With A 48% Price Drop For GMO internet, Inc. (TSE:4784) You'll Still Get What You Pay For

GMO internet, Inc. (TSE:4784) shareholders won't be pleased to see that the share price has had a very rough month, dropping 48% and undoing the prior period's positive performance. The good news is that in the last year, the stock has shone bright like a diamond, gaining 136%.

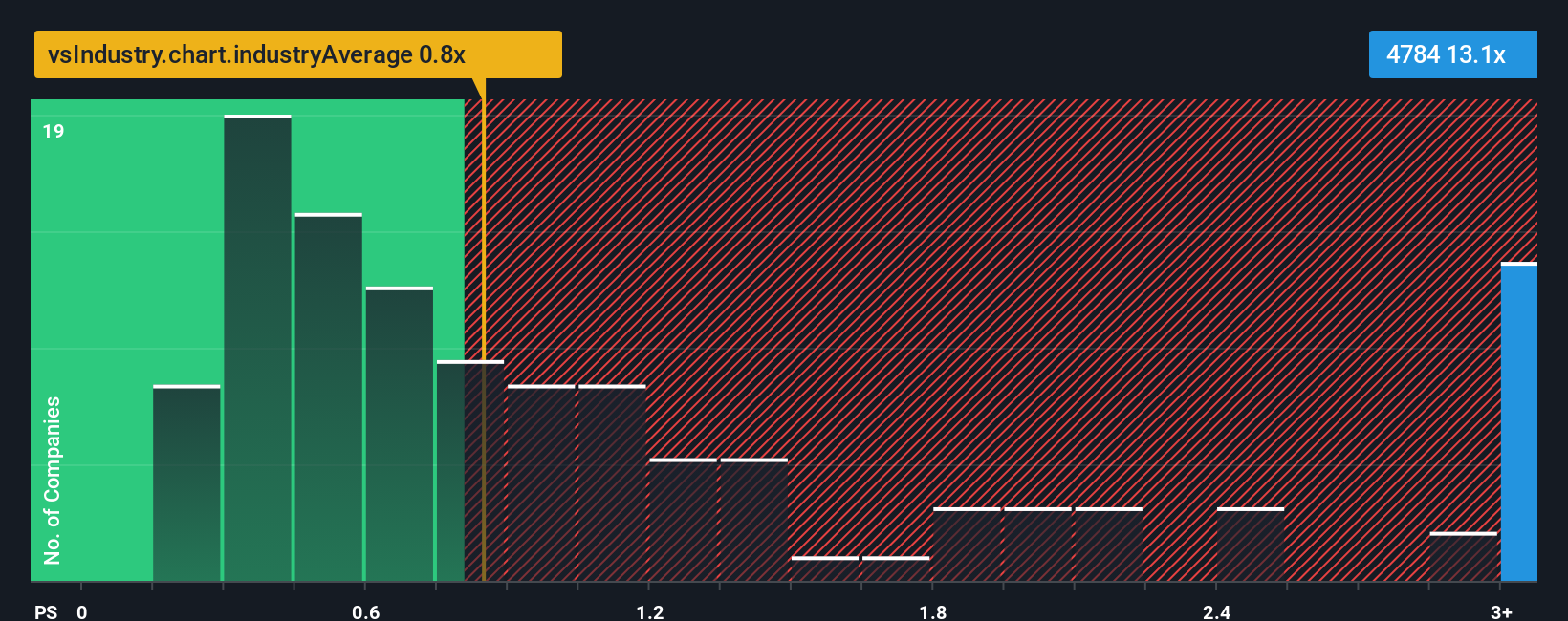

Even after such a large drop in price, given around half the companies in Japan's Media industry have price-to-sales ratios (or "P/S") below 0.8x, you may still consider GMO internet as a stock to avoid entirely with its 13.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for GMO internet

What Does GMO internet's Recent Performance Look Like?

Recent times have been advantageous for GMO internet as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on GMO internet.Is There Enough Revenue Growth Forecasted For GMO internet?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like GMO internet's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 103% gain to the company's top line. Still, revenue has barely risen at all from three years ago in total, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 186% over the next year. With the industry only predicted to deliver 17%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why GMO internet's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From GMO internet's P/S?

GMO internet's shares may have suffered, but its P/S remains high. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that GMO internet maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Media industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with GMO internet, and understanding these should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4784

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026