- Japan

- /

- Interactive Media and Services

- /

- TSE:6027

Bengo4.com,Inc. (TSE:6027) Analysts Are Pretty Bullish On The Stock After Recent Results

It's been a pretty great week for Bengo4.com,Inc. (TSE:6027) shareholders, with its shares surging 18% to JP¥3,615 in the week since its latest first-quarter results. It was a credible result overall, with revenues of JP¥3.8b and statutory earnings per share of JP¥46.69 both in line with analyst estimates, showing that Bengo4.comInc is executing in line with expectations. The analyst typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analyst has changed their mind on Bengo4.comInc after the latest results.

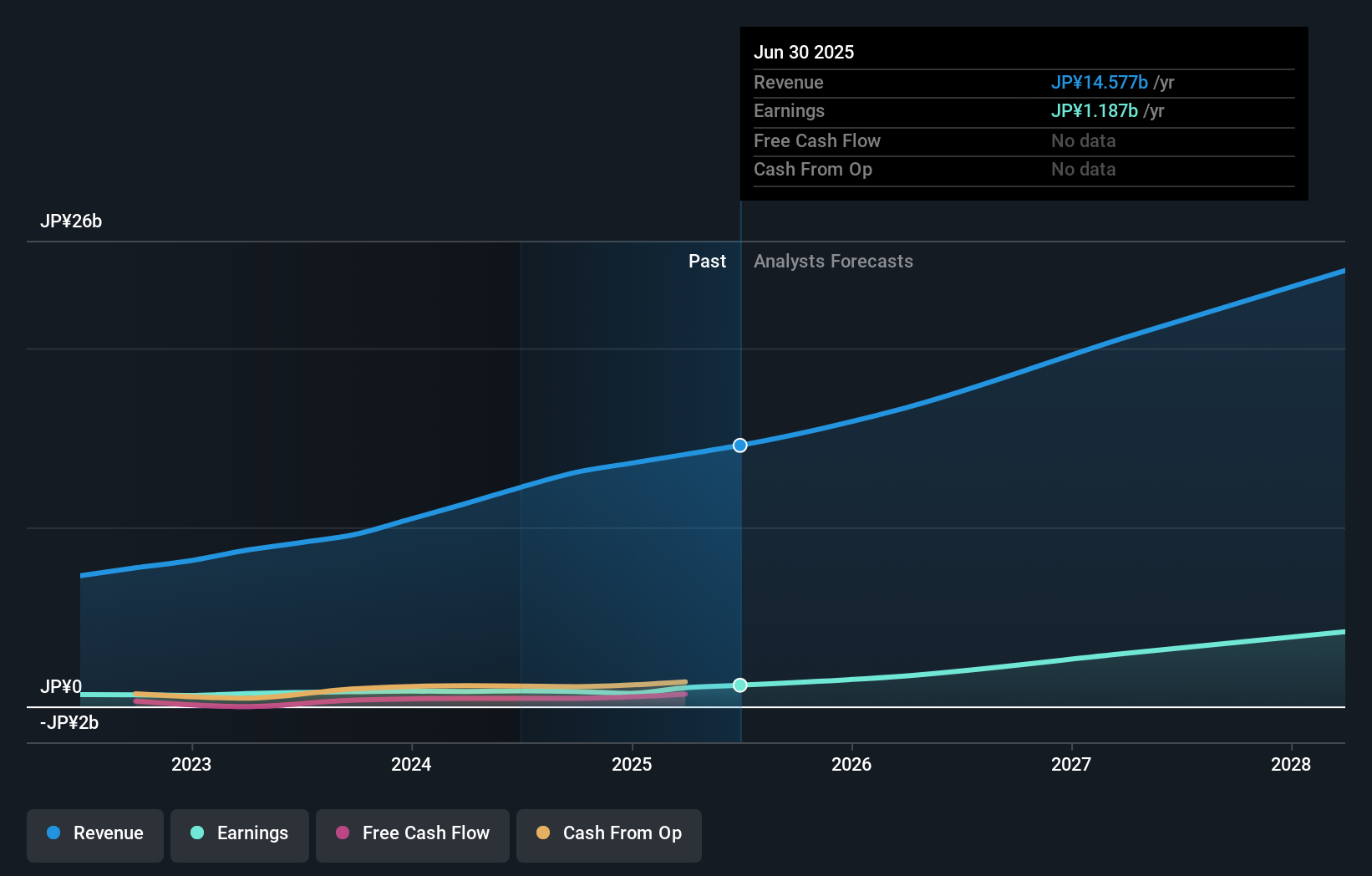

Taking into account the latest results, the most recent consensus for Bengo4.comInc from sole analyst is for revenues of JP¥16.7b in 2026. If met, it would imply a solid 14% increase on its revenue over the past 12 months. Per-share earnings are expected to soar 44% to JP¥75.45. Before this earnings report, the analyst had been forecasting revenues of JP¥16.6b and earnings per share (EPS) of JP¥68.67 in 2026. So the consensus seems to have become somewhat more optimistic on Bengo4.comInc's earnings potential following these results.

Check out our latest analysis for Bengo4.comInc

The consensus price target rose 7.9% to JP¥4,567, suggesting that higher earnings estimates flow through to the stock's valuation as well.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Bengo4.comInc's past performance and to peers in the same industry. The period to the end of 2026 brings more of the same, according to the analyst, with revenue forecast to display 20% growth on an annualised basis. That is in line with its 24% annual growth over the past three years. Compare this with the broader industry, which analyst estimates (in aggregate) suggest will see revenues grow 7.7% annually. So it's pretty clear that Bengo4.comInc is forecast to grow substantially faster than its industry.

The Bottom Line

The most important thing here is that the analyst upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism towards Bengo4.comInc following these results. Fortunately, they also reconfirmed their revenue numbers, suggesting that it's tracking in line with expectations. Additionally, our data suggests that revenue is expected to grow faster than the wider industry. There was also a nice increase in the price target, with the analyst clearly feeling that the intrinsic value of the business is improving.

With that in mind, we wouldn't be too quick to come to a conclusion on Bengo4.comInc. Long-term earnings power is much more important than next year's profits. At least one analyst has provided forecasts out to 2028, which can be seen for free on our platform here.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Bengo4.comInc that you need to be mindful of.

Valuation is complex, but we're here to simplify it.

Discover if Bengo4.comInc might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6027

Outstanding track record with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.