- Japan

- /

- Specialty Stores

- /

- TSE:9856

3 Reliable Dividend Stocks Offering Up To 5.1% Yield

Reviewed by Simply Wall St

As global markets navigate a period of mixed economic signals, with U.S. consumer confidence waning and European stocks showing modest gains, investors are increasingly seeking stability in dividend stocks. In the current climate, characterized by fluctuating indices and cautious optimism, reliable dividend stocks offering yields up to 5.1% can provide a steady income stream and potential resilience against market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.15% | ★★★★★★ |

Click here to see the full list of 1948 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

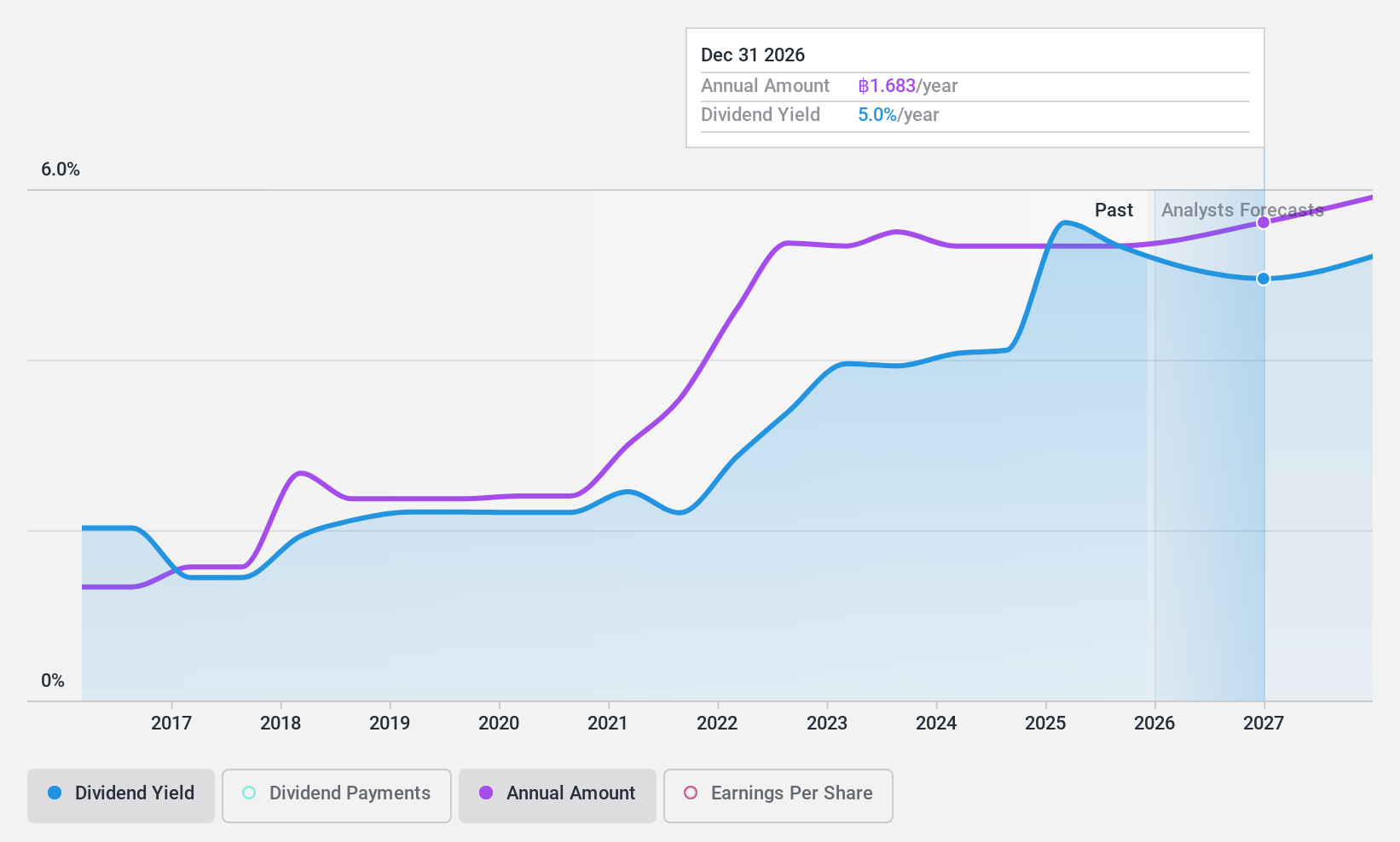

Mega Lifesciences (SET:MEGA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mega Lifesciences Public Company Limited, along with its subsidiaries, produces and distributes health food supplements, pharmaceutical products, over-the-counter items, herbal products, vitamins, and fast-moving consumer goods in Southeast Asia and Sub-Saharan Africa with a market cap of THB28.99 billion.

Operations: Mega Lifesciences generates revenue from its Brands segment at THB8.24 billion, Distribution at THB7.34 billion, and Original Equipment Manufacture (OEM) at THB289.67 million.

Dividend Yield: 4.8%

Mega Lifesciences' dividend payments have been volatile and unreliable over the past decade, with a payout ratio of 75.6% indicating coverage by earnings but less stability. The dividend yield of 4.81% is below Thailand's top tier, though dividends have grown over ten years. Trading at a significant discount to fair value may attract investors despite recent declines in net income and basic earnings per share compared to last year’s figures.

- Navigate through the intricacies of Mega Lifesciences with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Mega Lifesciences' share price might be too pessimistic.

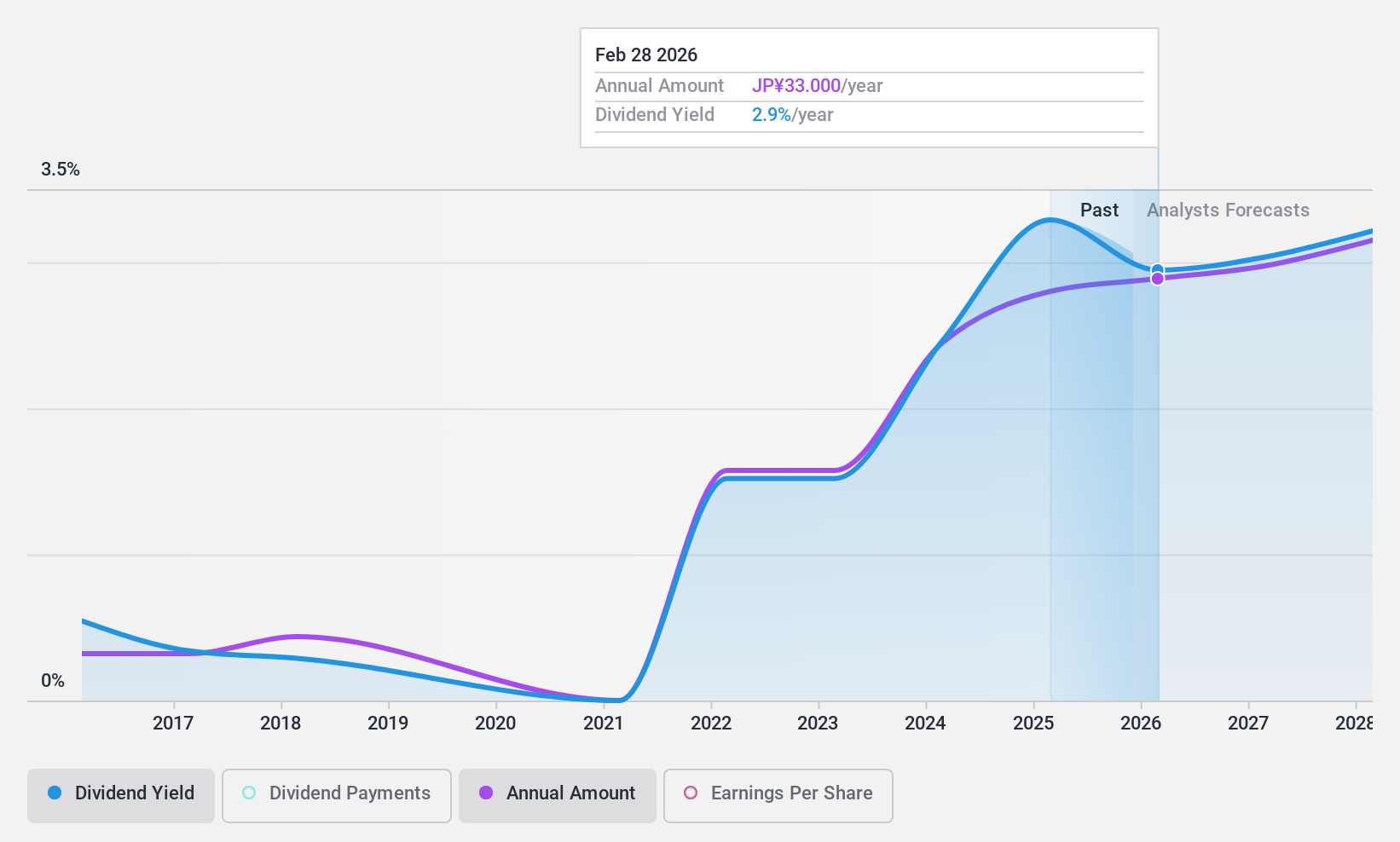

Vector (TSE:6058)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vector Inc. operates in public relations, advertising, press and video release distribution, direct marketing, media, investment, and human resources across Japan, China, and internationally with a market cap of ¥48.87 billion.

Operations: Vector Inc.'s revenue segments include public relations and advertising at ¥37,329 million, press release distribution at ¥2,768 million, video release distribution at ¥1,018 million, direct marketing at ¥25,105 million, media at ¥8,634 million, investment business at ¥3.41 billion and human resources services contributing ¥4.63 billion.

Dividend Yield: 3.1%

Vector's dividend payments, while covered by earnings with a payout ratio of 28.1% and cash flows at 37.6%, have been volatile over the past decade. The dividend yield of 3.07% is below Japan's top tier, though there has been growth in dividends over ten years. Recent changes to its dividend policy increased the year-end forecast to JPY 32 per share, reflecting a commitment to enhancing shareholder returns despite past instability in payments.

- Click here and access our complete dividend analysis report to understand the dynamics of Vector.

- The analysis detailed in our Vector valuation report hints at an deflated share price compared to its estimated value.

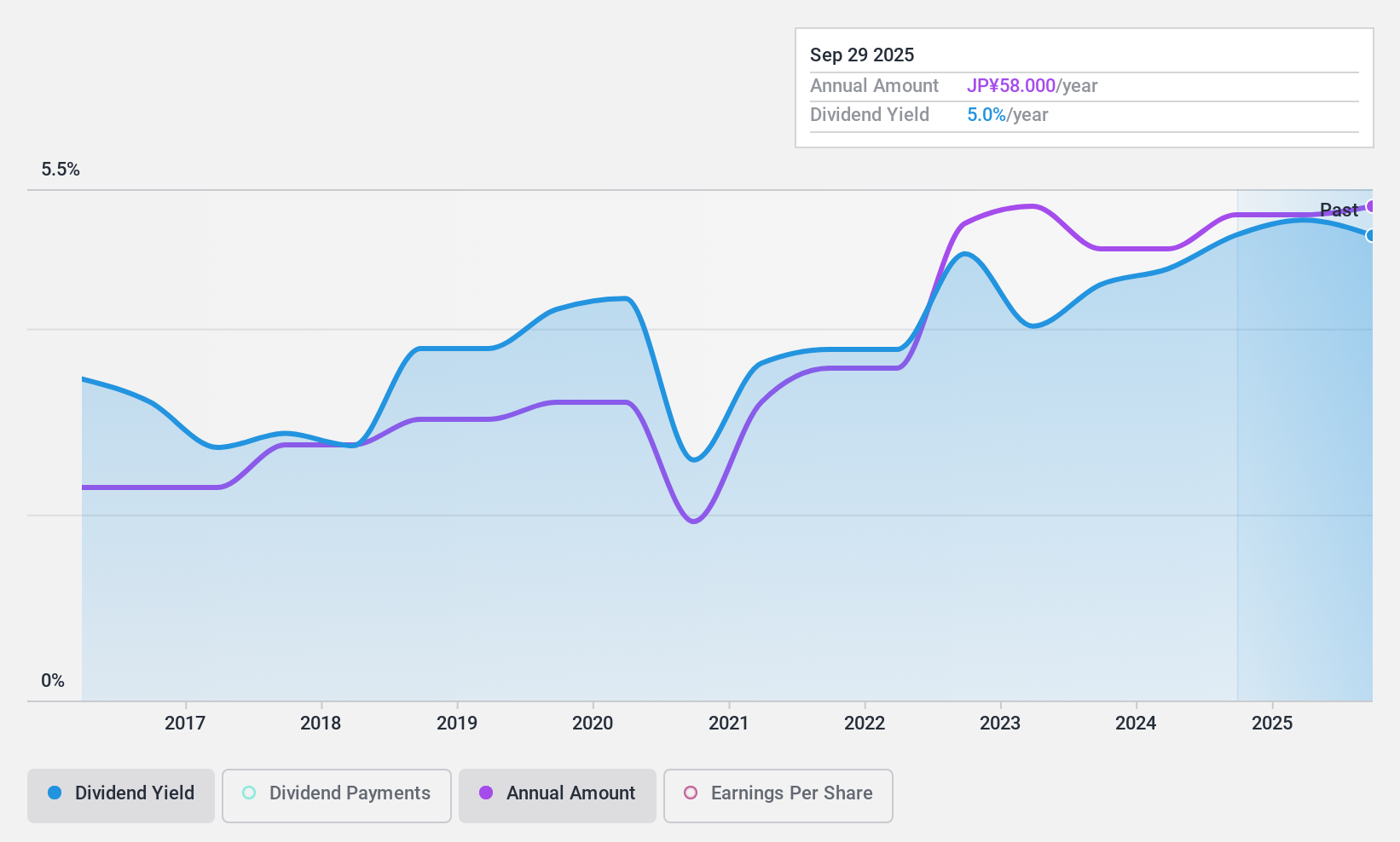

Ku HoldingsLtd (TSE:9856)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ku Holdings Co., Ltd. is involved in the import and sale of new and used cars in Japan, with a market cap of ¥36.50 billion.

Operations: Ku Holdings Co., Ltd. generates revenue through its operations in the import and sale of both new and used vehicles within Japan.

Dividend Yield: 5.1%

Ku Holdings Ltd.'s dividend yield of 5.13% places it among the top 25% in Japan, though its payments have been volatile over the past decade. Earnings and cash flows cover dividends well, with payout ratios at 20.5% and a cash payout ratio of 58.4%. Despite an unstable track record, dividends have grown over ten years, supported by a consistent earnings growth rate of 13.8% annually over five years.

- Get an in-depth perspective on Ku HoldingsLtd's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Ku HoldingsLtd is priced lower than what may be justified by its financials.

Where To Now?

- Discover the full array of 1948 Top Dividend Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ku HoldingsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9856

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.