtd (SZSE:301106)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Smartwin Electronics Technology Co., Ltd. operates in the electronic test and measurement instruments sector with a market capitalization of CN¥3.64 billion.

Operations: Smartwin generates revenue primarily from its electronic test and measurement instruments, amounting to CN¥758.76 million.

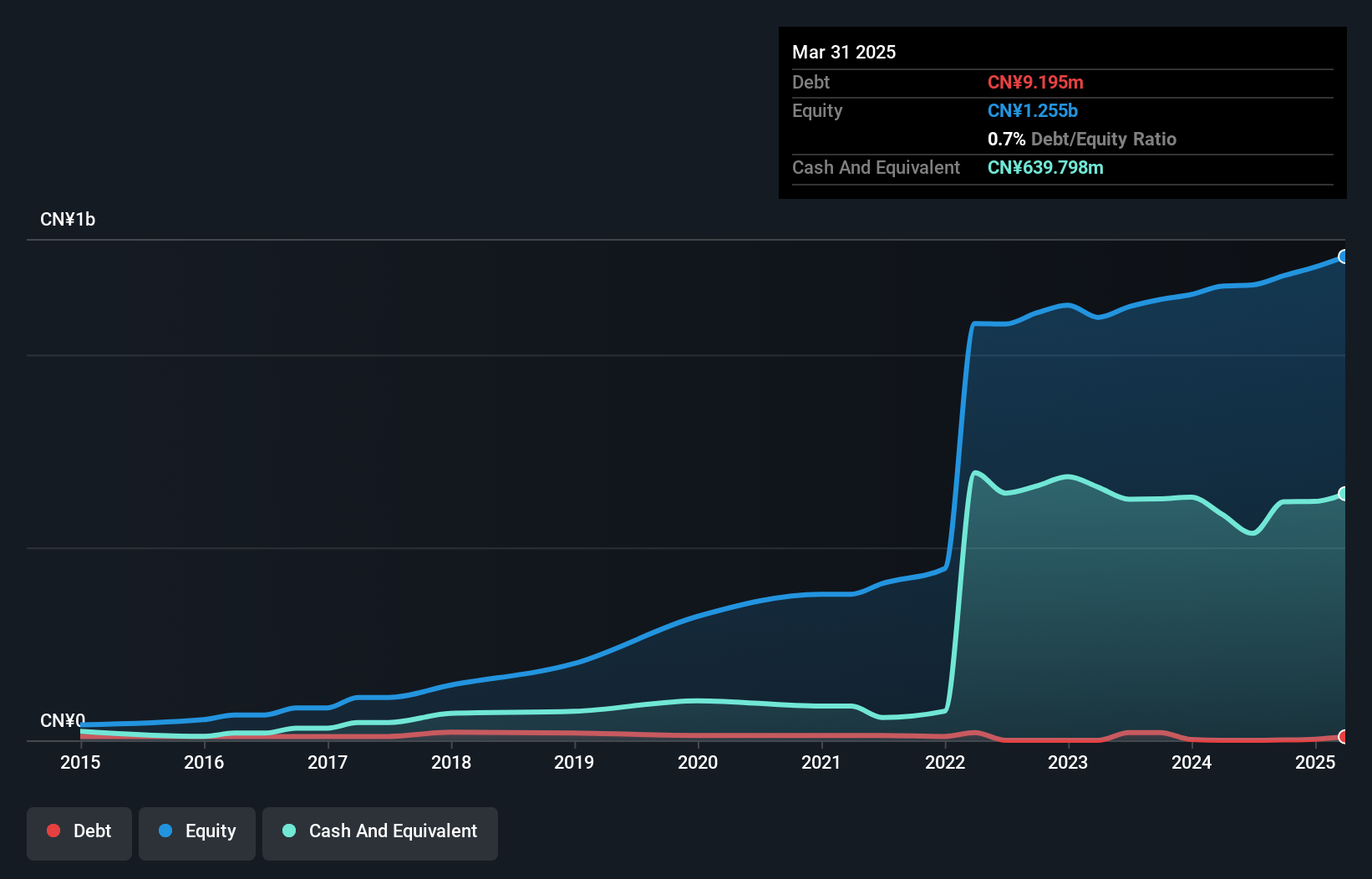

Jiangsu Smartwin Electronics Technology, a nimble player in the electronics sector, has shown impressive growth with earnings climbing 16.8% over the past year, outpacing the industry average of 1.7%. The company's debt to equity ratio significantly improved from 4.9 to just 0.07 over five years, highlighting effective debt management. Recent earnings reports reveal a robust performance with revenue reaching CNY 602.8 million for nine months ending September 2024, up from CNY 414.1 million last year; net income also rose to CNY 78.12 million from CNY 57.88 million previously, reflecting strong operational efficiency and potential for future growth.

