Market Cool On Vector Inc.'s (TSE:6058) Earnings Pushing Shares 35% Lower

Vector Inc. (TSE:6058) shareholders that were waiting for something to happen have been dealt a blow with a 35% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 41% share price drop.

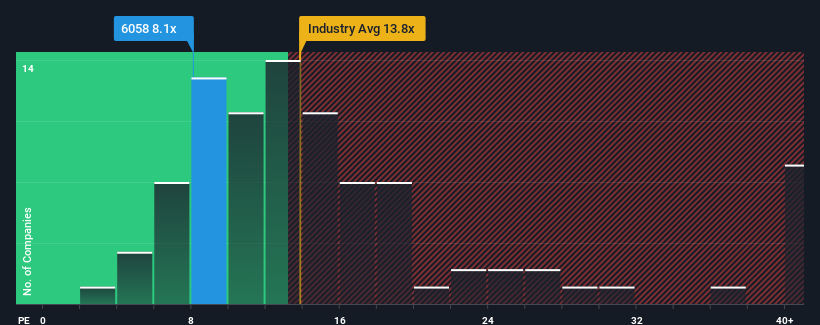

In spite of the heavy fall in price, Vector's price-to-earnings (or "P/E") ratio of 8.1x might still make it look like a buy right now compared to the market in Japan, where around half of the companies have P/E ratios above 12x and even P/E's above 19x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been advantageous for Vector as its earnings have been rising faster than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Vector

Is There Any Growth For Vector?

In order to justify its P/E ratio, Vector would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered an exceptional 48% gain to the company's bottom line. Pleasingly, EPS has also lifted 320% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 9.4% each year as estimated by the only analyst watching the company. With the market predicted to deliver 9.6% growth per year, the company is positioned for a comparable earnings result.

In light of this, it's peculiar that Vector's P/E sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

The Bottom Line On Vector's P/E

Vector's recently weak share price has pulled its P/E below most other companies. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Vector currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

Having said that, be aware Vector is showing 3 warning signs in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Vector, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6058

Vector

Engages in the public relations (PR) and advertising, press release distribution, video release distribution, direct marketing, media, investment, and human resources businesses in Japan, China, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives