- Japan

- /

- Entertainment

- /

- TSE:4772

The Price Is Right For Stream Media Corporation (TSE:4772) Even After Diving 25%

Stream Media Corporation (TSE:4772) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 20% in that time.

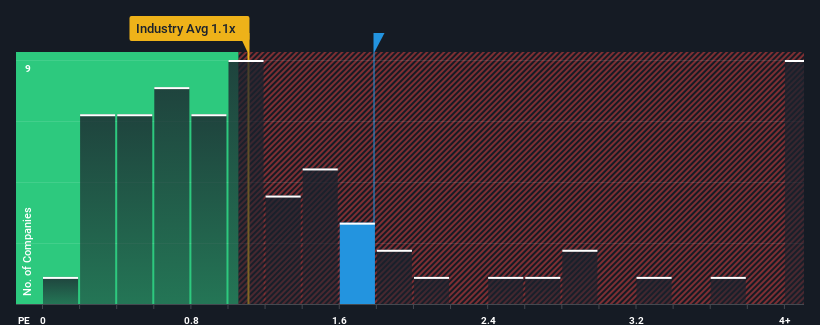

In spite of the heavy fall in price, given close to half the companies operating in Japan's Entertainment industry have price-to-sales ratios (or "P/S") below 1.1x, you may still consider Stream Media as a stock to potentially avoid with its 1.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Stream Media

What Does Stream Media's Recent Performance Look Like?

Revenue has risen firmly for Stream Media recently, which is pleasing to see. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Stream Media, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Stream Media?

The only time you'd be truly comfortable seeing a P/S as high as Stream Media's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered an exceptional 26% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 109% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 0.6% shows it's a great look while it lasts.

In light of this, it's understandable that Stream Media's P/S sits above the majority of other companies. Investors are willing to pay more for a stock they hope will buck the trend of the broader industry going backwards. However, its current revenue trajectory will be very difficult to maintain against the headwinds other companies are facing at the moment.

The Bottom Line On Stream Media's P/S

There's still some elevation in Stream Media's P/S, even if the same can't be said for its share price recently. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We see that Stream Media justifiably maintains its high P/S on the merits of its recentthree-year revenue growth beating forecasts amidst struggling industry. It could be said that investors feel this revenue growth will continue into the future, justifying a higher P/S ratio. Our only concern is whether its revenue trajectory can keep outperforming under these tough industry conditions. Otherwise, it's hard to see the share price falling strongly in the near future if its revenue performance persists.

Before you take the next step, you should know about the 2 warning signs for Stream Media (1 is potentially serious!) that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4772

SM ENTERTAINMENT JAPANLtd

Engages in the CS broadcasting, management, mobile, fan club, merchandising, events and concerts, music, and rights businesses primarily in Japan.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives