- Japan

- /

- Entertainment

- /

- TSE:7060

Little Excitement Around geechs inc.'s (TSE:7060) Revenues As Shares Take 29% Pounding

To the annoyance of some shareholders, geechs inc. (TSE:7060) shares are down a considerable 29% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 54% share price decline.

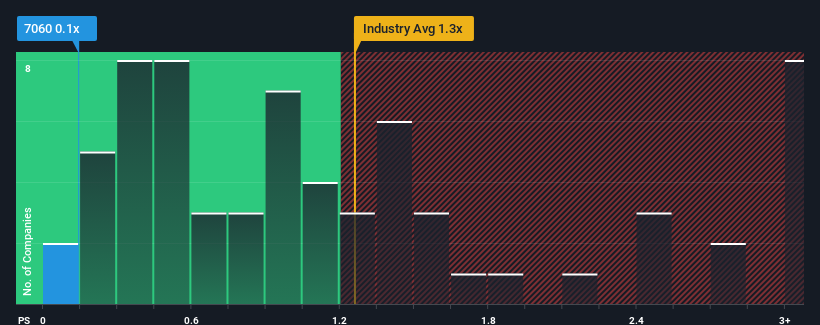

After such a large drop in price, given about half the companies operating in Japan's Entertainment industry have price-to-sales ratios (or "P/S") above 1.3x, you may consider geechs as an attractive investment with its 0.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for geechs

What Does geechs' Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, geechs has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think geechs' future stacks up against the industry? In that case, our free report is a great place to start.How Is geechs' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as geechs' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered an exceptional 48% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 2.8% per annum over the next three years. Meanwhile, the rest of the industry is forecast to expand by 6.0% per annum, which is noticeably more attractive.

In light of this, it's understandable that geechs' P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

The southerly movements of geechs' shares means its P/S is now sitting at a pretty low level. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of geechs' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 3 warning signs for geechs (1 is concerning!) that you should be aware of.

If these risks are making you reconsider your opinion on geechs, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7060

Adequate balance sheet with slight risk.

Market Insights

Community Narratives