Yungshin Construction & DevelopmentLtd (TPEX:5508)

Simply Wall St Value Rating: ★★★★★☆

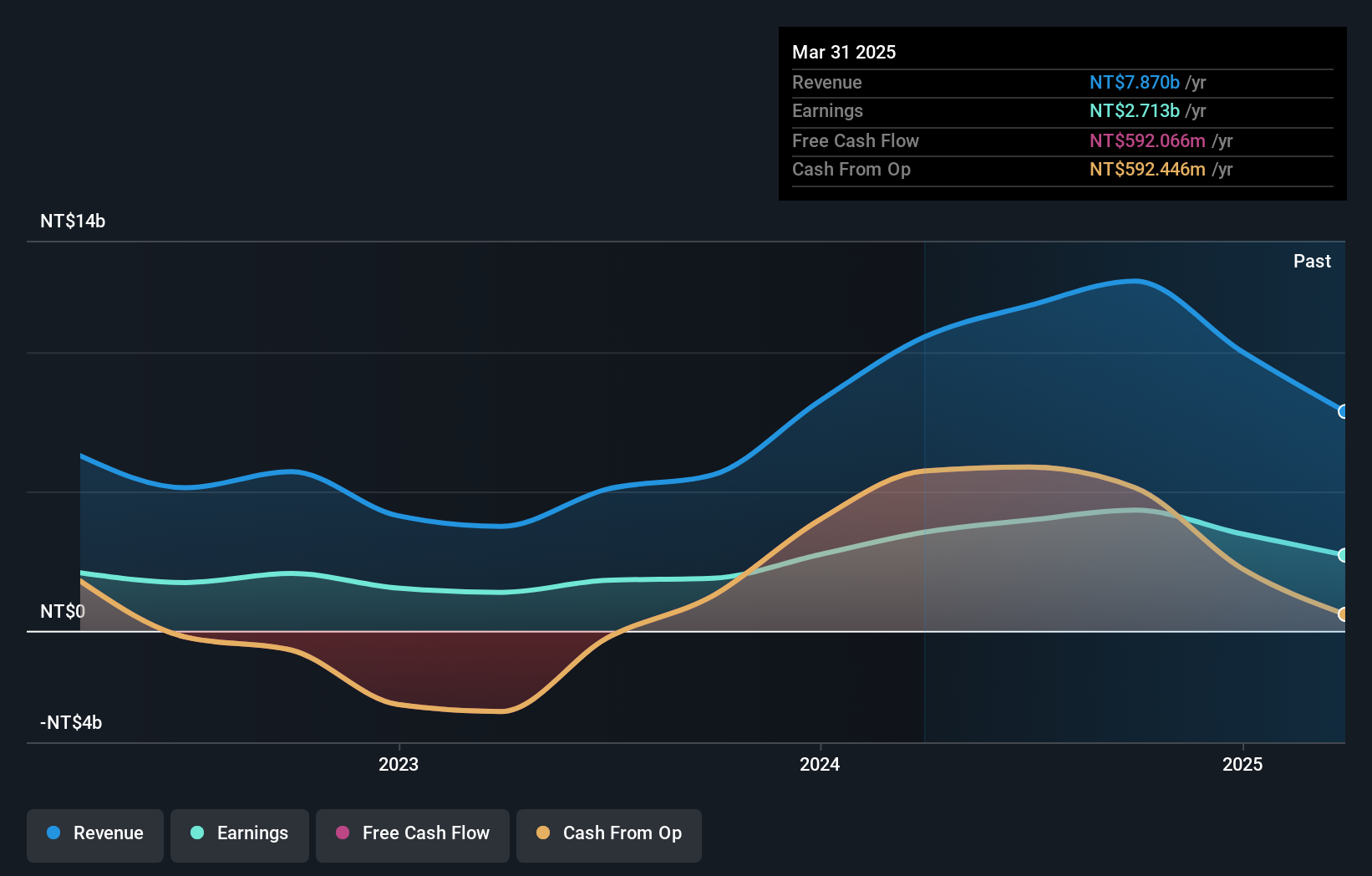

Overview: Yungshin Construction & Development Co., Ltd. operates in the construction industry, focusing on residential and commercial building projects, with a market capitalization of NT$41.42 billion.

Operations: Yungshin Construction & Development generates revenue primarily from its residential and commercial building projects, amounting to NT$12.55 billion. The company's net profit margin reflects its profitability within the construction sector.

Yungshin Construction & Development has shown impressive earnings growth, up 129% over the past year, outperforming the broader real estate industry. The company reported third-quarter sales of TWD 3.02 billion, a significant increase from TWD 2.14 billion last year, while net income rose to TWD 1.07 billion from TWD 715 million. Basic earnings per share climbed to TWD 4.94 from TWD 3.29 a year ago, reflecting strong operational performance despite high debt levels with a net debt to equity ratio of about 90%. Recent land acquisitions in Kaohsiung indicate strategic expansion efforts in key markets.

Daiichikosho (TSE:7458)

Simply Wall St Value Rating: ★★★★★☆

Overview: Daiichikosho Co., Ltd. focuses on the sale and rental of commercial karaoke systems in Japan, with a market capitalization of approximately ¥196.27 billion.

Operations: Daiichikosho generates revenue primarily from its Commercial Karaoke and Karaoke and Restaurant Business segments, which contribute ¥61.10 billion and ¥65.50 billion, respectively. The Music Soft segment adds an additional ¥6.50 billion to the company's revenue streams.

Daiichikosho, a notable player in the entertainment sector, has shown impressive earnings growth of 49.7% over the past year, outpacing the industry's -17.1%. The company's price-to-earnings ratio stands at 15.7x, which is favorable compared to the industry average of 24.6x, indicating good relative value. Despite an increase in its debt to equity ratio from 16.1% to 50.1% over five years, it remains satisfactory at 19.5%. Recent share repurchases totaling ¥3,999 million for approximately 2.22% of shares suggest confidence in its market position despite being dropped from a major index recently.

- Dive into the specifics of Daiichikosho here with our thorough health report.

Gain insights into Daiichikosho's historical performance by reviewing our past performance report.

Make It Happen

- Navigate through the entire inventory of 4670 Undiscovered Gems With Strong Fundamentals here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301106

Jiangsu Smartwin Electronics TechnologyLtd

Manufactures and sells liquid crystal display and display modules in China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives