- Japan

- /

- Entertainment

- /

- TSE:7060

There's No Escaping geechs inc.'s (TSE:7060) Muted Revenues Despite A 38% Share Price Rise

Despite an already strong run, geechs inc. (TSE:7060) shares have been powering on, with a gain of 38% in the last thirty days. The last 30 days bring the annual gain to a very sharp 55%.

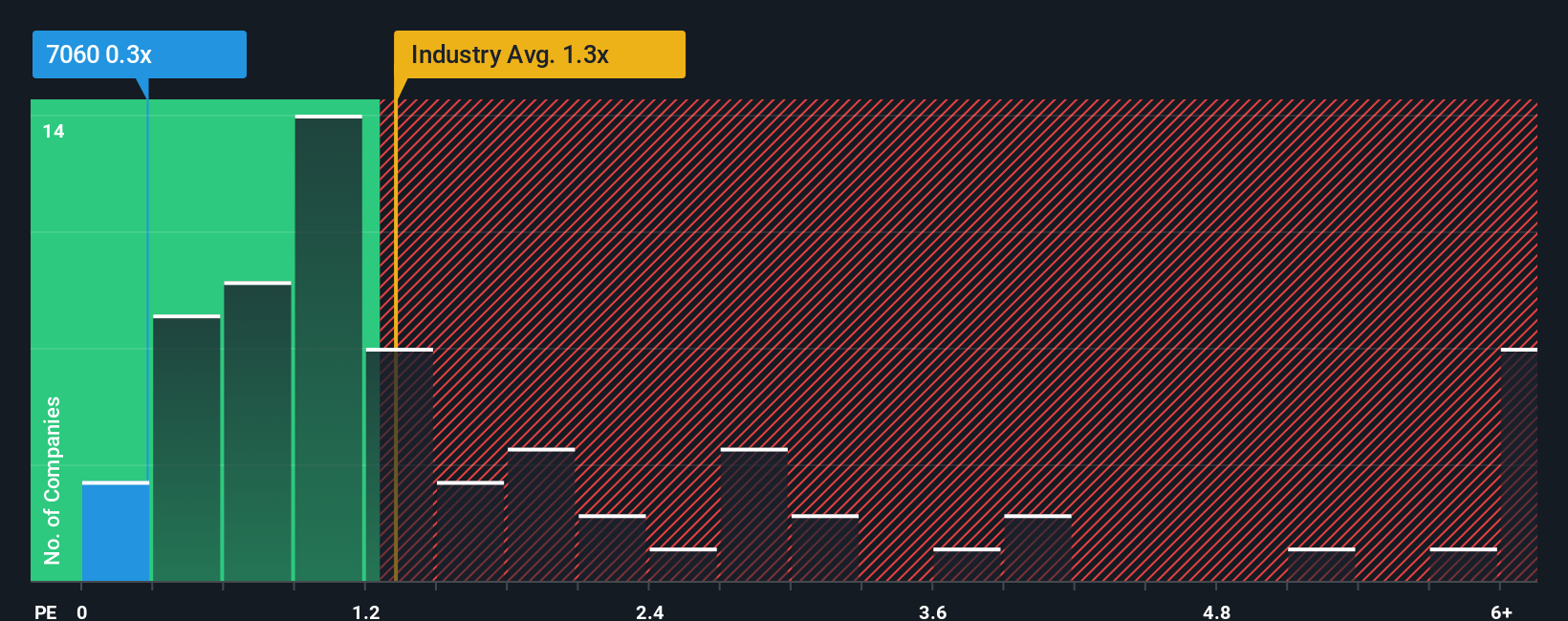

In spite of the firm bounce in price, it would still be understandable if you think geechs is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.3x, considering almost half the companies in Japan's Entertainment industry have P/S ratios above 1.3x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for geechs

What Does geechs' Recent Performance Look Like?

Recent times have been advantageous for geechs as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on geechs will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For geechs?

In order to justify its P/S ratio, geechs would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a decent 8.9% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 75% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 1.9% per year during the coming three years according to the lone analyst following the company. With the industry predicted to deliver 15% growth per year, the company is positioned for a weaker revenue result.

In light of this, it's understandable that geechs' P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does geechs' P/S Mean For Investors?

geechs' stock price has surged recently, but its but its P/S still remains modest. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of geechs' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 4 warning signs for geechs you should be aware of, and 1 of them is significant.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7060

Adequate balance sheet with slight risk.

Market Insights

Community Narratives